The Chefs' Warehouse: A Strategic Turnaround With Potential Upside

The Chefs' Warehouse (NASDAQ:CHEF) has had fluctuating performance over the past 10 years. Its share price increased by nearly 52%, from $23 per share in February 2014 to nearly $32.3 per share at the time of writing, delivering an annualized compounded return of merely 4.30%. Despite the historically sluggish share price performance, an anticipated improvement in operation performance could offer investors decent potential upside in the next several years.

Consistent revenue and profit growth

The Chefs' Warehouse is the premier distributor of specialty foods to many customers, such as fine dining restaurants, hotels, cruise lines and casinos in the U.S., the Middle East and Canada. The company sourced more than 55,000 stock-keeping units of highest-grade gourmet foods and ingredients from more than 2,500 different suppliers. The company does not have customer concentration risk, as its top 10 customers accounted for less than 6.50% of its total net sales in 2022.

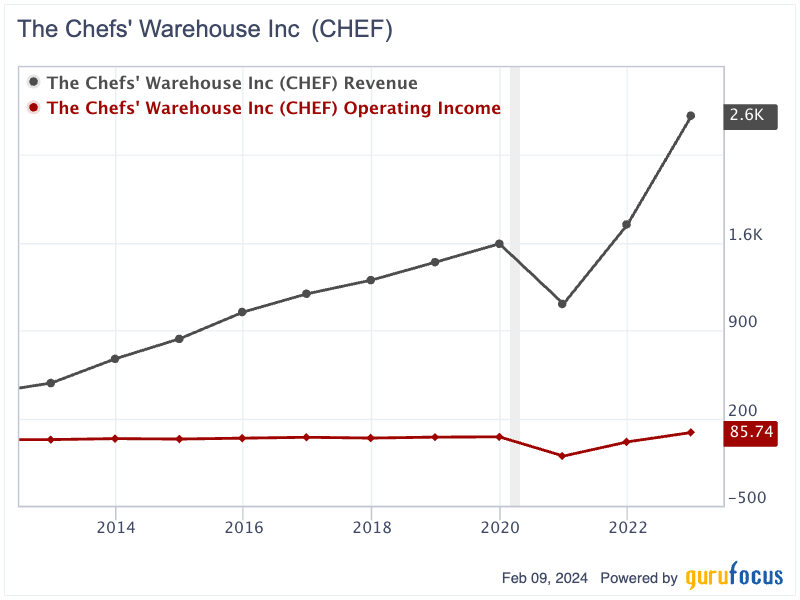

Over the past decade, the company has demonstrated consistent sales growth in nine out of 10 years. Its revenue surged from $480.30 million in 2012 to over $1.59 billion in 2019. However, the Covid-19 pandemic significantly affected the company, reducing its revenue to $1.11 billion in 2020. Despite this setback, the company's revenue rebounded impressively, surpassing pre-pandemic levels to reach $2.61 billion in 2022. Operating income followed a similar trend, growing from $28.80 million in 2012 to $50.70 million in 2019. Although the pandemic led to losses exceeding $100 million in 2020, the company's operating income rose to $85.70 million by 2022, which was higher than the pre-pandemic level.

Business growth driven by acquisitions

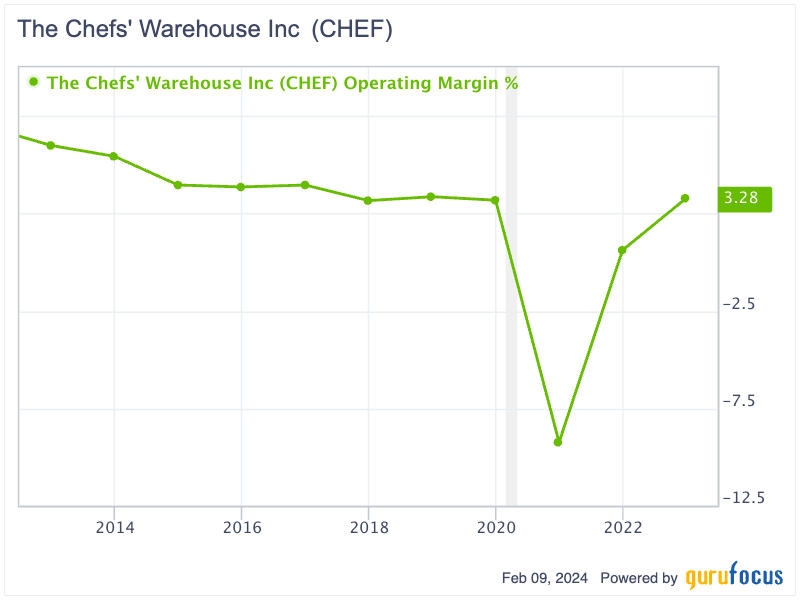

The company's revenue growth was primarily driven by its frequent acquisitions over the years, as its organic growth has been dismal. Recently, CEO Christopher Pappas stated his goal for organic growth to be between 4% and 6% over the next two years, which, in my opinion, is not very impressive. The company has concentrated on acquisitions, purchasing several low-margin businesses to increase market share and expand its distribution network. Excluding the loss-making year of 2020, the normalized operating margin over the past decade has been disappointingly low, fluctuating between 3% and 4%. In 2022, the operating margin was only 3.28%.

