Chemours (CC) Q3 Earning Miss, Titanium Technologies Hurt Sales

The Chemours Company CC reported earnings of $20 million or 13 cents per share in third-quarter 2023 compared with the year-ago quarter's earnings of $240 million or $1.52 per share.

Barring one-time items, the earnings came in at 64 cents per share. It lagged the Zacks Consensus Estimate of 77 cents.

The company’s net sales in the third quarter were $1,487 million, down around 16% year over year. It missed the Zacks Consensus Estimate of $1,543.1 million. The top line was impacted by lower sales in the Titanium Technologies segment and the advanced materials portfolio of the Advanced Performance Materials division.

Adjusted EBITDA declined 32% year over year to $247 million in the quarter, mainly due to weaker volumes in Titanium Technologies and the advanced materials portfolio.

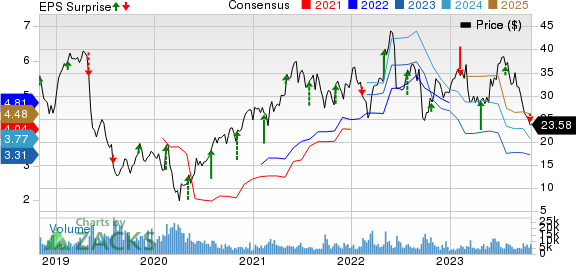

The Chemours Company Price, Consensus and EPS Surprise

The Chemours Company price-consensus-eps-surprise-chart | The Chemours Company Quote

Segment Highlights

The Titanium Technologies division logged revenues of $690 million in the quarter, down 21% year over year. It fell short of our estimate of $745.5 million. Prices in this segment declined 3%, while volumes fell 18%. Volumes were hurt by weaker demand in all regions. The drop in prices is mainly due to decreases in channels exposed to the market, although contractual price hikes partially balance this.

Revenues in the Thermal & Specialized Solutions segment ticked up 5% year over year to $436 million in the reported quarter. It was below our estimate of $453.3 million. Volume increased by 5% due to the ongoing adoption of Opteon products by stationary and automotive original equipment manufacturers. The price decline of 1% was due to the decline in automotive end-markets, partly counterbalanced by growth in value-based pricing within Refrigerants and Foam, Propellants and Other Products portfolios compared to the previous year.

Revenues in the Advanced Performance Materials unit were $343 million, down roughly 24% year over year. It was below our estimate of $375.8 million. Prices increased by 2% and volumes decreased by 26%. The price increase was driven by growing sales in high-value end-markets, such as advanced electronics and clean energy, within the Performance Solutions portfolio, along with pricing adjustments aimed at mitigating rising raw material costs in the Advanced Materials portfolio. The decline in volumes was primarily attributed to reduced demand in the Advanced Materials portfolio, which mainly caters to economically sensitive end markets.

Financials

Chemours ended the quarter with cash and cash equivalents of $852 million, down around 27% year over year. Long-term debt was $3,944 million, up nearly 12% year over year.

Cash provided by operating activities was $130 million in the reported quarter against cash provided of $301 million in the prior-year quarter. CC repurchased $18 million of common stock in the quarter.

Outlook

The company updated its adjusted EBITDA guidance for 2023, expecting it to be between $1.025 billion and $1.075 billion, down from its prior view of $1.100 billion and $1.175 billion. It also sees adjusted free cash flow of more than $225, including about $400 million in capital expenditures.

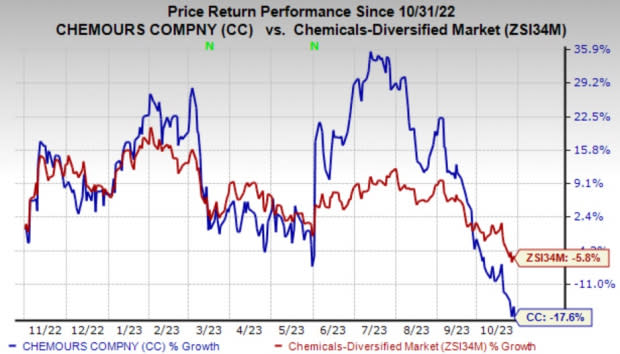

Price Performance

Shares of Chemours are down 17.6% in the past year compared with the industry’s fall of 5.8%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Chemours currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are The Andersons Inc. ANDE, sporting a Zacks Rank #1 (Strong Buy) and WestRock Company WRK and Koppers Holdings Inc. KOP, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward in the past 90 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 39.8% in a year.

In the past 60 days, the Zacks Consensus Estimate for WestRock’s current fiscal year has been revised upward by 5.2%. WRK beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have rallied 3.3% in the past year.

The consensus estimate for Koppers’ current fiscal year earnings is pegged at $4.45, indicating year-over-year growth of 7.5%. KOP beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 21.7%. The company’s shares have surged 46.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report