Chemours (CC) Q2 Earnings Beat, Titanium Technologies Hurt Sales

The Chemours Company CC slipped to a second-quarter 2023 loss of $376 million or $2.52 per share from the year-ago quarter's profit of $201 million or $1.26 per share. The bottom was hurt by $644 million of charges associated with legal settlements for legacy PFAS environmental matters and related fees.

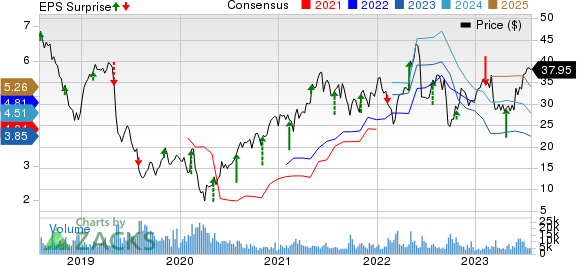

Barring one-time items, the company recorded earnings of $1.10, down from $1.89 in the prior-year quarter. It beat the Zacks Consensus Estimate of $1.09.

The company’s net sales in the second quarter were $1,643 million, down around 14% year over year. It missed the Zacks Consensus Estimate of $1,746.5 million. The top line was impacted by lower sales in the Titanium Technologies segment and the advanced materials portfolio of the Advanced Performance Materials division. Favorable pricing was offset by lower volumes in the quarter.

Adjusted EBITDA declined 32% year over year to $324 million in the quarter, mainly due to weaker results in Titanium Technologies.

The Chemours Company Price, Consensus and EPS Surprise

The Chemours Company price-consensus-eps-surprise-chart | The Chemours Company Quote

Segment Highlights

The Titanium Technologies division logged revenues of $707 million in the quarter, down 27% year over year. It fell short of our estimate of $784.1 million. Prices in this segment were flat while volumes fell 27%. Volumes were hurt by weaker demand in all regions. Prices were flat as contractual price increases were offset by lower pricing in global flex and distribution channels.

Revenues in the Thermal & Specialized Solutions segment ticked up 1% year over year to $523 million in the reported quarter. Volumes fell 1% as higher demand of Opteon refrigerants was offset by reduced demand for legacy refrigerants. Price increased 2% on gains across the portfolio, excluding automotive end markets, due to changing market and regulatory dynamics.

Revenues in the Advanced Performance Materials unit were $387 million, down roughly 3% year over year. It was below our estimate of $457.1 million. Higher sales in the performance solutions portfolio were offset by reduced sales in the advanced materials business. Price increase of 7% was offset by a volume decline of 9% and a 1% currency headwind. Volumes fell as a result of weaker demand in advanced materials and reduced demand in non-strategic end-markets.

Financials

Chemours ended the quarter with cash and cash equivalents of $738 million, down around 41% year over year. Long-term debt was $3,604 million, down roughly 1% year over year.

Cash provided by operating activities was $61 million in the reported quarter against cash provided of $291 million in the prior-year quarter. CC repurchased $37 million of common stock in the quarter.

Outlook

The company updated its adjusted EBITDA guidance for 2023 factoring in weaker demand visibility in the second half of 2023. It now anticipates adjusted EBITDA for 2023 to be between $1.100 billion and $1.175 billion, down from its prior view of $1.20 billion and $1.30 billion. It also sees free cash flow of more than $325, including about $400 million in capital expenditures.

Chemours also announced the closure of its titanium dioxide manufacturing plant in Taiwan as part of its plans to improve the earnings quality of the Titanium Technologies unit. The facility is expected to stop producing dry titanium dioxide pigment on Aug 1, 2023. CC expects the move to allow it to optimize its manufacturing circuit without compromising the ability to meet customer demand. It also sees significant recurring cost savings from this action starting in the second half of 2023.

Price Performance

Shares of Chemours are up 6.6% in the past year, compared with the industry’s rise of 7.7%.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Chemours currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include PPG Industries, Inc. PPG, Carpenter Technology Corporation CRS and Silvercorp Metals Inc. SVM.

PPG Industries currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for PPG's current-year earnings has been revised 3% upward over the past 60 days.

PPG Industries’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 7.3%, on average. PPG shares have gained around 12% in a year.

The Zacks Consensus Estimate for current-year earnings for CRS is currently pegged at $1.04, implying year-over-year growth of 198.1%. Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 30.9%, on average. The stock has rallied around 83% in a year.

Silvercorp Metals currently carries a Zacks Rank #2. The consensus estimate for current fiscal-year earnings for SVM is currently pegged at 26 cents, suggesting year-over-year growth of 23.8%.

Silvercorp Metals has a trailing four-quarter earnings surprise of roughly 12.5%, on average The stock has rallied gained 11% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Silvercorp Metals Inc. (SVM) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report