Cheniere Energy Partners LP (CQP) Reports Mixed Financial Results for Q4 and Full Year 2023

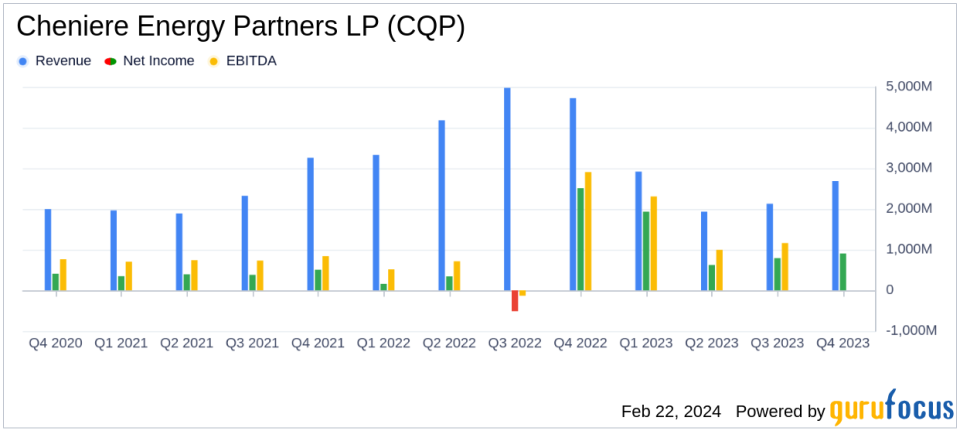

Revenue: Reported a significant decline in revenues to $2.7 billion in Q4 and $9.7 billion for the full year, marking a 43% and 44% decrease respectively from the previous year.

Net Income: Net income saw a contrasting trend with a 70% increase to $4.3 billion for the full year, despite a 64% drop in Q4 compared to the same period in 2022.

Adjusted EBITDA: Adjusted EBITDA decreased by 34% in Q4 and 28% for the full year, reflecting challenges in regasification revenues and derivative portfolio valuation.

LNG Exports: The number of cargoes and volumes exported remained relatively stable, with a slight increase in annual terms.

Liquidity: Total available liquidity stood at approximately $2.4 billion as of December 31, 2023.

Distribution Guidance: Introduced full year 2024 distribution guidance of $3.15 - $3.35 per common unit, maintaining a base distribution of $3.10 per common unit.

On February 22, 2024, Cheniere Energy Partners LP (NYSE:CQP) released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. The company, which is the direct owner of the Sabine Pass LNG terminals and the Creole Trail Pipeline, faced a challenging year with significant volatility in its financial metrics.

Financial Performance Overview

Cheniere Energy Partners LP reported a stark contrast in its revenue and net income figures for the year. While revenues saw a sharp decline of 43% in Q4 and 44% for the full year compared to the previous year, net income increased by 70% to $4.3 billion for the full year. This discrepancy was primarily due to changes in the fair value of the company's derivative portfolio, which had a significant impact on the financial results.

The company's Adjusted EBITDA also decreased by 34% in Q4 and 28% for the full year, mainly due to lower regasification revenues following the early termination of a terminal use agreement in 2022 and decreased total margins per MMBtu of LNG delivered. The company's derivative gains and losses, which are largely attributable to the fair value recognition of long-term Integrated Production Marketing (IPM) agreements, also contributed to the fluctuations in Adjusted EBITDA.

Capital Resources and Liquidity

As of December 31, 2023, Cheniere Energy Partners LP's total available liquidity was approximately $2.4 billion, including cash and cash equivalents of approximately $575 million. The company also had access to $1.0 billion of available commitments under the Cheniere Partners Revolving Credit Facility and $720 million under the SPL Revolving Credit Facility.

Operational Highlights and Future Outlook

The company's Sabine Pass LNG terminal, with a total production capacity of approximately 30 mtpa of LNG, has been a cornerstone of its operations. As of February 16, 2024, the terminal has produced and exported over 2,410 LNG cargoes. Looking ahead, Cheniere Energy Partners LP is developing the SPL Expansion Project, which is expected to add up to approximately 20 mtpa of LNG production capacity.

In terms of distributions to unitholders, the company declared a cash distribution of $1.035 per common unit for Q4 2023, which includes a base amount of $0.775 and a variable amount of $0.260. The company also introduced its full year 2024 distribution guidance, ranging from $3.15 to $3.35 per common unit, with a base distribution of $3.10 per common unit.

Conclusion

Cheniere Energy Partners LP's financial results for 2023 reflect the dynamic and volatile nature of the energy market. While the company has faced challenges, particularly in terms of revenue and Adjusted EBITDA, its stable LNG export volumes and strategic initiatives, such as the SPL Expansion Project, position it for potential growth in the future. Investors and stakeholders will be closely monitoring the company's performance as it navigates the evolving energy landscape.

For a more detailed analysis of Cheniere Energy Partners LP's financial results and future prospects, visit the company's website or consult the Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission.

Explore the complete 8-K earnings release (here) from Cheniere Energy Partners LP for further details.

This article first appeared on GuruFocus.