Chevron's Share Price Decline Presents Value Opportunity

The share price of Chevron Corp. (NYSE:CVX) suffered a significant decline in 2023, dropping 13.8%. It fell from $174.50 per share at the start of 2023 to just $150 per share, markedly underperforming compared to the S&P 500 (SPY), which saw a return of around 24%.

A substantial portion of this decline occurred around mid-October, coinciding with the announcement of disappointing third-quarter earnings results. Given the current share price, I believe Chevron is now undervalued.

Business overview

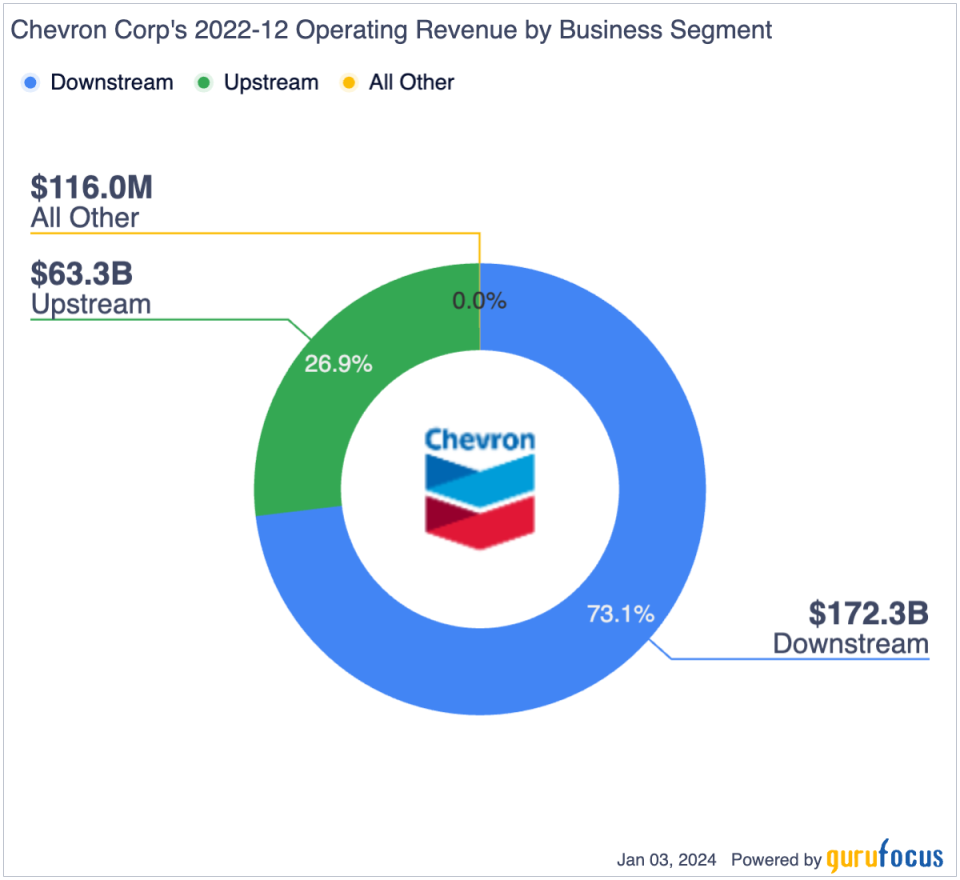

The oil and gas giant operates primarily through two business segments: Upstream and Downstream.

The Upstream segment encompasses crude oil and natural gas exploration, development, production and transportation. The Downstream segment is involved in refining crude oil into petroleum products and marketing and manufacturing fuel, petrochemical commodities and fuel and lubricant additives.

In terms of revenue, the Downstream segment is dominant, generating $172.3 billion in sales and accounting for 73.1% of Chevron's total revenue. In comparison, the Upstream segment contributed approximately $63.6 billion, representing 26.9% of total revenue. In 2022, the company reported nearly 11.23 billion barrels of oil equivalent in proven reserves, which refers to the amount of oil and natural gas that can be profitably extracted with a probability of at least 90%.

Third-quarter earnings drop on lower oil and gas prices

Chevron experienced a significant revenue decline in the third quarter of 2023, reporting an 18.8% decrease from the same period last year to $54.08 billion. The decline was primarily attributed to lower commodity prices. In 2022, the average price of West Texas Intermediate crude oil was nearly $95, but dropped to an average of $82.30 in the third quarter. Similarly, natural gas prices peaked at $9.30 per one million British thermal units in the third quarter of 2022, but fell to $2.59 per MMBtu in the same quarter of 2023.

Earnings per share for the quarter stood at approximately $3.05, which was below analysts' estimates and represented a significant 45% drop from $5.56 in the prior-year period. The decline in earnings was mainly due to lower upstream realizations and reduced margins from refined product sales.

Hess acquisition has long-term potential

Although Chevron had sluggish third-quarter results, I can see the company's long-term potential, especially with the pending Hess (NYSE:HES) acquisition.

