Chemours (CC) Sets Up International F-gas Lifecycle Program

The Chemours Company CC has introduced an international F-gas Lifecycle Program spanning the Americas, Asia and Europe. The program intends to enhance safe, global recovery, reclaim and reuse of fluorinated gases (F-gases) across its low global warming potential (GWP) Opteon products, Freon refrigerants and FM-200TM portfolios.

This program, which started as regional and national initiatives, will now incorporate worldwide monitoring to stimulate further adoption, partnerships and reclamation. Chemours will conduct a global review as part of the initiative to explore the potential for expansion and increased partnership.

This declaration reaffirms Chemours' commitment to a worldwide circular economy and the United Nations' Sustainable Development Goals, as highlighted in the company's most recent Sustainability Report. It also supports Chemours', the broader industry's and worldwide legislative bodies' net zero objectives through overall emission reduction.

Chemours continues to invest in and broaden reclaim channels. These include the United States and the recent extension of its EU and U.K. programs to reclaim low GWP refrigerants.

The company’s portfolio of F-gas technologies plays a key role in the decarbonization of several industries and delivers significant socioeconomic value through innovation, reliability, safety and efficiency.

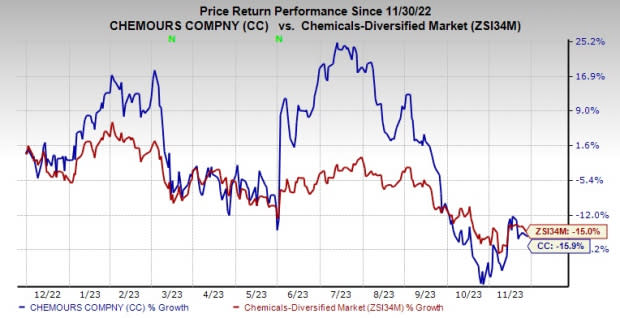

Shares of Chemours have lost 15.9% over the past year compared with a 15% decline of its industry.

Image Source: Zacks Investment Research

The company, on its third-quarter call, updated its adjusted EBITDA guidance for 2023 between $1.025 billion and $1.075 billion, down from its prior view of $1.100 billion and $1.175 billion. It expects adjusted free cash flow of more than $225, including about $400 million in capital expenditures.

The Chemours Company Price and Consensus

The Chemours Company price-consensus-chart | The Chemours Company Quote

Zacks Rank & Key Picks

Chemours currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Denison Mines has a projected earnings growth rate of 100% for the current year. It currently carries a Zacks Rank #1 (Strong Buy). DNN delivered a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 50% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axalta has a projected earnings growth rate of 5.4% for the current year. It currently carries a Zacks Rank #1. AXTA delivered a trailing four-quarter earnings surprise of roughly 6.7%, on average. The stock is up around 15.2% in a year.

Andersons currently carries a Zacks Rank #2 (Buy). The stock has gained roughly 29.2% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report