Chegg Is Coming Out of the Freezer

Last month I wrote about the value of momentum. To summarize, momentum investing is a recognized investing strategy which posits that recent stock market winners will continue their winning streak in the short term, while recent losers will continue to lag. This approach is also referred to as relative strength investing. Momentum in investing is the tendency of a stock's price to keep overperforming (or underperforming) for the near future. Through experimentation with GuruFocus backtesting, my experience is that stocks which show superior momentum over three months tend to maintain their momentum over six months to one year subsequently. Longer than that, the momentum seems to dissipate.

Identifying stocks with changing momentum

I have started looking for stocks that have low momentum scores, but are showing a change of momentum. I am particularly interested in stocks which have shown significantly higher performance over three months (more than 10%) relative to the S&P 500. My hypothesis is the market is beginning to recognize that something has changed in the fundamentals of the stock, but it cannot as yet put its finger on what has changed. While a three-month period may be sufficient time for the more astute investors to recognize the change in the stocks prospects, the majority of the investors have not caught on and if the early recognizers are right ,there is still time to jump on the momentum bandwagon.

Case study: Chegg

One such stock which is showing signs of life is a former hot stock that went ice cold and is now showing signs of life. Chegg Inc. (NYSE:CHGG) is an education technology company that provides a variety of services to students, including textbook rentals, homework help, writing help, exam prep and other student services. Founded in 2005 by Aayush Phumbhra and Osman Rashid, two students at Iowa State University, the company started out as a scholarship search engine, but quickly pivoted in 2007 to focus on textbook rentals.

Chegg's business model is simple: students can rent textbooks for a fraction of the cost of buying them. This was a major disruption to the textbook industry, which had been dominated by high prices and limited availability. The company quickly grew in popularity and expanded its services to include homework help, writing help and exam prep.

Since then, it has acquired several companies to expand its services, including Cramster in 2010 and InstaEDU in 2014. In November 2013, Chegg completed its initial public offering, followed by a second offering in August 2017. In April 2018, Chegg issued convertible senior notes. The company has since become a major player in the education technology industry with over 10 million subscribers.

Chegg has faced some challenges over the years. In 2016, the company was sued by a group of students who claimed it had facilitated cheating by allowing students to post and sell solutions to homework problems. Chegg settled the lawsuit for $12.5 million.

Impact of AI on Chegg's business model

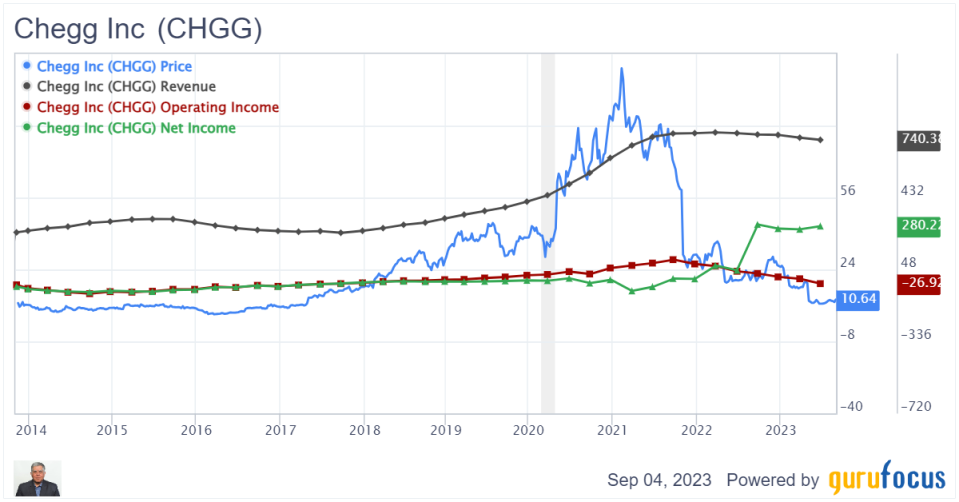

With the introduction of generative large language model artificial intelligence like ChatGPT, Investors have begun to question the company's business model. Investors fear that AI will replace many of the services being provided by Chegg for free, thus disrupting its business. Why should a learner pay for Chegg services when they can use a chatbot for free? All these questions have caused the company's stock to tank. Since the release of ChatGPT in the fall of 2022, the stock has fallen by over 60%, with a steep decline coming after the company released its declining gross subscription numbers for the first quarter in April 2022, though the company said its retention rates remained strong. However, since hitting its low over the summer, the stock has risen over 20% over the last three months, meeting my criteria of a "momentum change." This means, under the surface, investors are gaining confidence.

