Chevron: Entering 2024 on a Cautious Note

On Jan. 2, Chevron Corp. (NYSE:CVX) filed an 8K report with the SEC stating that it will record a non-cash impairment of between $3.5 billion and $4 billion for some of its U.S. upstream assets during the fourth quarter of 2023.

However, despite this large impairment charge, the company plans to continue operating its California assets for the foreseeable future. The reasons given by the company to justify the impairment charge were "due to continuing regulatory challenges in the state that have resulted in lower anticipated future investment levels in its business plans."

Chevron will also recognize a loss related to "the abandonment and decommissioning obligations from previously sold oil and gas production assets in the US Gulf of Mexico."

The company may have to take responsibility for part of the obligations as the buyers of those assets have filed for bankruptcy, potentially leaving Chevron liable for some of the commitments.

Chevron is one of many major oil companies facing legal issues in California. Along with Chevron, ExxonMobil (NYSE:XOM), ConocoPhillips (NYSE:COP), Shell Plc (NYSE:SHEL), BP Plc (NYSE:BP) and their subsidiaries are all involved in a lawsuit that was announced on Sept. 16, 2023.

The American Petroleum Institute trade group is also a party to this recent lawsuit brought by the office of Governor Gavin Newsom. The state of California is "suing Big Oil for more than 50 years of deception, cover-up, and damage that have cost California taxpayers billions of dollars in health and environmental impacts."

The announcement gave an idea of what to expect in the fourth-quarter results.

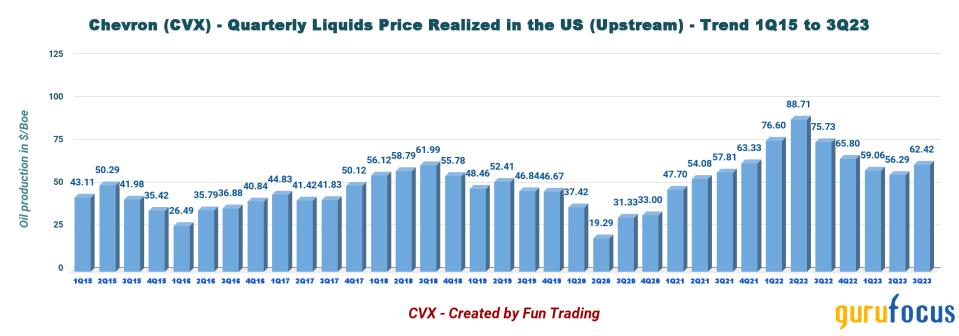

Chevron stated its upstream production will be affected by approximately 60,000 barrels of oil equivalent per day due to turnaround and downtime. On the other hand, PDC Energy's production is expected to increase to 265,000 boepd from 179,000 boepd in the third quarter of the year. In addition, average oil and gas prices are expected to remain relatively stable in the fourth quarter.

Balance sheet review

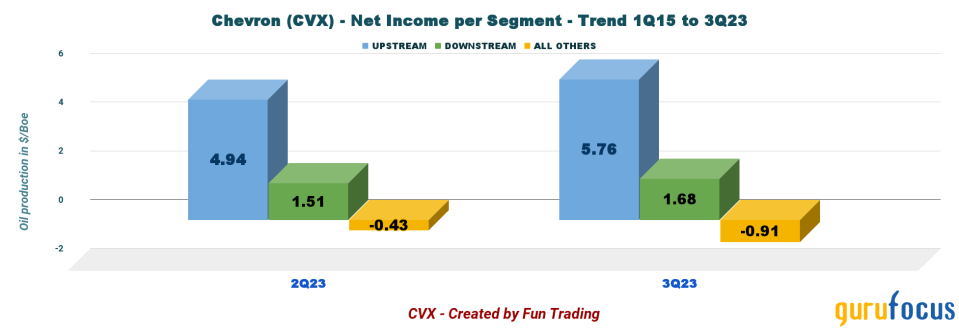

Chevron's third-quarter results were not exciting and fell below analysts' expectations, with adjusted earnings of $3.05 per share compared with $5.56 in the prior-year period.

