Chesapeake Utilities' (CPK) Unit Buys Propane Operating Assets

Chesapeake Utilities Corp. CPK announced that its subsidiary, Sharp Energy, has acquired the propane operating assets of J.T. Lee and Son's in Cape Fear, NC. Through this acquisition, the company will be able to increase its footprint in the state and provide cost savings and other synergistic benefits as a result of the expanded Wilmington service area.

Sharp Energy has gained more consumers in North Carolina as a result of this deal, adding over 3,000 customers and distributing about 800,000 gallons of propane annually. A bulk plant with 60,000 gallons of propane storage is also included in the acquisition. This will allow the company to realize efficiencies with more storage capacity and overlapping delivery regions.

Focus on Propane Business

Chesapeake Utilities has expanded its propane wholesale, retail and AutoGas businesses through its subsidiaries, using both organic and inorganic growth strategies. This has aided the business in growing throughout the Southeast and the Mid-Atlantic. The latest transaction will further strengthen CPK’s position in the U.S. propane market.

In December 2022, Chesapeake Utilities’ subsidiary, Florida Public Utilities, acquired the propane operating assets of Hernando Gas, based in Hernando, FL. This acquisition further helped the company to expand its operating footprint in Florida.

In December 2021, Sharp Energy also acquired Diversified Energy Company’s propane operating assets. The deal added nearly 19,000 residential, commercial and agricultural customers.

Growth Prospects

The rising demand for propane as a clean and efficient energy source, particularly in the residential and commercial sectors, is one of the key factors driving the propane market.

Propane is steadily gaining favor as an alternative to fossil fuels like petrol and diesel because of its low carbon content. Propane is in great demand and its market is growing rapidly due to its broad availability, reasonable price and higher dependability than other energy sources.

According to a Precedence Research report, the global propane market size was evaluated at $82.44 billion in 2022 and is projected to hit around $122.61 billion by 2032 at a registered CAGR of 4.1% during 2023-2032. The residential category is anticipated to rise at a CAGR of more than 5.2% between 2023 and 2032.

Price Performance

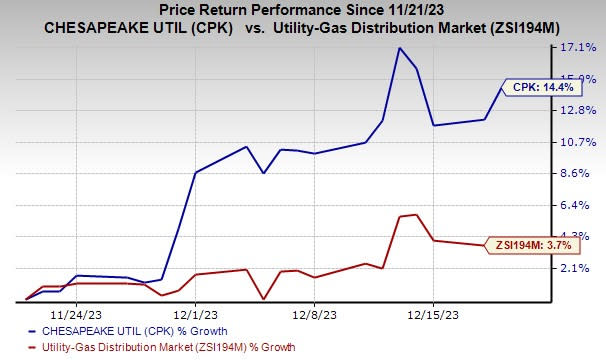

In the past month, shares of Chesapeake Utilities have risen 14.4% compared with the industry’s 3.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks from the same sector are Atmos Energy Corporation ATO, Sempra Energy SRE and IDACORP, Inc. IDA, each holding a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Atmos Energy’s long-term (three- to five-year) earnings growth rate is 7.26%. It delivered an average earnings surprise of 1.1% in the last four quarters.

Sempra Energy’s long-term earnings growth rate is 4.95%. The company delivered an average earnings surprise of 9% in the last four quarters.

IDACORP’s long-term earnings growth rate is 4.11%. The company delivered an average earnings surprise of 13.3% in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sempra Energy (SRE) : Free Stock Analysis Report

IDACORP, Inc. (IDA) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report