Chase Coleman's Tiger Global Management Buys More Fiat Chrysler

- By James Li

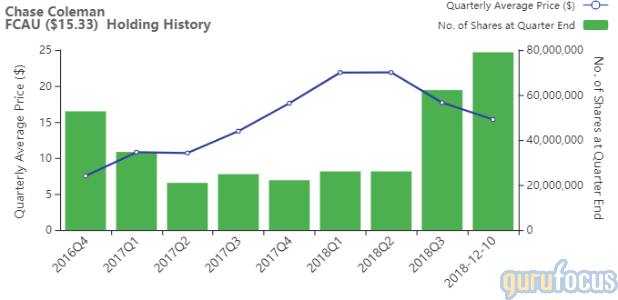

Chase Coleman (Trades, Portfolio)'s Tiger Global Management disclosed this week the firm increased its holding of Fiat Chrysler Automobiles NV (FCAU) by 27.07% according to GuruFocus real-time picks.

Warning! GuruFocus has detected 1 Warning Sign with FCAU. Click here to check it out.

The intrinsic value of FCAU

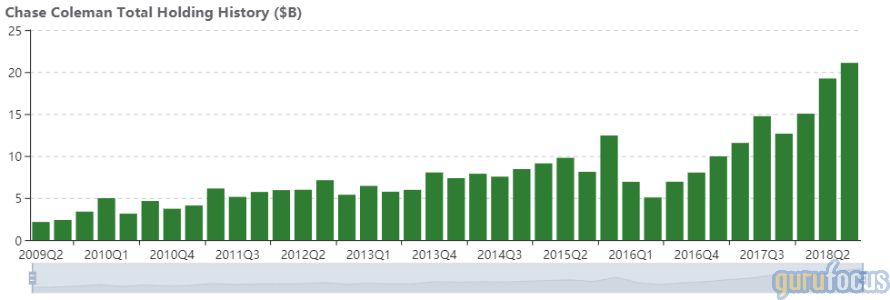

Coleman, a former protege of Tiger Management founder Julian Robertson (Trades, Portfolio), prefers investing in small caps and technology stocks. The $21.09 billion equity portfolio has a 40.46% weight in the technology sector.

Firm buys more Fiat Chrysler as China moves to tone down tariffs on U.S. auto imports

Coleman's firm added 16.83 million shares of Fiat Chrysler for $15.34 per share, increasing the position to 79 million shares. The transaction expanded the equity portfolio 1.21%.

CNBC columnist John Melloy said on Tuesday that Chinese Vice Premier Liu He planned to reduce the tariff on U.S. auto imports from 40% to 15%, a move that could "break an escalating trade war" between the U.S. and China according to reports from the Wall Street Journal. Shares of Fiat Chrysler closed at $15.44, up 0.72% from its previous close of $15.33.

Other gurus with large holdings in Fiat Chrysler include Ruane Cunniff (Trades, Portfolio), Bill Nygren (Trades, Portfolio), Pioneer Investments (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio).

Top U.S. auto companies also rise

General Motors Co. (GM), a major holding of David Einhorn (Trades, Portfolio) and Berkshire Hathaway Inc. (BRK-A)(BRK-B) CEO Warren Buffett (Trades, Portfolio), traded at an intraday high of $35.75, up 3.86% from its previous close of $34.44. Despite this, the Detroit-based auto manufacturer closed at $34.69, paring most of the gains.

Other major U.S. auto companies, which include Tesla Inc. (TSLA) and Ford Motor Co. (NYSE:F), increased on the news.

See also

While Coleman prefers investing in technology, the firm's equity portfolio has a 45.17% weight in the consumer cyclical sector, which includes industries like specialty retail, entertainment, homebuilding, autos and leisure. The firm's top five holdings as of the third quarter are Amazon.com Inc. (AMZN), Spotify Technology SA (SPOT), Microsoft Corp. (MSFT), JD.com Inc. (JD) and Booking Holdings Inc. (BKNG).

Disclosure: No positions.

Read more here:

Tech Guru Chase Coleman Buys Buffett's Apple, 7 More in 3rd Quarter

5 Auto Companies Gurus Agree On

Einhorn's General Motors Soars on Strong 3rd Quarter Sales Growth

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with FCAU. Click here to check it out.

The intrinsic value of FCAU