Charles Schwab-TD Ameritrade deal would be the latest in a long series of broker mergers

Charles Schwab (SCHW)’s power play for rival TD Ameritrade (AMTD) will create a goliath with over $5 trillion in combined client assets, but is far from the first merger in the retail brokerage space.

On Monday morning, Schwab and TD Ameritrade officially announced that the giants will be merging in a $26 billion all-stock deal. Under the agreement, TD Ameritrade stockholders will receive 1.0837 Schwab shares for each TD Ameritrade share, about a 17% premium given where those respective shares were trading over the last 30 days.

The deal was originally reported by CNBC and Fox Business on Thursday.

“We believe the combination of our two great companies positions us to be competing and winning in the investment services business for the long run — the very long run,” Schwab CEO Walter Bettinger said in a press release.

Bettinger will become the head of the combined company, since TD Ameritrade’s current CEO Tim Hockey had already planned on leaving the company by the end of February.

The deal comes amid the race to $0 brokerage fees, which has accelerated the scramble to gain scale.

Five main players offer retail brokerage services that allow customers to deposit cash and open a trading portfolio: Fidelity (29.6 million accounts), Charles Schwab (12.1 million accounts), TD Ameritrade (11 million accounts), E*Trade (5.1 million accounts), and Interactive Brokers (0.7 million accounts).

