Charlie Munger: It's time for regulators to 'let up' on Wells Fargo

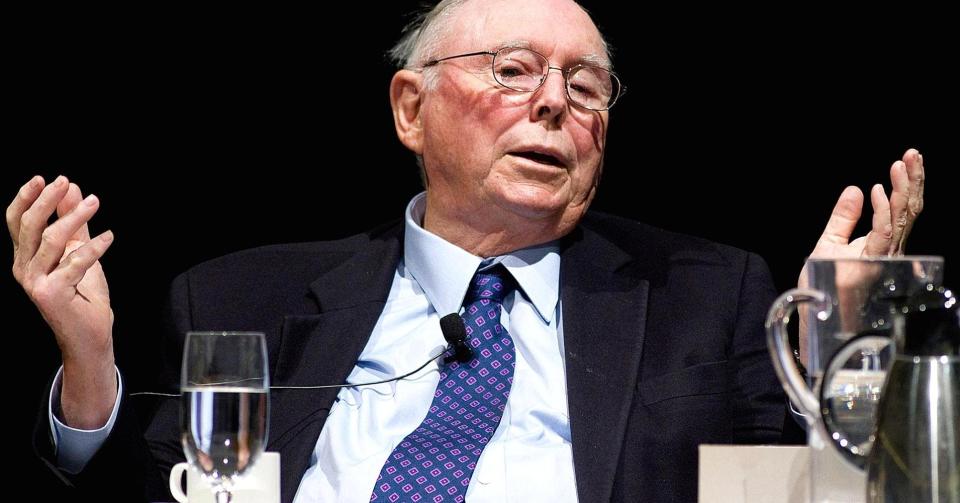

Berkshire Hathaway’s (BRK-A, BRK-B) vice chairman, Charlie Munger, says it’s time for regulators to “let up” on Wells Fargo (WFC).

“Of course, Wells Fargo had incentive systems that were too strong in the wrong direction,” Munger said at the Daily Journal’s (DJCO) annual meeting in Los Angeles. “Of course, they were too slow in reacting to the bad news when it came. Everyone makes those mistakes, but we make fewer than others.”

He added that it’s “time for the regulators to let up on Wells Fargo”

He said that Wells Fargo will be “better off” for having made those mistakes. He also thinks the customers will be better off too.

In the fall of 2016, it was revealed that as many as 2 million fraudulent accounts were opened without customers’ permission. The bank was fined $185 million after regulators found employees at the retail bank opened up the bogus accounts to meet sales targets. The bank fired more than 5,000 employees tied to the scandal.

Earlier this month, the Federal Reserve placed restrictions on Wells Fargo’s growth in the wake of the phony account scandal.

Berkshire Hathaway, which has been invested in Wells Fargo since 2001, owns more than 462.2 million shares, making it the firm’s largest position.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.