Cheesecake Factory Inc (CAKE) Reports Mixed Fourth Quarter Results Amidst Expansion Efforts

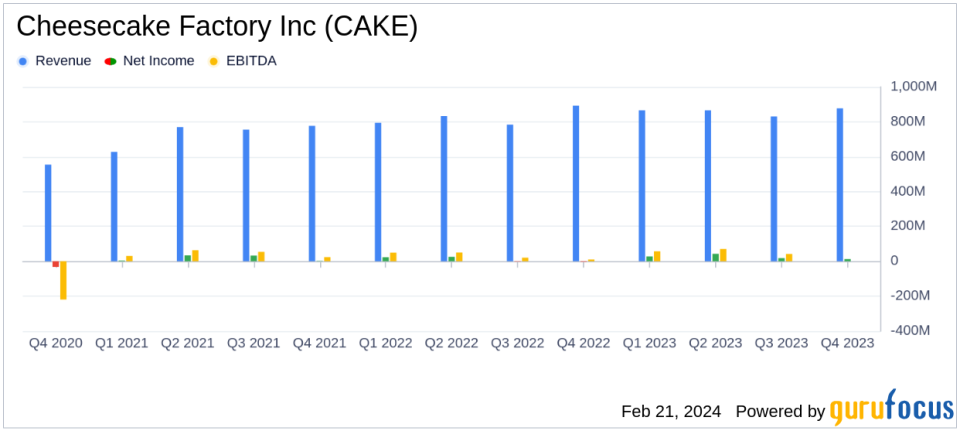

Revenue: Total revenues decreased slightly to $877.0 million in Q4 2023 from $892.8 million in Q4 2022.

Net Income: Reported net income was $12.7 million, with diluted earnings per share (EPS) of $0.26.

Adjusted Net Income: Adjusted for certain expenses, net income was $39.0 million, with adjusted EPS of $0.80.

Comparable Sales: The Cheesecake Factory restaurants saw a 2.5% year-over-year increase in comparable restaurant sales.

Expansion: Nine new restaurants opened in Q4 2023, and international presence grew with new locations in China, Thailand, and Mexico.

Liquidity and Capital Allocation: Total available liquidity stood at $292.8 million, with a quarterly dividend declared at $0.27 per share.

Stock Repurchase: Approximately 318,400 shares repurchased at a cost of $9.8 million during the quarter.

On February 21, 2024, Cheesecake Factory Inc (NASDAQ:CAKE) released its 8-K filing, detailing the financial results for the fourth quarter of fiscal 2023, which ended on January 2, 2024. Despite a slight decrease in total revenues from the same quarter last year, the company reported an increase in adjusted net income and earnings per share, reflecting a resilient performance in a challenging environment.

Cheesecake Factory owns and operates restaurants under various brands, including The Cheesecake Factory, North Italia, and a collection within the Fox Restaurants Concepts subsidiary. The company's international presence is through licensing agreements, and it also operates a bakery division. The majority of the company's revenue comes from The Cheesecake Factory restaurants segment.

Financial Performance and Challenges

The reported net income of $12.7 million and diluted EPS of $0.26 were impacted by a pre-tax net expense of $35.6 million related to asset impairment, lease termination expenses, and acquisition-related items. Adjusting for these factors, the adjusted net income and EPS were $39.0 million and $0.80, respectively. This adjustment is crucial for investors to understand the underlying performance of the company, excluding one-time costs.

Comparable restaurant sales at The Cheesecake Factory restaurants increased by 2.5% year-over-year, which is a positive indicator of the brand's strength and its ability to attract customers despite broader industry challenges. However, the company's total revenues saw a slight decline, primarily due to the previous year's quarter including an additional week of sales.

Financial Achievements and Importance

The company's financial achievements, such as the growth in adjusted net income and the successful opening of new restaurants, are significant in the competitive restaurant industry. These achievements demonstrate the company's ability to manage costs effectively and expand its market presence. The increase in comparable restaurant sales suggests that Cheesecake Factory is maintaining its appeal to customers, which is vital for long-term success.

During the quarter, Cheesecake Factory continued its expansion with nine new restaurant openings, including international locations. This expansion is a testament to the brand's growth strategy and its potential to increase market share both domestically and internationally.

Key Financial Metrics

Key financial metrics from the income statement, such as the 7.7% increase in revenues when adjusted for the additional week in the previous fiscal year, highlight the company's ability to grow sales. The balance sheet shows a healthy cash position of $56.3 million, and the cash flow statement reflects the company's ongoing ability to generate liquidity, with $292.8 million available including revolving credit facilities.

Important metrics such as labor expenses, which accounted for 35.2% of revenues, and food and beverage costs, at 23.0%, are critical for understanding the company's cost management strategies. These figures are essential for investors as they provide insight into the company's operational efficiency and profitability potential.

"Our fourth quarter results marked a strong finish to the year, with positive comparable sales growth and margin expansion contributing to record annual revenue and solid earnings growth for the year," said David Overton, Chairman and Chief Executive Officer.

Analysis of Company Performance

Cheesecake Factory's performance in the fourth quarter shows resilience in a challenging economic environment. The company's strategic expansion and operational efficiencies have contributed to its ability to maintain profitability and reward shareholders through dividends and share repurchases. However, the slight dip in total revenues indicates that the company must continue to innovate and adapt to maintain its growth trajectory.

Overall, Cheesecake Factory's mixed fourth-quarter results reflect a company that is managing to grow and expand despite some headwinds, positioning itself for future success in the evolving restaurant industry.

Explore the complete 8-K earnings release (here) from Cheesecake Factory Inc for further details.

This article first appeared on GuruFocus.