Cheetah Mobile's (NYSE:CMCM) Shareholders Are Down 83% On Their Shares

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example the Cheetah Mobile Inc. (NYSE:CMCM) share price dropped 83% over five years. We certainly feel for shareholders who bought near the top. Unfortunately the share price momentum is still quite negative, with prices down 14% in thirty days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Cheetah Mobile

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Cheetah Mobile moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

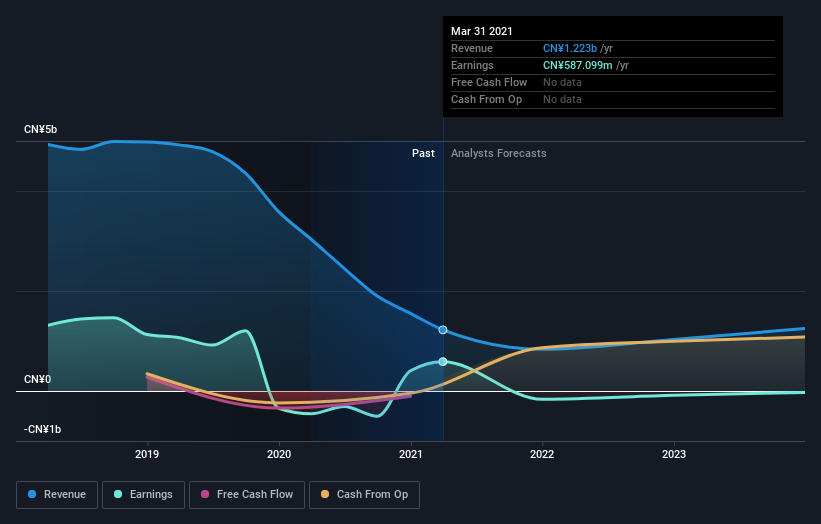

Arguably, the revenue drop of 14% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Cheetah Mobile has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Cheetah Mobile in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Cheetah Mobile's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Cheetah Mobile's TSR, at -69% is higher than its share price return of -83%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market gained around 40% in the last year, Cheetah Mobile shareholders lost 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Cheetah Mobile better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Cheetah Mobile (of which 1 is a bit concerning!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.