For the third quarter, Chevron's net income rose to $6.53 billion, an 8.6% quarter-over-quarter increase. The upstream segment of Chevron accounted for 88.2% of the total net income, as shown in the chart below.

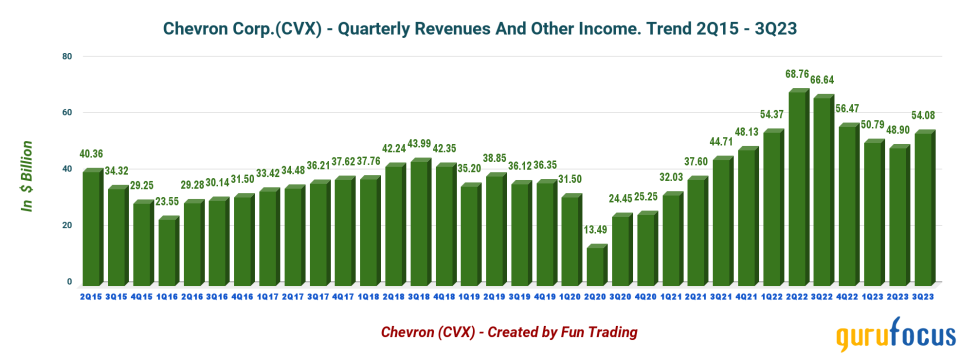

The total revenue for the quarter was $54.08 billion, representing a significant increase from the previous quarter but a decline of 18.8% compared to the same quarter last year.

Chevron has generated $20.37 billion in free cash flow over the last 12 months, excluding divestitures. The company's free cash flow was $5 billion, significantly lower than the $12.27 billion reported in the same quarter last year. However, there has been a solid increase in the sequential quarter, as demonstrated in the chart below.

The company will pay a quarterly dividend of $1.51 per share, which offers a dividend yield of 4.18%.

The payment of dividends is backed by sufficient free cash flow. Furthermore, the company has announced that in 2024, it will increase the quarterly dividend by 7.95% to $1.63 per share, which is quite generous.

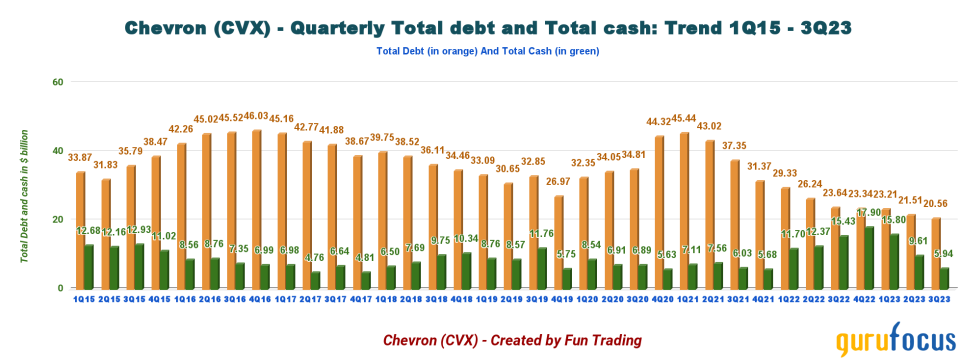

Chevro had $5.93 billion in cash, cash equivalents and marketable securities as of Sept. 30 and $20.56 billion in total debt (including current), resulting in an excellent total debt-to-equity ratio of 0.12. Chevron's net debt totaled $14.62 billion in the third quarter.

