Chemung Financial Corp (CHMG) Announces Annual and Q4 Earnings: A Mixed Financial Performance ...

Annual Net Income: $25.0 million, or $5.28 per share for 2023.

Quarterly Net Income: $3.8 million, or $0.80 per share for Q4 2023.

Net Interest Income: Slight increase to $74.5 million for 2023.

Provision for Credit Losses: Increased to $3.3 million for 2023.

Non-Interest Income: Rose by 14.5% to $24.5 million for 2023.

Non-Interest Expense: Up by 8.4% to $64.2 million for 2023.

Efficiency Ratio: Improved to 64.89% for 2023.

On January 25, 2024, Chemung Financial Corp (NASDAQ:CHMG) released its 8-K filing, detailing its financial performance for the year ended December 31, 2023, and the fourth quarter of the same year. The company, a bank holding firm with two primary segments in Core Banking and Wealth Management services, faced a challenging quarter marked by credit-related events but managed to deliver a strong annual financial performance.

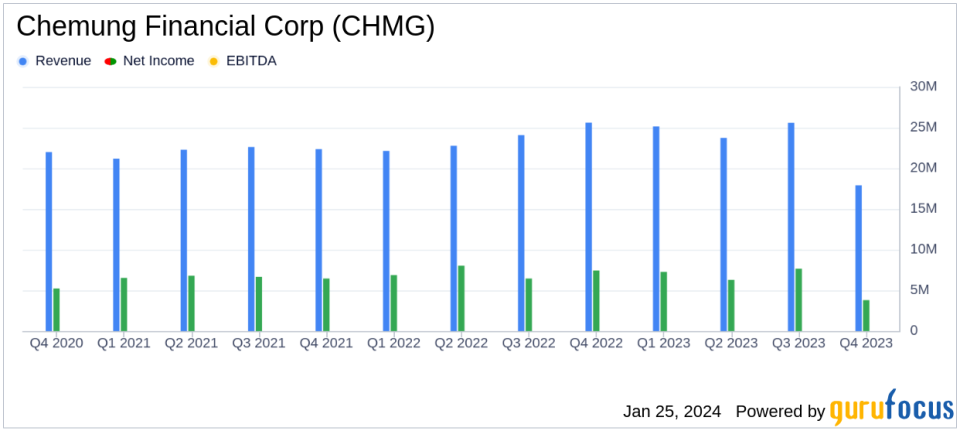

For the year, Chemung Financial Corp reported a net income of $25.0 million, or $5.28 per share, a decrease from the previous year's $28.8 million, or $6.13 per share. The fourth quarter saw a net income of $3.8 million, or $0.80 per share, which was lower compared to the third quarter of 2023 and the fourth quarter of the previous year. President and CEO Anders M. Tomson acknowledged the quarter's challenges but emphasized the overall strong financial results and the company's focus on revenue growth and cost management for the upcoming year.

Financial Performance and Challenges

Chemung Financial Corp's net interest income for 2023 was relatively stable at $74.5 million, with a slight increase attributed to higher interest income on loans and taxable securities, offset by increased interest expenses on deposits and borrowed funds. The provision for credit losses rose to $3.3 million due to specific allocations and the impact of adopting the CECL methodology. Non-interest income saw a significant increase, primarily due to the recognition of an employee retention tax credit and improved market conditions for wealth management services.

Non-interest expenses increased by 8.4% to $64.2 million, driven by higher salaries, wages, and data processing costs. The efficiency ratio, a measure of the bank's operational efficiency, improved to 64.89% for the year. Income tax expense decreased by 19.8%, with a lower effective tax rate of 20.6% for 2023.

Balance Sheet and Asset Quality

Total assets grew by 2.5% to $2.711 billion, with loans net of deferred origination fees and costs increasing by $143.2 million. The loan growth was concentrated in the commercial loan portfolio, which saw an 11.1% increase. Non-performing loans constituted 0.53% of total loans, a slight increase from the previous year. The allowance for credit losses stood at $22.5 million as of December 31, 2023.

Total liabilities increased by 1.5%, primarily due to a 4.4% increase in deposits. Shareholders' equity rose by 17.3% to $195.2 million, with an improved total equity to total assets ratio of 7.20%. The tangible equity to tangible assets ratio also improved from 5.51% to 6.45%.

Outlook and Strategic Focus

Chemung Financial Corp remains committed to driving revenue growth and managing costs effectively. The company undertook strategic realignments in the fourth quarter to position itself for improved long-term performance. With a focus on expense management and new opportunities, the bank aims to continue its trajectory of financial strength in the face of market challenges.

The detailed financial results and management's commentary on the performance and outlook for Chemung Financial Corp provide valuable insights for investors and potential members of GuruFocus.com. The company's focus on strategic growth and cost management, despite the challenges faced, underscores its commitment to maintaining financial stability and delivering value to shareholders.

Explore the complete 8-K earnings release (here) from Chemung Financial Corp for further details.

This article first appeared on GuruFocus.