Charter Communications Inc (CHTR) Reports Mixed Q4 and Full Year 2023 Results Amid Expansion Efforts

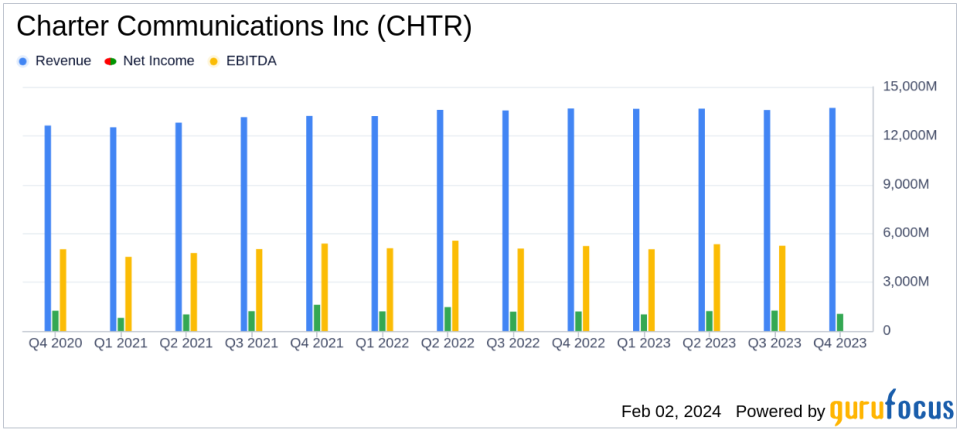

Revenue Growth: Modest year-over-year increase of 1.1% to $54.6 billion for the full year 2023.

Net Income: Decreased by 9.9% to $4.6 billion for the full year 2023.

Adjusted EBITDA: Slight increase of 1.3% to $21.9 billion for the full year 2023.

Capital Expenditures: Rose significantly by 18.6% to $11.1 billion for the full year 2023.

Free Cash Flow: Decreased by 42.8% to $3.5 billion for the full year 2023.

Customer Dynamics: Residential and SMB Internet customers saw a decrease in Q4, while mobile lines increased.

Stock Repurchases: Charter purchased 9.0 million shares for approximately $3.6 billion in 2023.

On February 2, 2024, Charter Communications Inc (NASDAQ:CHTR) released its 8-K filing, detailing the financial and operating results for the fourth quarter and full year ended December 31, 2023. The company, a leading broadband connectivity provider and the second-largest U.S. cable company, operates under the Spectrum brand, serving approximately 56 million homes and businesses across the country.

Performance and Challenges

Charter's fourth quarter saw a decrease in total residential and SMB Internet customers by 61,000, ending the year with 30.6 million customers. Despite this, the company added 155,000 total Internet customers in 2023. The mobile segment experienced robust growth, with an addition of 546,000 lines in Q4, culminating in 2.5 million new mobile lines for the year.

While the company's revenue for Q4 grew marginally by 0.3% year-over-year to $13.7 billion, driven by Internet and mobile service revenue growth, it faced challenges with a decrease in residential video customers and advertising sales revenues. The decline in video customers was partly attributed to the temporary loss of Disney programming. This trend reflects the broader industry shift towards streaming and cord-cutting, posing a challenge for Charter's traditional cable TV business.

Financial Achievements and Industry Significance

Charter's financial achievements in 2023 include a full-year revenue growth of 1.1% to $54.6 billion and a 1.3% increase in Adjusted EBITDA to $21.9 billion. These gains are significant in the highly competitive and capital-intensive telecommunications industry, demonstrating Charter's ability to grow its core broadband business and expand its mobile offerings. However, the company's net income for the year decreased by 9.9% to $4.6 billion, and free cash flow saw a substantial decline of 42.8% to $3.5 billion, primarily due to higher capital expenditures related to network evolution and expansion initiatives.

Key Financial Metrics

Charter's capital expenditures for the year totaled $11.1 billion, with $4.0 billion allocated to line extensions. The company's net cash flows from operating activities for the full year amounted to $14.4 billion, a slight decrease from the previous year. The Adjusted EBITDA margin remained stable at 40.1%, reflecting the company's operational efficiency.

Our rural footprint expansion is exceeding our deployment and penetration targets," said Chris Winfrey, President and CEO of Charter. "Our network evolution and convergence efforts remain on course. And we are beginning to see the benefits of investments in our employees and digital service to improve the customer experience. We are executing on a clear strategy to ensure we offer consumers the best products and services, all while saving them money. Not only now, but in the future."

Analysis of Company's Performance

Charter's mixed performance in Q4 and the full year 2023 reflects both the strengths and challenges faced by the company. The growth in Internet and mobile services underscores Charter's successful pivot towards these segments, which are increasingly important as consumer preferences evolve. However, the decline in video customers and the significant increase in capital expenditures to support network expansion and evolution indicate that Charter is in a transitional phase, investing heavily to position itself for future growth.

For value investors, Charter's aggressive share repurchase program, which reduced shares outstanding by 5.2% in 2023, may signal management's confidence in the company's intrinsic value. Additionally, Charter's ongoing investments in network infrastructure and customer experience improvements could enhance its competitive positioning in the long term, potentially leading to sustained growth and profitability.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider the implications of Charter's strategic initiatives and financial results for their investment decisions.

Explore the complete 8-K earnings release (here) from Charter Communications Inc for further details.

This article first appeared on GuruFocus.