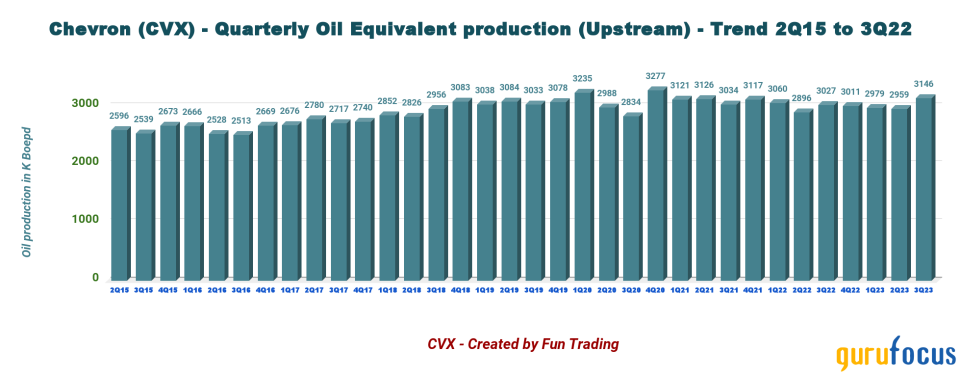

Finally, the oil equivalent production was 3,146,000 boepd, down 3.9% from the same quarter a year ago and up 6.3% sequentially. Liquids represented 58.2% of the total output.

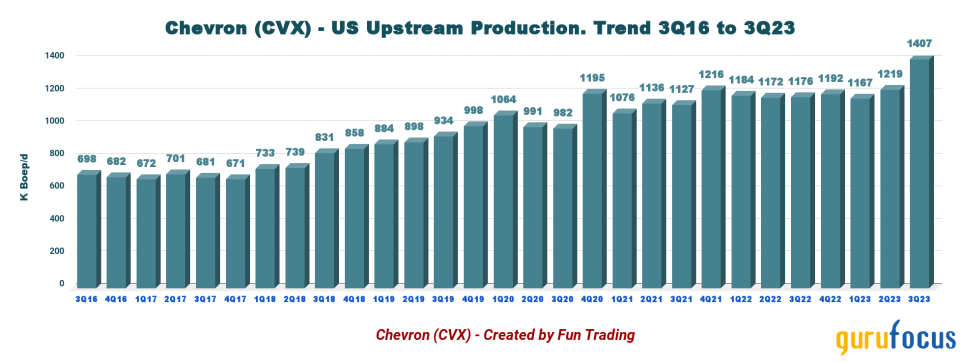

Production for the U.S. Upstream segment was 1,407,000 boepd.

Third-quarter production increased 3.9% year over year following the $7.6 billion acquisition of PDC Energy, which added 6,000 acres to the Denver-Julesburg Basin in Colorado. According to the Denver Post:

"Under the deal, Chevron acquired 275,000 net acres, much of it next to its existing operations in northeast Colorado's Denver-Julesburg Basin, and more than 1 billion barrels of oil equivalent in proven reserves. The company also added 25,000 acres to its operations in the Permian Basin of West Texas and southeastern New Mexico."

However, acquiring Hess Corp. (NYSE:HES) in 2024 will change the company and be an important topic for the fourth quarter of 2023.

How will the Hess acquisition impact Chevron's global production?

