Chemed (CHE) Q3 Earnings and Revenues Surpass, Margins Rise

Chemed Corporation CHE reported adjusted earnings per share (EPS) of $5.32 in the third quarter of 2023, up 24.9% year over year. The figure also surpassed the Zacks Consensus Estimate by 8.1%.

The company’s GAAP EPS was $4.93, up 30.4% from last year’s reported figure.

Revenues in Detail

Revenues in the reported quarter improved 7.2% year over year to $564.5 million. The metric beat the Zacks Consensus Estimate by 0.8%.

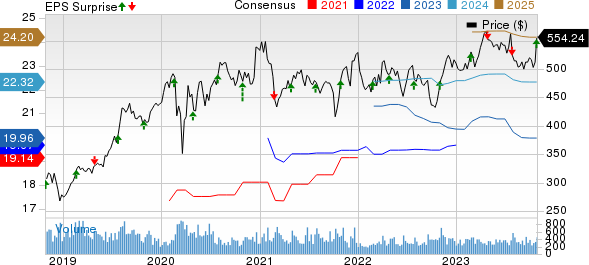

Chemed Corporation Price, Consensus and EPS Surprise

Chemed Corporation price-consensus-eps-surprise-chart | Chemed Corporation Quote

Segmental Details

Chemed operates through two wholly owned subsidiaries — VITAS (a major provider of end-of-life care) and Roto-Rooter (a leading commercial and residential plumbing plus drain cleaning service provider).

VITAS

In the third quarter, net revenues totaled $333.7 million, up 12.5% year over year. This figure compares with our model’s segmental projection of $331.1 million for the third quarter.

The rise in revenues was primarily due to a 9.4% increase in days of care and an increase in the geographically weighted average Medicare reimbursement rate of nearly 2.7%.

Roto-Rooter

The segment reported sales of $230.8 million in the third quarter, up 0.4% year over year. This figure compares with our model’s segmental projection of $227.4 million for the third quarter.

Total Roto-Rooter branch commercial revenues improved 1.5% from the last year, on a 1.8% rise in commercial plumbing, 11.9% growth in excavation revenues and a 2.0% hike in commercial water restoration revenues. This was offset by a 4.2% decrease in drain cleaning revenues.

Total Roto-Rooter branch residential revenues registered an increase of 0.3% over the prior-year period. This consisted of a 0.3% increase in plumbing, 3.2% growth in excavation and a 4.3% increase in water restoration, offset by a 6.7% decrease in drain cleaning.

Margins in Detail

The gross profit increased 12.6% year over year to $202.2 million in the third quarter of 2023. The gross margin expanded 171 basis points (bps) year over year to 35.8% despite an increase in the cost of products and services by 4.5% in the third quarter of 2023.

The adjusted operating profit increased 7.4% from the year-ago period to $102.6 million. The adjusted operating margin expanded 2 bps to 18.2% despite an increase of 18.6% in adjusted operating expenses.

Liquidity & Capital Structure

Chemed exited the third quarter of 2023 with cash and cash equivalents of $173.2 million, which marked a significant increase from $7.8 million at the end of the prior year’s comparable period. Meanwhile, the company did not have any long-term debt at the quarter end compared with $95.9 million at the end of the third quarter of 2022.

The cumulative net cash provided by operating activities at the end of the third quarter of 2023 was $221.7 million compared with $209.7 million in the year-ago period.

During the quarter, the company repurchased 28,457 shares of Chemed stock for $14.3 million, which equates to a cost per share of $504.07. As of Sep 30, 2023, there was approximately $60 million of remaining share repurchase authorization under its plan.

Chemed has a consistent dividend-paying history, with the five-year annualized dividend growth being 6.04%.

2023 Guidance

Chemed provided updated 2023 guidance during the third-quarter earnings call.

The company anticipates 2023 revenues from VITAS, prior to Medicare Cap, to increase in the range of 9.3%-9.5% from the prior year (previously projected at 8.5%-9.5%).

Roto-Rooter is expected to achieve 2023 revenue growth in the range of 1.6-2% (previously 1%-2%).

For 2023, the Zacks Consensus Estimate for total revenues is pegged at $2.25 billion, suggesting 5.4% growth from the 2022 reported figure.

For the full-year 2023, the adjusted EPS is estimated in the range of $19.82-$20.02 (previously $19.90-$20.10). The Zacks Consensus Estimate for the metric is pegged at $19.96, suggesting 1.1% growth over the 2022 adjusted figure.

Our Take

Chemed ended the third quarter of 2023 with better-than-expected earnings and revenues. The performance reflects continued improvement in VITAS' Healthcare segment’s operational metrics, a direct result of the company’s retention and hiring program launched on Jul 1 last year. The Roto-Rooter segment remains well-positioned in spite of economic headwinds on consumer spending. Further, expansion in both margins raises our optimism.

However, within Roto-Rooter, revenues from commercial and residential drain cleaning services posted a decline during the quarter.

Zacks Rank and Key Picks

Chemed currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the broader medical space are Inari Medical NARI, Insulet PODD and Cencora, Inc. COR.

Inari Medical, carrying a Zacks Rank #2 (Buy), reported a second-quarter 2023 adjusted EPS of 4 cents, beating the Zacks Consensus Estimate by a staggering 128.6%. Revenues of $119 million outpaced the consensus estimate by 2.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inari Medical has an estimated earnings growth rate of 725% for the next year. Inari Medical’s earnings surpassed estimates in all the trailing four quarters, the average being 66.8%.

Insulet, carrying a Zacks Rank #2, reported a second-quarter 2023 adjusted EPS of 38 cents, which beat the Zacks Consensus Estimate by 58.3%. Revenues of $396.5 million outpaced the consensus estimate by 3.3%.

Insulet has an estimated long-term earnings growth rate of 41.5% compared with the industry’s 14.4% growth. PODD’s earnings surpassed estimates in all the trailing four quarters, the average being 126.9%.

Cencora reported third-quarter fiscal 2023 adjusted earnings of $2.92, which beat the Zacks Consensus Estimate by 3.2%. Revenues of $66.9 billion surpassed the Zacks Consensus Estimate by 5.6%. It currently has a Zacks Rank #2.

Cencora has an earnings yield of 6.8% compared with the industry’s -1.1%. COR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cencora, Inc. (COR) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report