Chemed Corp CFO David Williams Sells 5,000 Shares: An Insider Sell Analysis

Chemed Corp (NYSE:CHE), a diversified company that operates in the healthcare and chemical industries, has recently witnessed a significant insider sell by one of its top executives. David Williams, the Executive Vice President & CFO of Chemed Corp, sold 5,000 shares of the company on November 14, 2023. This transaction has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is David Williams of Chemed Corp?

David Williams has been a key figure in Chemed Corp's financial leadership. As the Executive Vice President & CFO, Williams has been responsible for overseeing the company's financial operations, including financial planning and analysis, accounting, and investor relations. His role is crucial in shaping the company's financial strategy and ensuring its fiscal health. With years of experience in the financial sector, Williams' actions, such as stock transactions, are closely monitored for insights into the company's performance and outlook.

Chemed Corp's Business Description

Chemed Corp operates through two main segments: VITAS Healthcare and Roto-Rooter. VITAS Healthcare is a provider of end-of-life care services, offering hospice care to patients with life-limiting illnesses. This segment is known for its compassionate care and comprehensive palliative services. On the other hand, Roto-Rooter is a leading provider of plumbing, drain cleaning, and water cleanup services. This segment has a strong reputation for its efficient services and customer satisfaction. Together, these segments form a unique combination of businesses that contribute to Chemed Corp's overall success.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are often considered a signal of a company's future prospects. When insiders buy shares, it is generally perceived as a sign of confidence in the company's future performance. Conversely, insider sells can sometimes raise concerns among investors, as it may suggest that insiders believe the stock is overvalued or that there may be challenges ahead.

Over the past year, David Williams has sold a total of 25,000 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in various ways. It might indicate that the insider is diversifying their personal portfolio, realizing gains, or it could also suggest a cautious outlook on the company's valuation or future performance.

Looking at the broader insider transaction history for Chemed Corp, there have been no insider buys and 14 insider sells over the past year. This trend of insider selling could potentially raise questions about the insiders' collective sentiment towards the stock's future.

On the day of Williams's recent sell, Chemed Corp shares were trading at $586.26, giving the company a market cap of $8.670 billion. The price-earnings ratio stood at 35.78, higher than both the industry median of 26.16 and the company's historical median. This elevated P/E ratio might suggest that the stock is priced on the higher end compared to its earnings, which could be a factor in the insider's decision to sell.

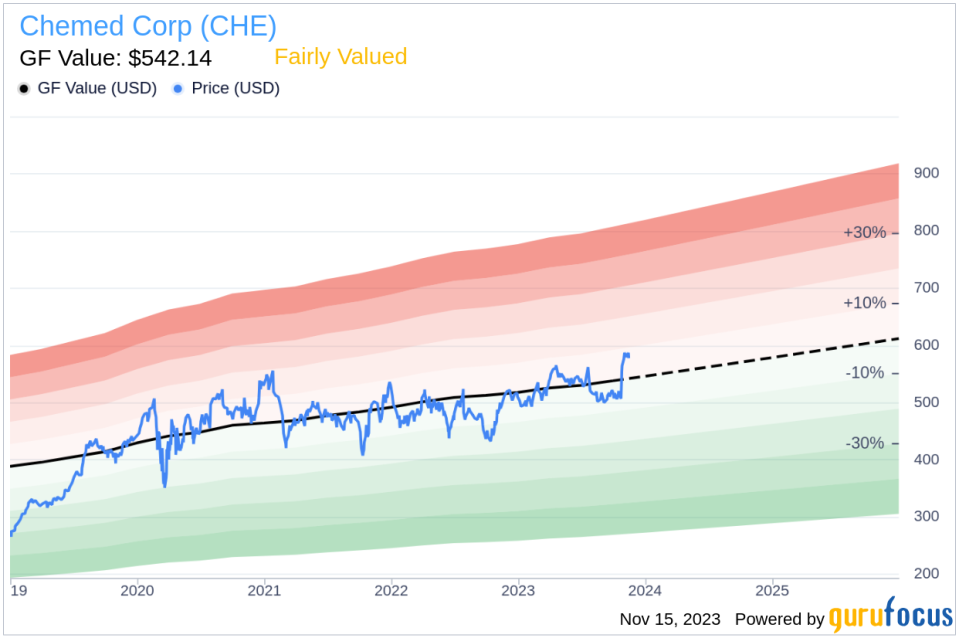

However, when considering the GF Value, which is an intrinsic value estimate developed by GuruFocus, Chemed Corp appears to be Fairly Valued with a price-to-GF-Value ratio of 1.08. The GF Value is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation suggests that the stock is not significantly overpriced, which could mitigate concerns about the insider sell.

The insider trend image above provides a visual representation of the selling and buying activities of Chemed Corp insiders. The absence of buys and the presence of multiple sells could be a point of analysis for investors considering the stock's potential.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. The proximity of the current price to the GF Value indicates that the stock is not significantly undervalued or overvalued, which could reassure investors about the stock's current pricing.

Conclusion

The recent insider sell by David Williams, the CFO of Chemed Corp, is a significant event that warrants attention. While the pattern of insider selling over the past year could be a cause for concern, the Fairly Valued status of the stock based on the GF Value suggests that the company's shares are not excessively overpriced. Investors should consider the insider trends, the company's P/E ratio, and the GF Value analysis when making investment decisions regarding Chemed Corp. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's fundamentals, industry trends, and broader market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.