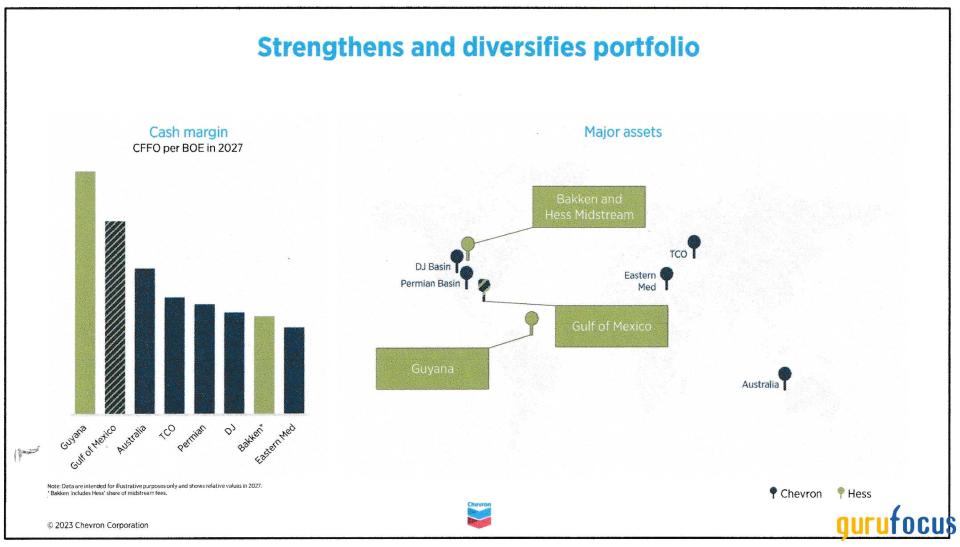

One important acquisition that will impact Chevron's business is the proposed acquisition of Hess.

According to the press release, Chevron will acquire Hess in a $60 billion all-stock transaction (including debt). The company indicated it will issue approximately 317 million shares of common stock, bringing a total share diluted of approximately 2.19 billion.

Both companies' boards of directors have approved the acquisition, with the completion date set for the first half of 2024.

Hess' production comes from four distinct upstream segments and a midstream component.

Guyana, where Hess owns a 30% working interest in the Stabroek block, with a production of 108,000 boepd in the third quarter.

The Bakken Basin, which produced 190,000 boepd.

The Gulf of Mexico offshore assets produced 28,000 boepd.

Southeast Asia's natural gas business produced 69,000 boepd.

Hess also owns a midstream segment with a net income of $66 million.

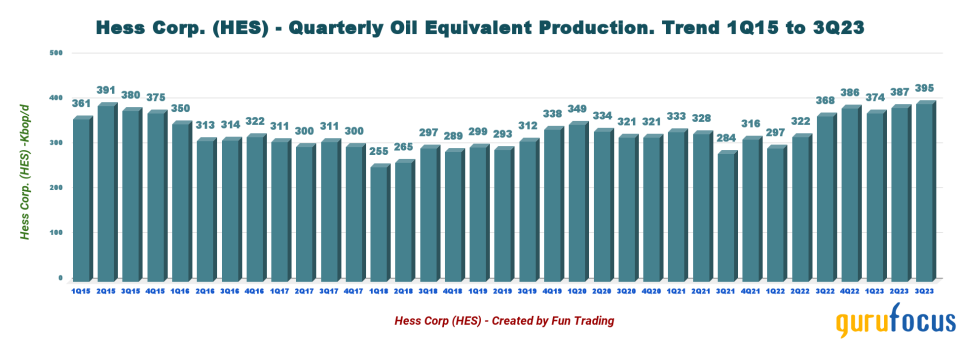

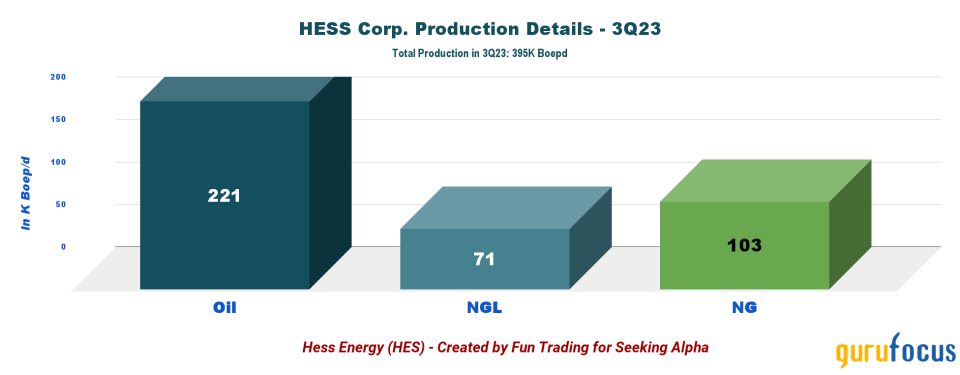

Hess' total production was 395,000 boepd in the third quarter, as shown in the chart below:

Oil production represents 56% of the total input.

