Chemed (CHE) Roto-Rooter Business Grows, VITAS Admission Dips

Chemed’s CHE Roto-Rooter business has been registering robust performance over the past few quarters. A good solvency position buoys optimism. Yet, headwinds like seasonality in business, competitive landscape and dependence on government mandates are intimidating. The stock carries a Zacks Rank #3 (Hold).

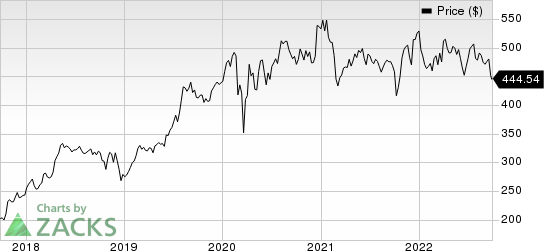

Over the past year, Chemed has outperformed its industry. The stock has gained 1.4% against the industry's 36.3% decline.

Chemed ended the second quarter of 2022 with better-than-expected earnings. The year-over-year growth in adjusted earnings per share appears promising. Robust performance by the Roto-Rooter segment drove the top line. The company recorded substantial increases in drain cleaning, plumbing, excavation and water restoration revenues in the quarter under review. The expansion of gross and operating margins instills optimism. The decline in operating costs is encouraging too.

Chemed’s nursing home admissions for the second quarter rose 5.3%. Assisted living facility admissions increased 5.6% and home-based pre-admit admissions grew 0.2% on a year-over-year basis. The company’s average length of stay in the reported quarter was 103.7 days, up from 94.5 days in the second quarter of 2021. The quarter’s median length of stay of 17 days compared favorably with the 14 days median length of stay in the year-ago period.

Chemed has been registering strong performance from the VITAS business over the past few quarters. Although the segment's revenues declined during the second quarter, it was somewhat offset by a geographically weighted average Medicare reimbursement rate increase of nearly 1.3%. The company’s second-quarter operating results reflected good earnings performance of the VITAS arm, which exceeded its internal estimates amid the persistent disruption from the pandemic.

The company’s latest admission data suggests that senior housing is in the process of stabilization and recovery. The company’s 2022 outlook anticipates a continued acceleration in the senior housing base census throughout the year.

Chemed Corporation Price

Chemed Corporation price | Chemed Corporation Quote

On the flip side, Chemed’s VITAS revenues registered a 4.5% year-over-year decline in second-quarter 2022, raising apprehension. The VITAS arm continued to be challenged by pandemic-related issues, including health care labor shortages, disruption in senior housing occupancy and related hospice referrals. In the reported quarter, VITAS admissions totaled 14,735 patients, down 12.5% on a year-over-year basis. The company also witnessed a 20.5% decline in hospital-directed admissions compared to the year-ago period.

During the second quarter, Chemed’s average daily census was 17,315 patients, a decline of 3.8% year over year. Per management, this decline directly resulted from pandemic-related disruptions across the entire health care system since March 2020.

The deterioration in short-term cash levels is worrisome. The persistent macroeconomic headwinds related to the volatility in COVID-19 trends, rising inflationary pressure and other challenges continue to hamper business performance. A competitive landscape and reimbursement headwinds are other challenges.

Key Picks

Some better-ranked stocks in the broader medical space are ShockWave Medical SWAV, McKesson MCK and Semler Scientific SMLR. While ShockWave Medical sports a Zacks Rank #1 (Strong Buy), McKesson and Semler Scientific carry a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for ShockWave Medical have improved from earnings of $10.41 to $11.26 for 2022 and $7.94 to $8.30 for 2023 in the past 60 days. SWAV stock has gained 41.4% so far this year.

ShockWave Medical delivered an earnings surprise of 180.1%, on average, in the last four quarters.

McKesson’s earnings per share estimates increased from $23.26 to $24.25 for fiscal 2023 and $25.41 to $26.04 for fiscal 2024 in the past 60 days. MCK has gained 38.1% so far this year.

McKesson delivered an earnings surprise of 13.00%, on average, in the last four quarters.

Estimates for Semler Scientific’s earnings per share increased from $1.37 to $1.58 for 2022 and $2.39 to $2.42 for 2023 in the past 60 days. SMLR has declined 59.9% so far this year.

Semler Scientific has an earnings yield of 4% against a negative yield for the industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

Semler Scientific Inc. (SMLR) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research