Chemed (CHE) Faces Macroeconomic Woes, Tough Competition

Chemed’s CHE business suffers from headwinds like seasonality in business, competitive landscape and dependence on government mandates. The stock carries a Zacks Rank #4 (Sell).

In recent times, Chemed’s margin performance has been affected by inflation, increased logistics costs and higher employee-related expenses. In the second quarter, CMS re-implemented sequestration, which negatively impacted the company’s gross margin.

In the second quarter of 2023, the company witnessed a gross margin contraction of 417 basis points (bps) year over year to 32.4% due to an increase in the cost of products and services by 11.1%. Adjusted operating margin contracted 478 bps to 15.3% on an 8.1% increase in adjusted operating expenses.

Further, the market for sewer, drain and pipe cleaning and plumbing repair businesses is highly competitive. Competition is fragmented in most markets, with primarily local and regional firms competing. Besides, Hospice care in the United States is competitive as programs for hospice services are generally uniform. As the hospice care industry is highly fragmented, VITAS competes with a large number of organizations on the basis of its ability to deliver quality, responsive services.

On a positive note, Chemed’s VITAS segment benefited from the strong adoption of its advanced hospice and palliative care services through a network of physicians, registered nurses, home health aides, social workers, clergy and volunteers. In the second quarter, VITAS net revenues were up 7.8% year over year. The rise in revenues was primarily due to a 6.2% increase in days of care and an increase in the geographically weighted average Medicare reimbursement rate of nearly 2.7%.

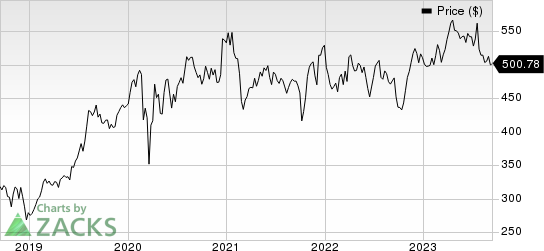

Chemed Corporation Price

Chemed Corporation price | Chemed Corporation Quote

Management believes Roto-Rooter is well-positioned for growth post-pandemic and anticipates continued expansion of the segment’s market share, banking on the company’s core competitive advantages in terms of brand awareness, customer response time, 24/7 call centers and Internet presence. A notable e-marketing initiative by Roto-Rooter is to expand brand awareness among younger audiences by placing advertisements and content on various social media platforms, including Facebook, Instagram and YouTube.

Over the past year, shares of Chemed have outperformed the industry. The stock has risen 5.7% against the industry’s 8.9% decline.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Quanterix QTRX and SiBone SIBN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Haemonetics’ stock has risen 15% in the past year. Earnings estimates for Haemonetics have increased from $3.56 to $3.74 for 2023 and from $3.96 to $4.07 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.39%. In the last reported quarter, it posted an earnings surprise of 38.16%.

Estimates for Quanterix’s 2023 loss per share have narrowed from $1.19 to 97 cents in the past 30 days. Shares of the company have increased 159.4% in the past year against the industry’s decline of 4.1%.

QTRX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Estimates for SiBone’s 2023 loss have narrowed from $1.42 to $1.27 per share in the past 30 days. Shares of the company have increased 23.1% in the past year against the industry’s fall of 2.1%.

SIBN’s earnings beat estimates in all the trailing four quarters, the average surprise being 20.37%. In the last reported quarter, SiBone delivered an earnings surprise of 26.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report

SiBone (SIBN) : Free Stock Analysis Report