What can we expect for the fourth quarter?

Such a large impairment and a possible miss in adjusted earnings could pressure the stock even if the company expects to increase the dividend to $1.63 per share and accelerate share buybacks.

According to CBC, citing Deloitte's analysis, oil prices are projected to stay at a low level in 2024.

"An average West Texas Intermediate (WTI) price typically regarded as the benchmark for crude oil of $72 US per barrel this year.

That depression in price is because of cuts from major producers, record production in the United States, and slowing growth in demand, according to the report."

The Hess acquisition will face greater scrutiny due to the 2024 oil outlook turning bearish and Guyana's assets becoming riskier following the territorial dispute initiated by Venezuela.

Technical analysis

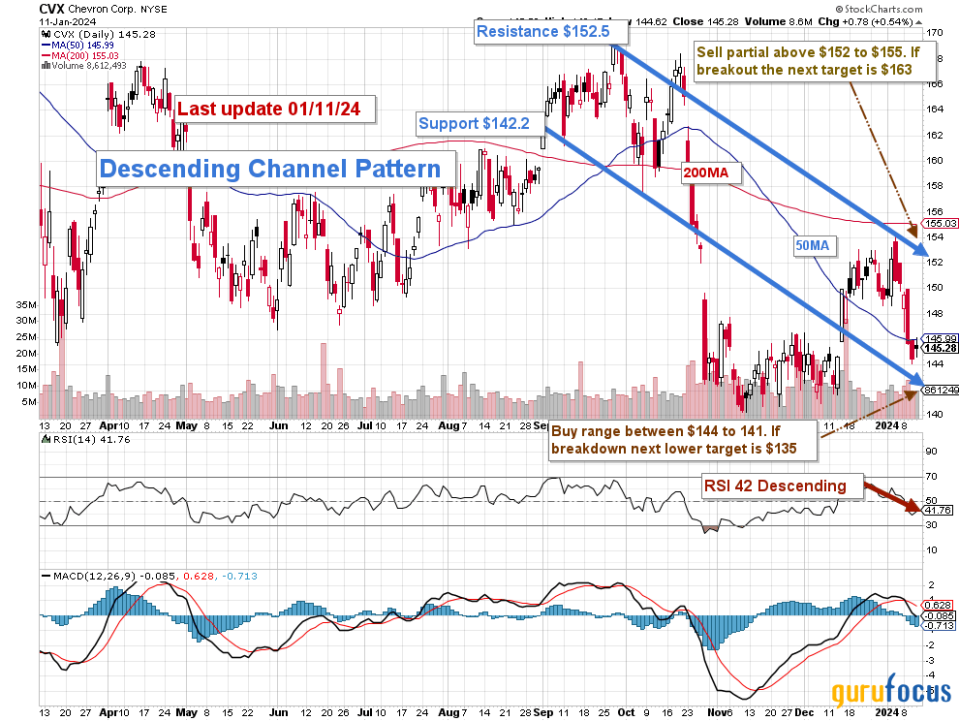

Note: The dividend is taken into account in the chart above.

Chevron has formed a descending channel pattern with resistance at $152.5 and support at $142.2. The relative strength index is currently at 42 and descending toward an oversold situation.

Descending channel patterns are typically viewed as short-term bearish signals. However, they are often seen within longer-term uptrends as continuation patterns. Therefore, these patterns are usually followed by higher prices. This implies that investors should consider a drop below $140 as a great opportunity to add to their holdings.

A recommended trading strategy is to sell your most recent purchases for a profit (about 5% to 7%) while holding onto your long-term position for a secure dividend now above 4%. The idea is to repeat this exercise as often as you can.

According to this strategy, you should sell approximately 30% to 40% of your position between $152 and $155. There may be a potential higher resistance at $153. Then, accumulate Chevron between $144 and $141, with a possible lower support of $136.

This article first appeared on GuruFocus.