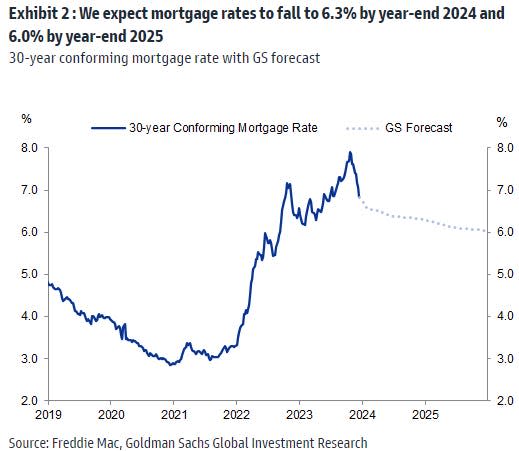

CHART OF THE DAY: Mortgage rates will stay above 6% through 2025, Goldman Sachs says

Mortgage rates are going to stay above 6% through 2025, according to estimates from Goldman Sachs.

Goldman said the decline in mortgage rates should offer marginal improvements in housing affordability.

The average 30-year mortgage rate fell to 6.62% last week after hitting a cycle-high of 7.8%.

Our Chart of the Day is from Goldman Sachs, which plots the firm's expectation that the 30-year mortgage rate will stay above 6% through 2025.

Goldman said it expects 30-year mortgage rates will drop to 6.3% by the end of 2024, and fall slightly in 2025 to 6% as the Fed starts to cut interest rates. Previously, Goldman had expected the 30-year mortgage rate to be at 7.1% by the end of 2024 and at 6.6% by the end of 2025.

"This revision reflects our economists' expectation that the Fed will deliver five cuts in 2024 amidst a robust growth backdrop for the economy, as well as some compression in the spread between mortgage rates and Treasury yields," Goldman Sachs analyst Roger Ashworth said in a note on Wednesday.

The average 30-year mortgage rate stood at 6.62% last week, according to Freddie Mac, representing a sharp decline from its cycle high of 7.79% reached in October.

A continued decline in mortgage rates would help marginally improve housing affordability, Goldman said, though it won't be enough to completely unwind the sharp increase seen in mortgage rates from 2022 to 2023.

Overall, lower mortgage rates should bring stability to the mortgage-backed securities market and boost mortgage originations to $2 trillion in 2025, compared to $1.5 trillion in 2023.

Much of that expected growth in mortgage originations will likely be driven by "heightened" refinance activity, Ashworth said, as consumers who bought homes over the past year seek to lock-in a lower mortgage rate.

Read the original article on Business Insider