Cheniere (LNG) Q4 Earnings Decline Y/Y, Sales Beat Estimates

Cheniere Energy Inc. LNG reported fourth-quarter 2023 adjusted profit of $5.76 per share, which outpaced the Zacks Consensus Estimate of $2.70. This outperformance can be primarily attributed to a year-over-year decrease in costs and expenses. The bottom line, however, deteriorated from the year-ago quarter’s level of $15.78.

Revenues totaled $4.8 billion, which beat the Zacks Consensus Estimate of $4.5 billion. This can be attributed to the year-over-year increase in cargo shipped and a surge in volumes. However, the top line decreased 46.9% from the year-ago quarter’s level of $9.1 billion. This can be attributed to the year-over-year reduction in liquid natural gas and Regasification sales.

Cheniere reported adjusted EBITDA of $1.66 billion in the fourth quarter, down 45.2% from that recorded a year ago. This can be attributed to a reduction in the total profit margins per MMBtu of LNG transported, driven by lower global gas prices and a decrease in total sales volumes to short-term markets. Additionally, the decrease was somewhat influenced by lower revenues from regasification.

Distributable cash flow (DCF) came in at $1.34 billion. In the reported quarter, the company shipped 169 cargoes compared with 166 in the year-ago period. The total volume of liquid natural gas exported came in at 615 trillion British thermal units (TBtu) compared with 600 TBtu in the comparable period of 2022.

Between Jan 1, 2024, and Feb 16, 2024, Cheniere repurchased about 2.9 million shares, amounting to more than $450 million, thereby reducing the total outstanding shares to less than 235 million.

Cheniere and Cheniere Energy Partners, L.P. stopped trading on the NYSE American after the market closed on Feb 2, 2024, and began trading on the New York Stock Exchange when the market opened on Feb 5. They continue trading under the symbols LNG and CQP.

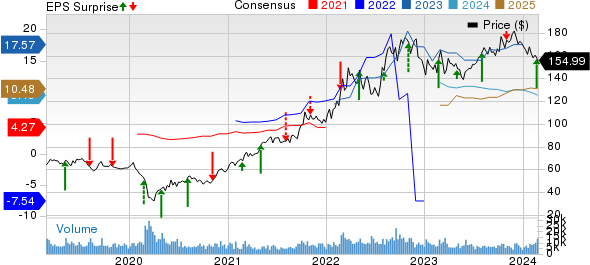

Cheniere Energy, Inc. Price, Consensus and EPS Surprise

Cheniere Energy, Inc. price-consensus-eps-surprise-chart | Cheniere Energy, Inc. Quote

Costs & Balance Sheet

Costs and expenses amounted to $2.4 billion for the fourth quarter, up 0.6% from the prior-year quarter’s level.

As of Dec 31, 2023, Cheniere had approximately $4.1 billion of cash and cash equivalents. Its net long-term debt amounted to $23.4 billion. As of the same date, the company reported cost of sales worth $1.4 billion.

Guidance

The company expects consolidated adjusted EBITDA in the $5.5-$6 billion range for 2024.

It also expects DCF to be in the band of $2.9-$3.4 billion for 2024.

Project Updates

Sabine Pass Liquefaction Project (SPL): Cheniere operates six natural gas liquefaction trains for a total production capacity of about 30 million tons per annum (mtpa) of liquid natural gas at the Sabine Pass LNG terminal in Cameron Parish, LA.

SPL Expansion Project: Cheniere Partners is developing an expansion of the SPL Project, which could produce up to 20 mtpa of liquid natural gas. In May 2023, certain Cheniere Partners subsidiaries began the pre-filing review process for the SPL Expansion Project with the Federal Energy Regulatory Commission (FERC) under the National Environmental Policy Act.

Additionally, in April 2023, Cheniere Partners subsidiary signed a contract with Bechtel to handle the Front-End Engineering and Design for the SPL Expansion Project.

Cheniere expects to file an application with the FERC for authorization to site, construct and operate the SPL Expansion Project by the end of the first quarter of 2024.

CCL Project: LNG operates three natural gas liquefaction trains at the Corpus Christi LNG terminal, with a total production capacity of approximately 15 mtpa.

CCL Stage 3 Project: Cheniere is constructing an expansion next to the CCL Project, which includes seven midscale Trains. This expansion is expected to have a total production capacity exceeding 10 mtpa of liquid natural gas. The first production from the first train of the CCL Stage 3 Project is expected to be achieved by the end of 2024, with a progress update as of Dec 31, 2023.

CCL Midscale Trains 8 & 9 Project: The company is developing two midscale Trains adjacent to the CCL Stage 3 Project, with an anticipated total production capacity of about 3 mtpa of LNG. In March 2023, certain company subsidiaries submitted an application to the Federal Energy Regulatory Commission (FERC) for site approval, to construct, and operate the Project.

Additionally, in April 2023, LNG applied to the Department of Energy (DOE) seeking authorization to export liquid natural gas to both Free-Trade Agreement (FTA) and non-FTA countries. In July 2023, the company received approval from the DOE to export liquid natural gas to FTA countries.

Zacks Rank and Key Picks

Currently, LNG carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at some better-ranked stocks like Subsea 7 S.A. SUBCY, Energy Transfer LP ET and Murphy USA Inc. MUSA, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Subsea 7 is valued at $4.09 billion. The company currently pays a dividend of 38 cents per share, or 2.85%, on an annual basis.

SUBCY offers offshore project services for the energy industry, specializing in subsea field development, covering project management, design, engineering, procurement, fabrication, survey, installation and commissioning of seabed production facilities.

Energy Transfer is valued at $50.15 billion. The company currently pays a dividend of $1.26 per share, or 8.46%, on an annual basis.

ET is an independent energy company, principally engaged in the acquisition, exploration, development and production of crude oil and natural gas.

Murphy USA is valued at around $8.6 billion. In the past year, its shares have risen 55.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

Subsea 7 SA (SUBCY) : Free Stock Analysis Report