Charter Communications Inc Director Craig Jacobson Sells Company Shares

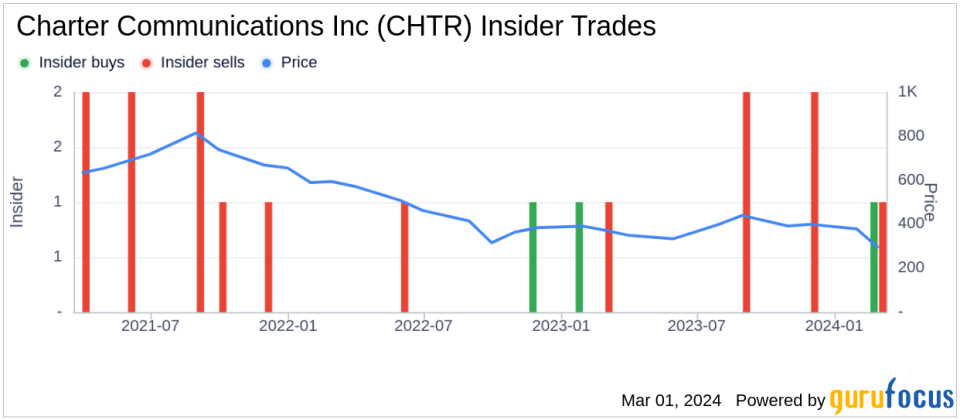

Charter Communications Inc (NASDAQ:CHTR), a leading broadband connectivity company and cable operator serving more than 31 million customers in 41 states through its Spectrum brand, has reported an insider sale according to a recent SEC filing. Director Craig Jacobson sold 918 shares of the company on February 28, 2024.Craig Jacobson, who holds a position at the company, executed the sale at an average price of $289.24 per share, which resulted in a transaction amount of $265,520.72. Following this transaction, the insider's stake in Charter Communications Inc has adjusted accordingly.Over the past year, the insider has sold a total of 3,022 shares of Charter Communications Inc and has not made any purchase of the company's shares. This latest transaction continues a trend of insider sales at the company, with a total of 5 insider sells and only 1 insider buy over the past year.

The market capitalization of Charter Communications Inc stands at $42.574 billion, reflecting the scale of the company within the telecommunications sector. The stock's price-earnings ratio is currently 9.77, which is below both the industry median of 16.45 and the company's historical median price-earnings ratio, suggesting a lower valuation relative to its peers and its own trading history.

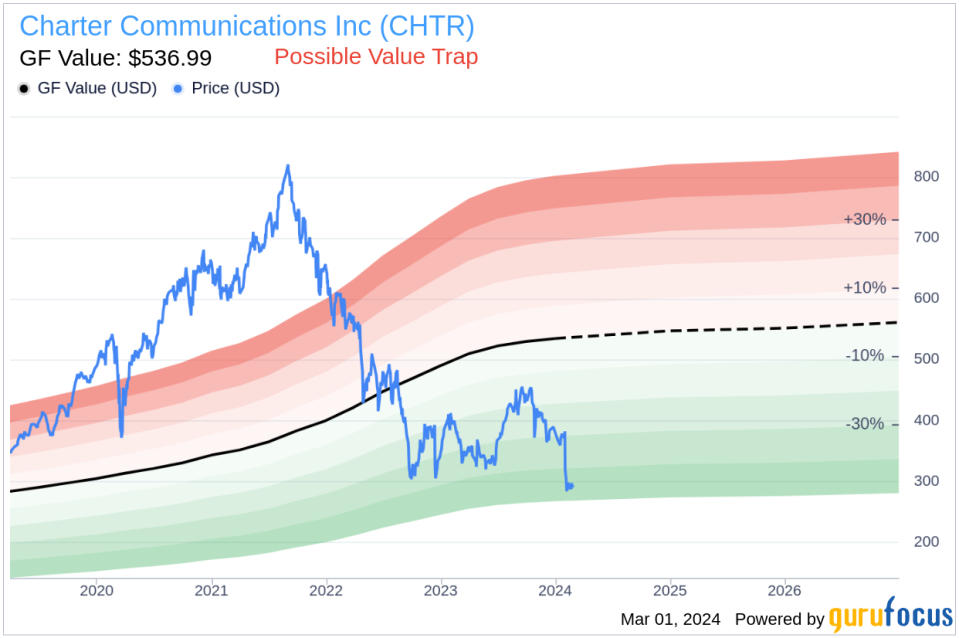

According to the GuruFocus Value chart, with a current share price of $289.24 and a GF Value of $536.99, Charter Communications Inc is trading with a price-to-GF-Value ratio of 0.54. This indicates that the stock is a possible value trap and investors should think twice, based on its GF Value. The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.The insider's recent sale may attract the attention of investors who track insider behaviors as an indicator of company performance and future outlook. It is important for investors to consider the broader context of the market, the company's performance, and other insider transactions when evaluating the significance of this sale.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.