Cheniere Energy Inc (LNG) Reports Robust Financial Results for 2023 and Sets 2024 Guidance

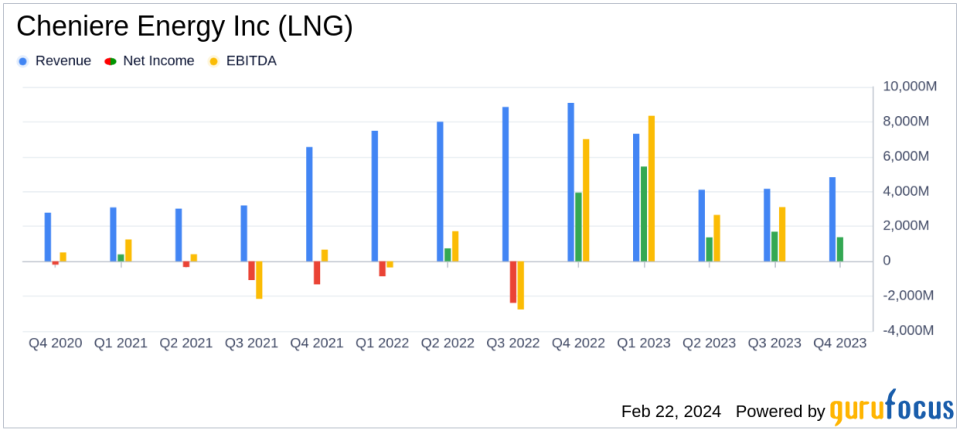

Revenue: Cheniere Energy Inc (NYSE:LNG) reported revenues of $20.4 billion for the full year 2023.

Net Income: The company's net income soared to $9.9 billion for the year.

Consolidated Adjusted EBITDA: Achieved $8.8 billion, at the high end of guidance.

Distributable Cash Flow: Exceeded guidance with $6.5 billion for 2023.

2024 Financial Guidance: Cheniere introduces a guidance range of $5.5 to $6.0 billion for Consolidated Adjusted EBITDA and $2.9 to $3.4 billion for Distributable Cash Flow.

Capital Allocation: Prepaid $1.2 billion of debt and repurchased $1.5 billion of common stock in 2023.

Stock Performance: From the start of 2024 to February 16, repurchased approximately 2.9 million shares for over $450 million.

On February 22, 2024, Cheniere Energy Inc (NYSE:LNG) released its 8-K filing, detailing a year of strong financial performance and setting the stage for continued growth in 2024. As the leading producer and exporter of liquefied natural gas (NYSE:LNG) in the United States, Cheniere Energy owns and operates the Sabine Pass and Corpus Christi LNG terminals, with a significant stake in Cheniere Partners, and a marketing arm that handles LNG sales using Cheniere's gas volumes.

Financial Performance Highlights

Cheniere Energy Inc (NYSE:LNG) reported a substantial increase in its financial metrics for the year ended December 31, 2023. The company's revenues reached approximately $20.4 billion, with a net income of $9.9 billion, reflecting a significant increase from the previous year. The Consolidated Adjusted EBITDA stood at approximately $8.8 billion, aligning with the high end of the company's guidance. Distributable Cash Flow also surpassed expectations, reaching approximately $6.5 billion.

The company's financial achievements are particularly noteworthy in the context of the Oil & Gas industry, where stable and predictable cash flows are critical for sustaining operations and funding future growth. Cheniere's ability to generate substantial revenues and net income not only demonstrates operational efficiency but also provides the financial flexibility necessary for strategic investments and shareholder returns.

Challenges and Strategic Moves

Despite the impressive financial results, Cheniere Energy Inc (NYSE:LNG) faced challenges due to decreased total margins per MMBtu of LNG delivered, primarily driven by lower international gas prices and a higher proportion of volumes sold under long-term contracts. The company's strategic response included prepaying a significant portion of its debt and repurchasing shares, which reflects a strong commitment to capital discipline and shareholder value.

Cheniere's proactive capital allocation strategy, which saw the prepayment of $1.2 billion in consolidated long-term indebtedness and the repurchase of $1.5 billion in common stock, underscores the company's robust financial position and its ability to return value to shareholders. The repurchase of shares, in particular, has a positive impact on earnings per share and reflects management's confidence in the company's future prospects.

Looking Ahead: 2024 Financial Guidance

Looking forward, Cheniere Energy Inc (NYSE:LNG) has introduced its full-year 2024 financial guidance, projecting a Consolidated Adjusted EBITDA of $5.5 to $6.0 billion and a Distributable Cash Flow of $2.9 to $3.4 billion. This guidance reflects the company's expectations for continued strong performance and its ability to capitalize on growth opportunities in the LNG market.

Cheniere's focus on executing its expansion projects at Sabine Pass and Corpus Christi, along with its highly-contracted operating platform, positions the company to meet the growing global demand for natural gas. The company's expansion projects are expected to enhance its production capacity and further solidify its role as a key player in the global LNG market.

For a detailed analysis of Cheniere Energy Inc (NYSE:LNG)'s financial results and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Cheniere Energy Inc (NYSE:LNG) remains committed to delivering value to its shareholders and playing a pivotal role in the global energy landscape. With a clear strategic direction and a track record of financial success, the company is well-positioned for continued growth and profitability.

Explore the complete 8-K earnings release (here) from Cheniere Energy Inc for further details.

This article first appeared on GuruFocus.