Charter's (NASDAQ:CHTR) Posts Q4 Sales In Line With Estimates But Stock Drops

Cable, internet, and telephone services provider Charter (NASDAQ:CHTR) reported results in line with analysts' expectations in Q4 FY2023, with revenue flat year on year at $13.71 billion. It made a GAAP profit of $7.07 per share, down from its profit of $7.69 per share in the same quarter last year.

Is now the time to buy Charter? Find out by accessing our full research report, it's free.

Charter (CHTR) Q4 FY2023 Highlights:

Market Capitalization: $56.56 billion

Revenue: $13.71 billion vs analyst estimates of $13.7 billion (small beat)

EPS: $7.07 vs analyst expectations of $8.77 (19.4% miss)

Free Cash Flow of $1.06 billion, similar to the previous quarter

Gross Margin (GAAP): 55.4%, up from 45.5% in the same quarter last year

Residential video subscribers: 13.5 thousand (in line)

Residential internet subscribers: 28.5 thousand (slight miss)

"Our rural footprint expansion is exceeding our deployment and penetration targets," said Chris Winfrey, President and CEO of Charter.

Operating as Spectrum, Charter (NASDAQ:CHTR) is a leading telecommunications company offering cable television, high-speed internet, and voice services across the United States.

Cable and Satellite

Cable and satellite companies often enjoy local oligopolies as there are limited options if a household or business wants TV or internet service. The flip side of this coin is that these businesses have oligopolies because they are capital-intensive, with multi-year investments in laying fiber, for example, needed to serve customers. These massive physical footprints make it challenging to adjust to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power.

Sales Growth

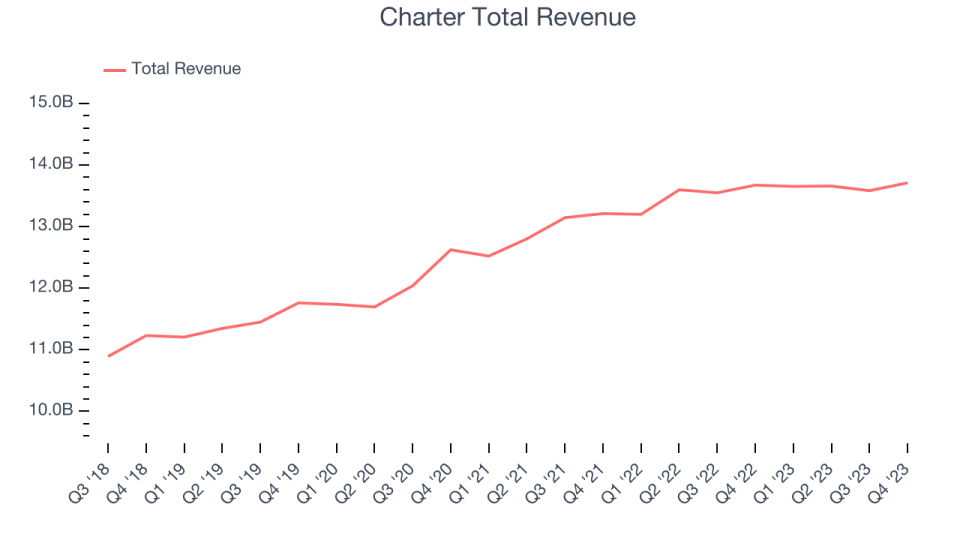

Exploring a company's long-term performance can offer valuable insights into its business quality. Any business can experience brief periods of success, but distinguished ones maintain steady growth over time. Charter's annualized revenue growth rate of 4.3% over the last 5 years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Charter's recent history shows its growth has slowed, as its annualized revenue growth of 2.8% over the last 2 years is below its 5-year trend.

This quarter, Charter's $13.71 billion of revenue was flat year on year and in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 1.6% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

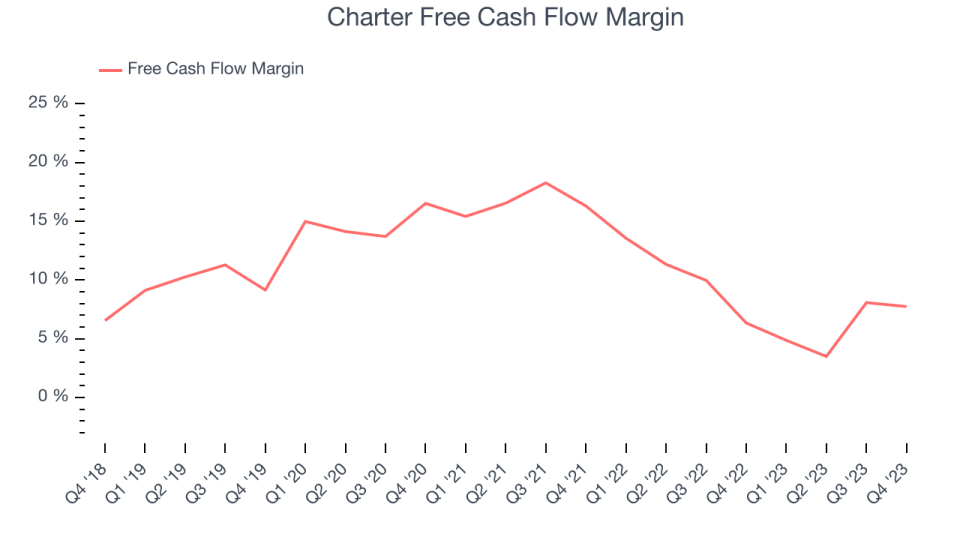

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Charter has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.2%, subpar for a consumer discretionary business.

Charter's free cash flow came in at $1.06 billion (7.7% margin) in Q4, up 22.4% year on year.

Over the next year, analysts predict Charter's cash profitability will improve. Their consensus estimates imply a 1.3 percentage point increase in the company's free cash flow margin to 9%.

Key Takeaways from Charter's Q4 Results

We struggled to find many strong positives in these results. Revenue beat by a very small amount. On the other hand, residential video subscriber count was in line while internet subscribers missed by a bit. Adjusted EBITDA was below expectations, leading to an EPS miss vs. analysts' expectations. Overall, this was a mixed but mediocre quarter for Charter. The company is down 5.2% on the results and currently trades at $363 per share.

Charter may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.