Can Cheniere Energy (LNG) Maintain Its Earnings Beat Run in Q2?

Cheniere Energy, Inc. LNG is set to release second-quarter results on May 2. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $5.77 per share on revenues of $6.6 billion.

Let’s delve into the factors that might have influenced the liquefied natural gas (“LNG”) exporter’s performance in the June quarter. But it’s worth taking a look at Cheniere Energy’s previous-quarter performance first.

Highlights of Q1 Earnings & Surprise History

In the last reported quarter, this Houston, TX-based transporter of super-chilled fuel crushed the consensus mark on higher contributions from certain portfolio optimization activities and increasing total margins per metric million British thermal units of LNG delivered. Cheniere Energy had reported adjusted earnings per share of $6.89 that comprehensively beat the Zacks Consensus Estimate of $5.96. The company’s quarterly revenues of $7.3 billion also outperformed the Zacks Consensus Estimate by 11.2%.

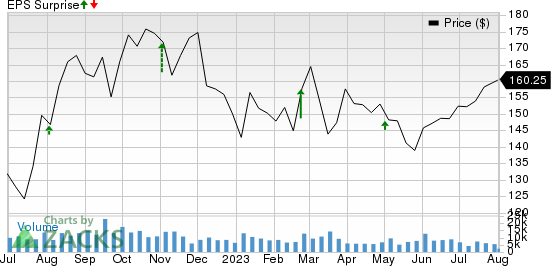

LNG beat the Zacks Consensus Estimate for earnings in each of the last four quarters, resulting in an earnings surprise of 70.9%, on average. This is depicted in the graph below:

Cheniere Energy, Inc. Price and EPS Surprise

Cheniere Energy, Inc. price-eps-surprise | Cheniere Energy, Inc. Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the second-quarter bottom line has been revised 7.7% downward in the past seven days. The estimated figure indicates a 21% fall year over year. Meanwhile, the Zacks Consensus Estimate for revenues suggests a 40% decrease from the year-ago period.

Factors to Consider

LNG shipments for export from the United States have been robust for months on the back of environmental reasons and high prices of the super-chilled fuel elsewhere. Moreover, with the Russia-Ukraine conflict showing no signs of abating, LNG has become even more coveted, with an increasing number of countries vying for the American-made fuel to replace supplies from Moscow. This means that LNG deliveries are poised to rise further. This augurs well for Cheniere Energy — the dominant U.S. LNG exporter — in the to-be-reported quarter.

As proof of this bullish backdrop, our projection for second-quarter LNG volumes loaded is pegged at 602 trillion British thermal units (TBtu), suggesting an increase from the year-ago level of 564 TBtu. This should have aided the company’s revenues and cash flows.

However, a dip in LNG realizations is likely to have hurt Cheniere Energy’s revenues and cash flows. Going by our model, the company’s second-quarter average LNG revenues is pegged at $3.9 billion — significantly down from the year-earlier level of $7.9 billion. This is primarily because of a drop in natural prices of late.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Cheniere is likely to beat estimates in the second quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company is -2.67%.

Zacks Rank: LNG currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for Cheniere Energy, here are some firms that you may want to consider on the basis of our model:

Pembina Pipeline Corporation PBA has an Earnings ESP of +1.48% and a Zacks Rank #2. The firm is scheduled to release earnings on Aug 3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Pembina Pipeline beat the Zacks Consensus Estimate for earnings in two of the last four quarters and missed in the other two. It has a trailing four-quarter earnings surprise of 30.7%, on average. Valued at around $17.3 billion, PBA has lost 16.5% in a year.

TransAlta Corporation TAC has an Earnings ESP of +217.65% and a Zacks Rank #3. The firm is scheduled to release earnings on Aug 4.

For 2023, TransAlta Corporation has a projected earnings growth rate of 1,387.5%. Valued at around $2.6 billion, TAC has lost 9.7% in a year.

ALLETE Inc. ALE has an Earnings ESP of +2.56% and a Zacks Rank #3. The firm is scheduled to release earnings on Aug 8.

For 2023, ALLETE has a projected earnings growth rate of 7.4%. Valued at around $3.3 billion, ALE has lost 7.6% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TransAlta Corporation (TAC) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

Pembina Pipeline Corp. (PBA) : Free Stock Analysis Report