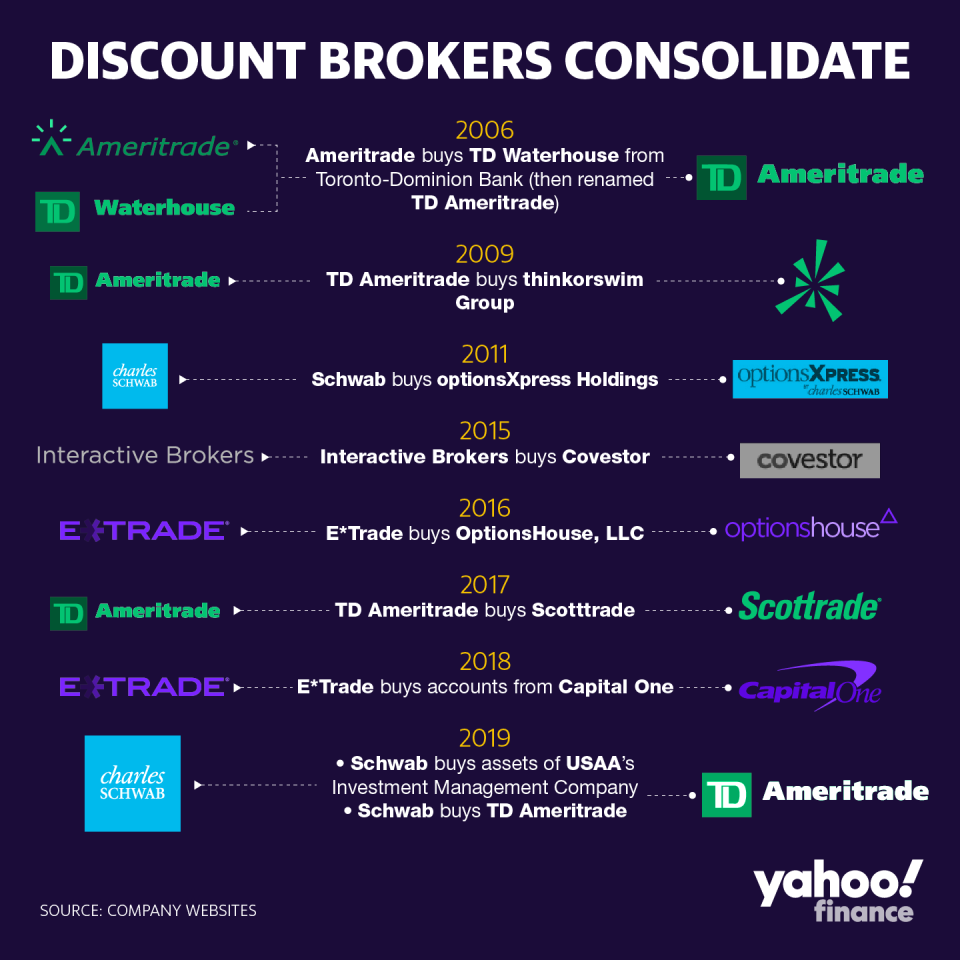

A Schwab and TD Ameritrade tie-up gives the company the combined scale to take on the privately held Fidelity Investments. The industry has already earned a reputation for hot M&A activity; the largest recent transaction was TD Ameritrade’s 2017 deal to merge with Scottrade.

The next question: which firm will sell next?

“We expect most firms in the sector, including [E*Trade], to be in merger discussions given the pressures on the business, this transaction, game theory, as well as the attractive synergies and accretion,” Bank of America Merrill Lynch wrote Nov. 21.

Race to $0

The retail brokerages have been enormously pressured to figure out new strategies to grow revenue since the advent of Robinhood, the stock trading app that built a user base of over 6 million users in just six years by offering zero commission trades.

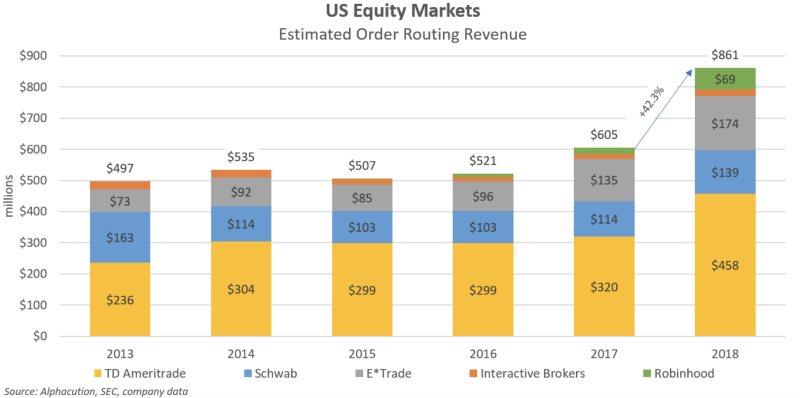

In October, the brokerage firms followed suit by lowering their commission fees to zero, instead relying on selling order flow to wholesale market makers like Citadel Securities or Virtu Financial. These market makers ultimately execute the trades in the market, splitting the spread made on those trades between themselves and the brokerages that sold the order flow.

Despite losing the revenue on trade commissions, the brokerages will therefore be able to recoup some losses through order routing revenue collected from the wholesale market makers.

But at large, the brokerage firms will have to lean on other revenue streams to drive profits.

Charles Schwab is among the better firms positioned to hedge against the race to $0 in brokerage fees, relying on interest-bearing assets and fees on mutual funds and ETFs as main revenue drivers. Schwab said in its most recent filings that commissions represented only 6% of its $2.7 billion in net revenues, saying that $0 commissions would cover only $90 million to $100 million of those net revenues.

TD Ameritrade, by comparison, attributed a third of its $6 billion in net revenues to commissions and transaction fees, projecting that $0 commissions would decrease net revenues by a whopping $880 million to $960 million per fiscal year.

Before the deal was formally announced on Monday, BAML cautioned that while the Schwab and TD Ameritrade merger would “make strategic sense,” their analysts warned that there are questions over who would run TD Ameritrade with Hockey’s departure. BAML also flagged some regulatory headwinds given TD Ameritrade’s bank relationship with the Toronto-Dominion Bank, which owns about 43% of TD Ameritrade’s common stock.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Fed officials split over October cut but now see interest rates as 'well calibrated'

Fed Chair Powell on economic expansion: 'No reason why it can't last'

Philly Fed's Harker: Central bank should 'hold steady for a while'

Fed Chair Powell: Negative interest rates 'would certainly not be appropriate'

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.