Why AI might not replace Chegg

Nonetheless, it seems that generative AI is not yet poised to replace services like Chegg, primarily due to two key reasons.

First, there is a lack of validation. A fundamental challenge lies in the absence of a reliable mechanism to verify the accuracy of answers generated by the AI chatbots. There is no certainty that the responses provided by these AI systems are correct. Unless the large language model AI is trained on good, high-quality data, there is a propensity that random errors will surface unexpectedly.

Second, there are complexity and expertise requirements. Utilizing generative AI effectively demands a level of expertise and precision in phrasing questions. Users need to frame their inquiries meticulously to extract valuable responses from services such as ChatGPT. In other words, garbage in will result in garbage out.

Response to AI disruption

Meanwhile, Chegg relies on the combined expertise of its human tutors and an extensive repository of validated solutions. These solutions have undergone rigorous scrutiny from real users, involving discussions, comments, voting and comprehensive feedback mechanisms to ensure reasonable quality control.

In its May earnings call, Chegg introduced its novel AI-enhanced learning service, CheggMate, which aims to combine the power of OpenAI's advanced GPT4 model with Chegg's proprietary knowledge database. CheggMate is designed to offer students a personalized learning experience, incorporating tailored learning paths, quizzes, tests and contextual guidance throughout their educational journey. This service is currently being rolled out to its user base.

Conclusion

Chegg is certainly a battleground stock with bulls and bears fighting to gain control.

On one hand, we have the bulls saying that Chegg has the track record, organization and expertise as an educational technology company and is able to adapt to changing technology and circumstances. By leveraging AI, it will be able to add to its broad offerings. The bulls say that AI alone will not be enough, but has to be married to specific company knowledge to be effective. A "walled garden" approach to AI as conceived by Chegg is much better and safer option than a walk with a wild AI in the open which may be hallucinating and making up things.

The bears, on the other hand, say that student subscribers are a fickle and disloyal lot and are very price sensitive. They will find that free, AI chatbots are already "good enough" for non-business stuff like homework and assignments and they do not need the frills and assurance offered by tools such as the paid CheggMate. The bears argue that Chegg is caught up in the classical innovators dilemma. The Innovator's Dilemma is a term coined by Harvard Business School Professor Clayton M. Christensen to describe the phenomenon whereby a successful company finds it difficult to adapt to disruptive new technologies and business models. The dilemma arises when a company's current business model becomes obsolete, but the company is unable to adapt to the new technologies and business models that are emerging. This is because it is more concerned with preserving its old successful business model and profits compared to its competitors who are unconcerned about any legacy issues and have nothing to lose by forging ahead.

Chegg announced its new AI-enhanced learning service, CheggMate, during its May earnings call. CheggMate combines the power of OpenAI's new advanced GPT-4 model powered by Chegg's proprietary knowledge database to offer students a more personalized and validated learning experience. The service is designed to provide students with a tailored learning paths, quizzes, tests, and contextual guidance throughout their educational journey. Chegg believes that its business can benefit from AI rather than being undermined by it, citing user surveys that suggest students still prefer AI tools supplemented by human expertise.

Chegg's stock currently appears to be good value, though analysts' consensus rating is an unenthusiastic "hold" even though it is profitable and cash flow positive. Overall, if you are of a contrarian bent of mind, it may not be a bad idea to take a small long position in the company and see how things develop with AI. However there is no denying that the stock is risky given that it is facing disruptive and rapidly improving technology. Suffice to say, the stock is not for the faint hearted.

This article first appeared on GuruFocus.