Chase Coleman's Tiger Global Management Reduces Stake in ATRenew Inc

On February 14, 2024, Tiger Global Management, led by Chase Coleman (Trades, Portfolio), made a significant adjustment to its investment portfolio by reducing its stake in ATRenew Inc (NYSE:RERE). The transaction involved the sale of 3,827,073 shares at a price of $1.09 per share, resulting in a 33.33% decrease in the firm's holdings in the company. This move has altered the landscape of the guru's investment strategy, with ATRenew Inc now representing a 0.06% position in the portfolio, down from 0.09% previously, and the firm's ownership in the traded stock standing at 8.40%.

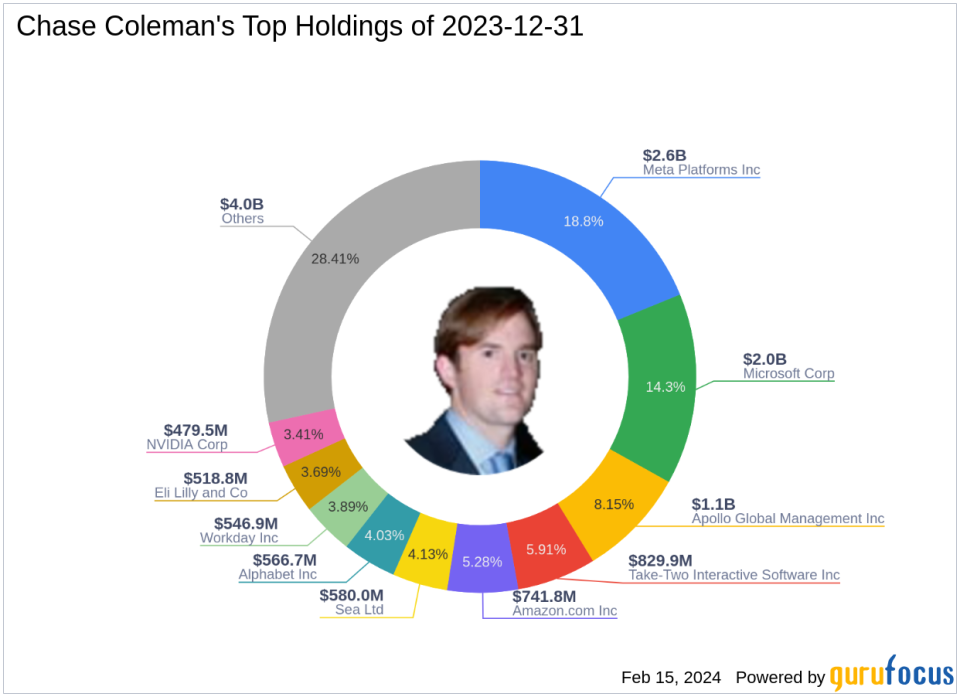

Chase Coleman (Trades, Portfolio) and Tiger Global Management's Investment Profile

Chase Coleman (Trades, Portfolio)'s Tiger Global Management is a renowned investment firm established in 2001. As a "tiger cub" protege of Julian Robertson, Coleman has carved out a niche in the investment world with a focus on small caps and technology stocks. The firm's investment philosophy is rooted in a long-term, fundamentally oriented approach, targeting high-quality companies poised for secular growth and led by top-tier management teams. With 39 stocks in its portfolio and an equity value of $14.05 billion, Tiger Global Management's top holdings include Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and Microsoft Corp (NASDAQ:MSFT), predominantly in the Technology and Communication Services sectors.

