Are Chevron's (CVX) Q3 Earnings Poised to Beat Expectations?

Chevron Corporation CVX is set to release third-quarter results on Oct 27. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $3.46 per share on revenues of $54.7 billion.

Let’s delve into the factors that might have influenced the American energy biggie’s performance in the September quarter. But it’s worth taking a look at Chevron’s previous-quarter performance first.

Highlights of Q2 Earnings & Surprise History

In the last reported quarter, the San Ramon, CA-based integrated player beat the consensus mark due to a higher-than-expected bottom line in its key upstream segment. Chevron had reported adjusted earnings per share of $3.08, surpassing the Zacks Consensus Estimate of $2.95. However, revenues of $48.9 billion had come in 4.9% below the consensus mark on weaker oil and natural gas realizations.

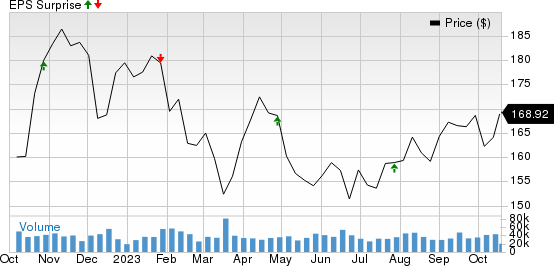

CVX beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed in the other, resulting in an earnings surprise of 4.8%, on average. This is depicted in the graph below:

Chevron Corporation Price and EPS Surprise

Chevron Corporation price-eps-surprise | Chevron Corporation Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the third-quarter bottom line has been revised 0.3% upward in the past seven days. The estimated figure indicates a 37.8% deterioration year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 17.9% decrease from the year-ago period.

Factors to Consider

Chevron is expected to have benefited from a slight uptick in domestic oil and gas production, primarily reflecting robust output in the showpiece Permian Basin region. As a matter of fact, for the to-be-reported quarter, our estimate for the U.S. volume is pegged at 1,179.1 thousand oil-equivalent barrels per day (MBOE/d), indicating a rise from the prior-year quarter’s volume of 1,176 MBOE/d.

On a further bullish note, a relatively stronger macro backdrop is expected to have impacted Chevron’s refined product sales, which we estimate will improve 1.5% year over year to 2,724.9 thousand barrels per day.

Finally, the drop in CVX’s costs might have buoyed the company’s to-be-reported bottom line. Going by our model, the company’s third-quarter purchased oil and products cost will likely total $31.7 billion, down 16.9% from the year-ago period. The decreasing cost trajectory could be attributed to the company’s prudent expense management policies.

Why a Likely Positive Surprise?

Our proven model predicts an earnings beat for Chevron this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

CVX has an Earnings ESP of +3.18% and a Zacks Rank #2.

Other Stocks to Consider

Chevron is not the only energy company looking up this earnings cycle. Here are some other firms from the space that you may want to consider on the basis of our model:

Matador Resources Company MTDR has an Earnings ESP of +6.52% and a Zacks Rank #1. The firm is scheduled to release earnings on Oct 24.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Matador Resources beat the Zacks Consensus Estimate for earnings in each of the last four quarters. It has a trailing four-quarter earnings surprise of 11.8%, on average. Valued at around $7.7 billion, MTDR has edged up 0.2% in a year.

Oceaneering International, Inc. OII has an Earnings ESP of +7.93% and a Zacks Rank #1. The firm is scheduled to release earnings on Oct 25.

For 2023, Oceaneering International has a projected earnings growth rate of 167.7%. Valued at around $2.6 billion, OII has surged 167% in a year.

Exxon Mobil Corporation XOM has an Earnings ESP of +1.61% and a Zacks Rank #2. The firm is scheduled to release earnings on Oct 27.

Over the past 30 days, ExxonMobil saw the Zacks Consensus Estimate for 2023 move up 4.2%. Valued at around $445.9 billion, XOM has gained 8.9% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report