Cheesecake Factory (CAKE) Jumps 24% in a Year: Can It Continue?

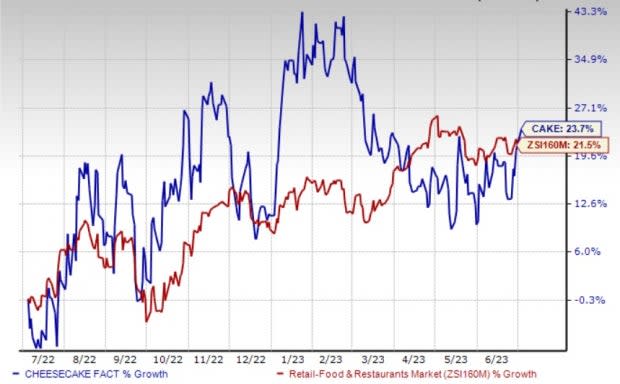

Shares of The Cheesecake Factory Incorporated CAKE have gained 23.7% in the past year compared with the industry’s growth of 21.5%. Robust comps growth, off-premise sales and emphasis on FRC-related differentiated concepts are aiding CAKE’s performance. However, high costs are concerning.

Our model predicts the company’s sales and earnings in 2023 to witness growth of 6.8% and 77.8% year over year, respectively.

Let’s delve deeper to find out why investors should retain the stock.

Growth Drivers

Cheesecake Factory continues to benefit from robust comps growth. During first-quarter fiscal 2023, comps at CAKE restaurants increased 5.7% year over year compared with 20.7% reported in the prior-year quarter. Also, comps rose 14.9% from 2019 levels driven by a rise in average check of 4.7% (based on an increase of 10.4% in menu pricing partially offset by a 5.7% negative impact from mix) and 1.0% improved customer traffic.

North Italia comparable sales rose 9% year over year compared with 32% reported in the year-ago quarter. Also, comps increased 30% from 2019 levels driven by customer traffic and average check growth of 3.5% and 5.5%, respectively.

The Zacks Rank #3 (Hold) company is benefiting from robust off-premise sales, which contributed delivery channel. In order to boost consumer convenience, Cheesecake Factory has implemented operational changes and technology upgrades which include a contactless menu and payment technology, and text paging. We believe that an uplift in customer count coupled with targeted off-premise marketing will drive the channel’s performance further in the upcoming periods.

Fox Restaurants Concepts sales have continued to build and off-premise volumes were solid. During first-quarter 2023, FRC (excluding Flower Child) recorded sales of $68.6 million, marking a 17% increase compared with the prior-year quarter’s levels. Sales per operating week reached $152,200.

FRC’s (including Flower Child) average weekly sales were $118,800 and external bakery sales amounted to $14.9 million. The company intends to focus on rewards program and leverage data analytics to enhance guest engagement and drive incremental sales.

Image Source: Zacks Investment Research

Concerns

High costs remain headwinds for CAKE. Pre-opening costs of outlets, given its unit expansion plans, expenses related to sales initiatives, higher labor expenditures and additional cleaning costs, are likely to affect profits.

During the fiscal first quarter, cost of food and beverage, as a percentage of revenues, increased 10 basis points year over year to 23.8%. This was primarily driven by commodity inflation and higher menu pricing. General and administrative expenses accounted for 6.2% of revenues. In the fiscal first quarter, pre-opening costs accounted for $3.1 million compared with the prior-year quarter’s $1.8 million.

For second-quarter fiscal 2023, Cheesecake Factory anticipates commodity inflation in high single digits. Labor inflation is anticipated int the mid-single digits range. For fiscal 2023, our model estimates total cost of sales to rise 3.7% year over year.

Key Picks

Here we present some better-ranked stocks in the Retail-Wholesale sector.

Chuy's Holdings, Inc. CHUY currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 23.4%, on average. Shares of CHUY have skyrocketed 97.1% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Chuy’s Holdings’ 2023 sales and EPS suggests growth of 9.9% and 27%, respectively, from the year-ago period’s levels.

BJ's Restaurants, Inc. BJRI flaunts a Zacks Rank #1 at present. BJRI has a long-term earnings growth rate of 15%. The stock has improved 44% in the past year.

The Zacks Consensus Estimate for BJ's Restaurants’ 2023 sales and EPS suggests improvements of 5.5% and 311.8%, respectively, from the year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO currently carries a Zacks Rank #2 (Buy). ARCO has a long-term earnings growth rate of 9.5%. The stock has gained 48.3% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2023 sales and EPS suggests rises of 13.4% and 4.4%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

The Cheesecake Factory Incorporated (CAKE) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report