ATRenew Inc at a Glance

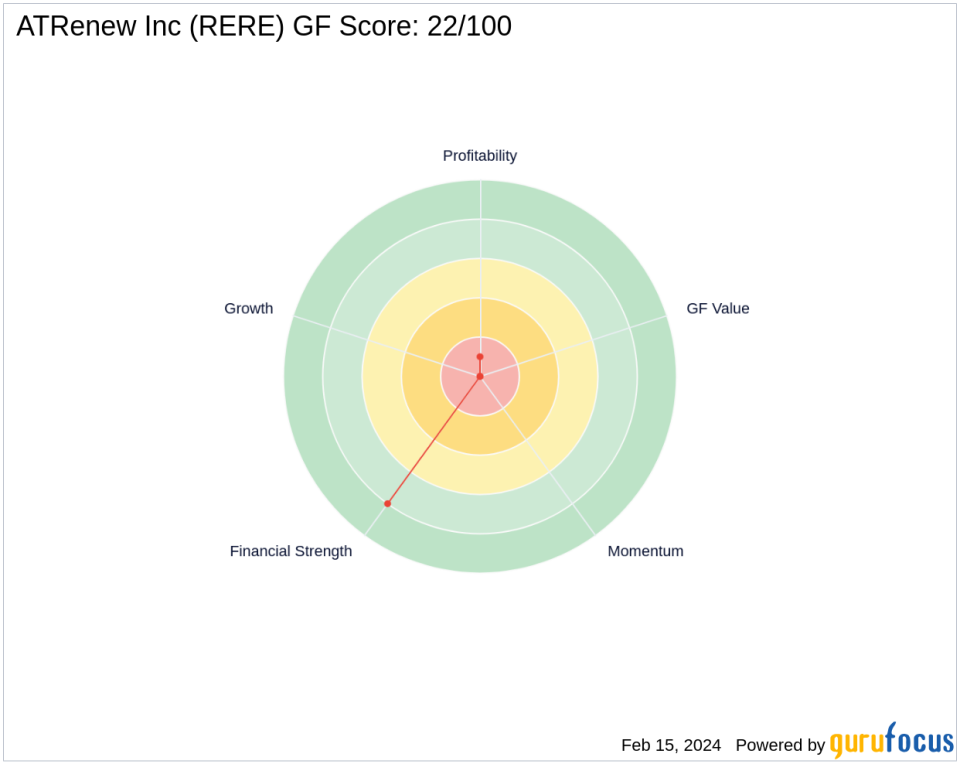

ATRenew Inc, trading under the symbol RERE, is a Chinese company that operates a platform for pre-owned consumer electronics transactions and services. Since its IPO on June 18, 2021, the company has primarily generated revenue through online sales of phones and other consumer electronics. Despite a market capitalization of $250.272 million, ATRenew Inc is currently not profitable, with a PE percentage of 0.00, indicating that the company is operating at a loss. The stock's GF Score stands at 22/100, suggesting a challenging outlook for future performance.

Impact on Coleman's Portfolio

The recent trade has slightly decreased the prominence of ATRenew Inc within Chase Coleman (Trades, Portfolio)'s portfolio. The reduction of over 3.8 million shares has brought the firm's total shareholding in ATRenew Inc to 7,654,145, accounting for a modest 0.06% of the portfolio. This adjustment reflects a strategic shift by the firm, possibly in response to the stock's performance or a reevaluation of its growth prospects.

Comparing ATRenew Inc to Top Holdings

When juxtaposed with Chase Coleman (Trades, Portfolio)'s top holdings, ATRenew Inc stands out as a unique investment. Unlike the firm's preference for large-cap technology and communication services companies, ATRenew Inc operates in the cyclical retail sector and has a significantly smaller market cap. This investment represents a diversification into a different industry and market segment, which may offer a distinct set of risks and opportunities compared to the firm's other top investments.

Market Performance and Stock Analysis

Since the trade date, ATRenew Inc's stock price has seen a marginal increase of 1.83%, with the current price at $1.11. However, the stock has experienced a substantial decline of 93.93% since its IPO and a year-to-date drop of 36.21%. The company's financial health, as indicated by its Financial Strength rank of 8/10, appears stable, but its Profitability Rank of 1/10 and Growth Rank of 0/10 raise concerns about its ability to generate profits and expand its business.

Prospects for ATRenew Inc

The future potential of ATRenew Inc is uncertain, with a GF Score of 22/100 indicating poor future performance potential. The company's balance sheet appears robust, with a cash to debt ratio of 8.10, but its profitability and growth metrics are less encouraging. The stock's Piotroski F-Score of 4 and Altman Z score of 2.57 suggest moderate financial stability, but the lack of profitability and growth may hinder its long-term prospects.

Conclusion

Chase Coleman (Trades, Portfolio)'s recent trade reflects a strategic reduction in Tiger Global Management's stake in ATRenew Inc. While the company's financial health is relatively strong, its poor profitability and growth prospects, as well as its underwhelming market performance, may have influenced the firm's decision to decrease its position. Investors will be watching closely to see how this move aligns with Tiger Global Management's broader investment strategy and whether ATRenew Inc can overcome its current challenges to become a more attractive investment opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.