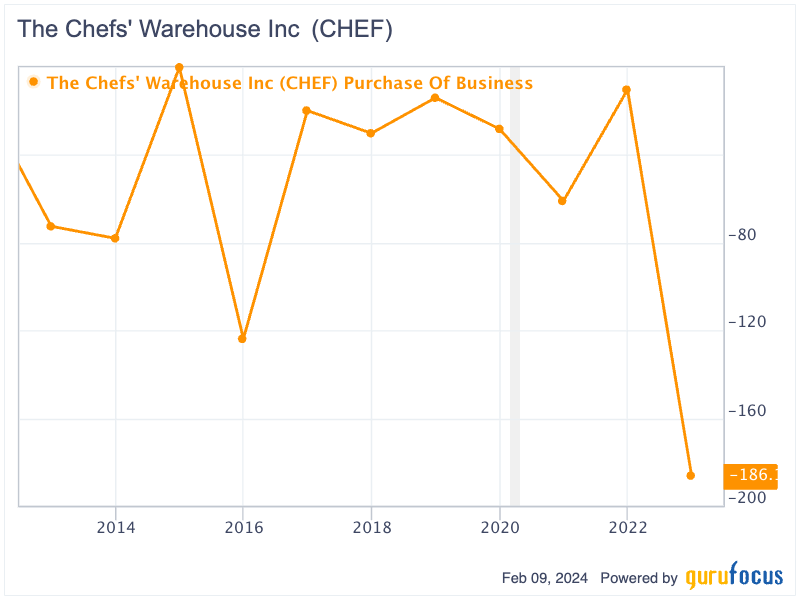

Over the past decade, Chefs' Warehouse has invested a significant amount of money in business acquisitions. In nine out of the last 10 years, the company has allocated funds for acquisitions, with amounts ranging from $13.90 million to $186.20 million. Throughout this period, it spent a total of $623.50 million on purchasing businesses.

Pappas has mentioned the company is focusing its efforts on digesting all the acquisitions it has done in the past two years, including generating more revenue from the same customers, attracting new customers and boosting volumes for the newly constructed warehouses. If the company can reduce the pace of its acquisitions and concentrate on enhancing efficiency and achieving synergies from its past acquisitions, I anticipate more organic revenue growth, cost savings and higher profitability.

High but manageable leverage

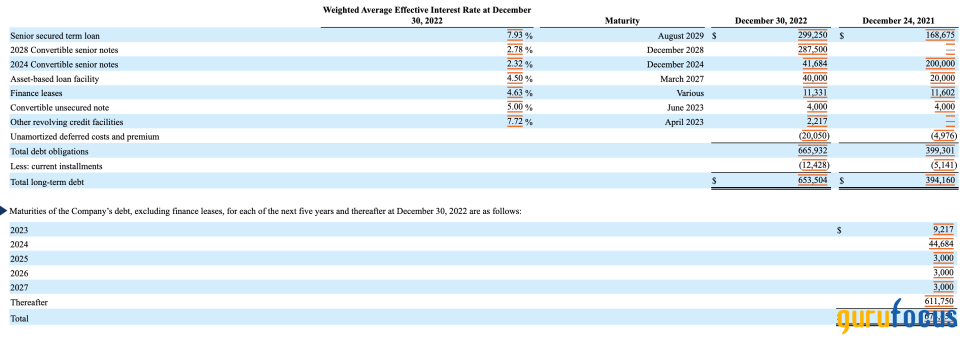

What is worrisome is the company's high leverage. As of September, the company reported a total shareholders' equity of $434.78 million, with cash and cash equivalents at a mere $33 million. The interest-bearing debt and lease liabilities amounted to $701.20 million, and the operating lease liabilities came in at nearly $194 million. However, the debt maturities are well-distributed over time. Only $41.70 million of the outstanding debt is due in December 2024. Between 2025 and 2027, the company faces a modest annual principal repayment of $3 million. Significant repayments are not scheduled until December 2028 and December 2029, when $287.50 million and $299.25 million are due.

Source: Chefs' Warehouse's 10-K

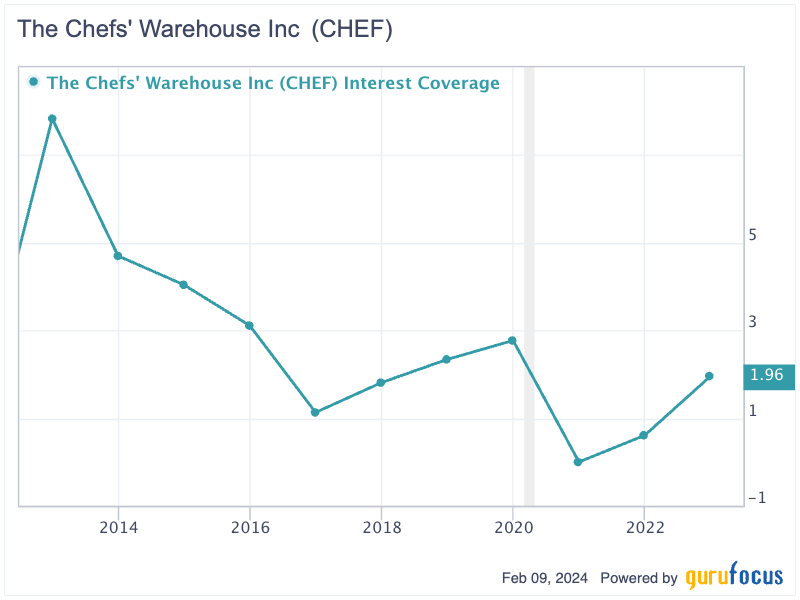

Despite employing a high degree of leverage, Chefs' Warehouse has consistently generated sufficient profits to cover its interest expenses for most of the period. From 2012 to 2022, with the exception of the years 2020 and 2021 due to the pandemic, the company's interest coverage ratio remained between 1.13 and 7.83. In 2022, the company achieved a solid interest coverage ratio of 1.96.

Potential upside

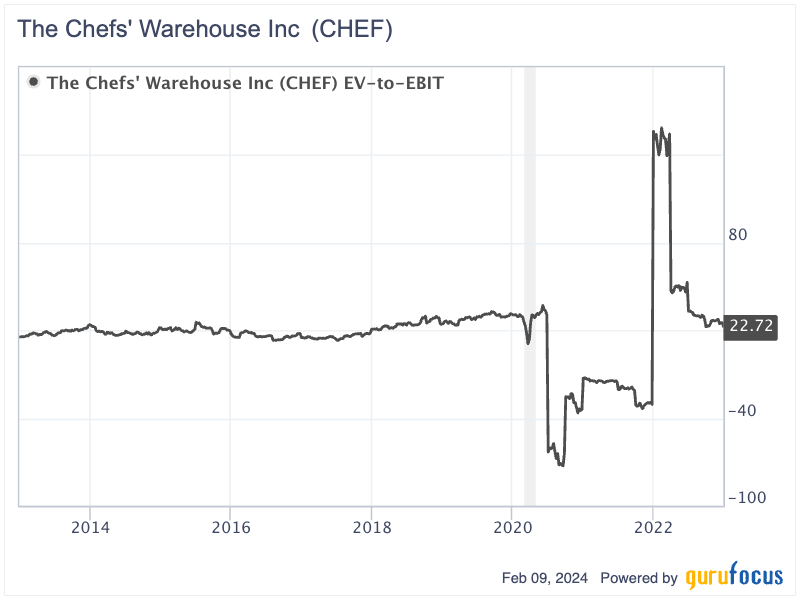

Chefs' Warehouse's enterprise value/Ebit ratio has fluctuated in the past decades, with an especially notable range during the Covid-19 pandemic, swinging from a low of -72.7 to a high of 158.59. Disregarding the anomalous years of 2020 to 2022, the company's normalized earnings multiples have been between 13.16 and 33.5, averaging at 23.

During this period, the company's revenue grew at an annual compounded rate of 18.4%, largely fueled by its acquisitions. The 10-year average Ebit margin stood at only 2.50%. With the company's recent announcement to decelerate its acquisition pace and concentrate on enhancing profitability, let's assume that its revenue growth may slow to about 10% annually, while operating margins could potentially double to 5% within the next five years. This would bring the company's Ebit to an estimated $210.40 million by 2027. Using the average multiple of 23, Chefs' Warehouse's enterprise value could reach $4.84 billion by that year. When factoring in a 10% discount rate over five years, the present value of the company's enterprise value would be $3 billion, a 36% upside from its current market price.

Key takeaway

Chefs' Warehouse appears set for a potential upswing. After a turbulent decade, the company is poised to improve its financial health and streamline operations. With a solid strategy to enhance profitability and a more conservative approach to acquisitions, the forecast suggests a potential 36% upside in its value. This could make the stock an attractive option for investors eyeing growth opportunities in the specialty food distribution sector.

This article first appeared on GuruFocus.