The deal should be transformative, bolstering Chevron's portfolio with high-quality oil and gas assets that promise significant long-term benefits. It includes a 30% stake in Guyana's Stabroek block, which is home to over 11 billion barrels of oil equivalent in discovered recoverable resources. Chevron expects this asset to offer high cash margins per barrel and a promising production growth outlook. Additionally, the company will gain 465,000 net acres in the Bakken region, which is characterized by long-duration inventory and supported by Hess Midstream's integrated assets.

The transaction is both a strategic fit and synergistic, complementing Chevron's Gulf of Mexico operations and its steady cash flow from the Southeast Asia natural gas business. Financially, the acquisition is set to be accretive to cash flow per share from 2025, driven by synergies and the start-up of the fourth floating production storage and offloading vessel in Guyana. It is estimated to enhance Chevron's five-year production and free cash flow growth rates, extending growth into the 2030s. Additionally, the deal is poised to deliver direct benefits to shareholders, with Chevron planning an 8% increase in its first-quarter dividend and a substantial $2.5 billion increase in share repurchases.

Despite short-term earnings challenges, this strategic move positions Chevron for robust growth and shareholder value creation into the next decade.

Conservative capital structure

Chevron maintains a cautious and well-structured approach to its capital. As of September, its shareholders' equity stood at $165.3 billion. This figure includes retained earnings and Treasury stocks worth $55.64 billion, reflecting the company's ongoing efforts to buy back shares to return value to shareholders. Its cash and cash equivalents were approximately $5.8 billion. The company has effectively reduced its interest-bearing debt, including finance lease liabilities, by about 34%, from $31.1 billion in 2022 to $20.56 billion in the third quarter of 2023.

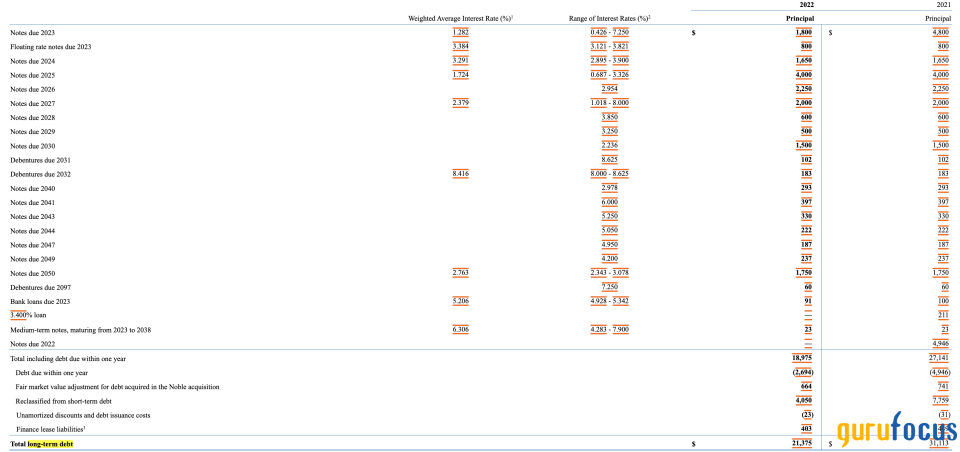

The company's debt obligations extend as far as 2097, with individual principal amounts varying from $23 million to $4 billion. However, a significant portion of this long-term debt is scheduled for repayment between 2023 and 2027, averaging around $2 billion in principal per year. The largest single debt obligation is $4 billion, due in 2025.

Source: Chevron's 10-K

Over the past decades, Chevron has consistently generated substantial operating cash flows, ranging between $19.45 billion and $49.6 billion. These amounts are five to 12 times greater than the highest annual principal payment on its debt. Therefore, the company appears to be in a comfortable position to meet its debt and interest obligations. Indeed, Chevron's financial leverage can be considered quite conservative compared to its operating cash flow.

A legacy of dividends and buybacks over two decades

Income investors highly favor Chevron due to its consistent record of returning money to shareholders through dividends and share repurchases. The company has achieved an impressive streak of increasing its dividend for 36 consecutive years, successfully navigating various economic downturns.

Chevron's dividend per share has grown from $1.40 in 2002 to $5.68 in 2022, representing an annual compounded growth rate of 7.25%. Additionally, the total value of share repurchases during these two decades has approached nearly $49 billion. In the first nine months of 2023, the company allocated approximately $8.5 billion for dividend payments and about $11.5 billion for stock buybacks. Consequently, the total sum returned to shareholders in the first three quarters of 2023 amounted to $20 billion, resulting in a shareholder yield of 7% in just nine months.

Potential 42% upside

By 2024, Chevron is projected to achieve revenue of $209.5 billion and earnings of $14.19 per share. Currently trading at $150 per share, the stock's market valuation stands at approximately 10.6 times its projected 2024 earnings. Over the past five years, Chevron's average price-earnings ratio has fluctuated between 10.21 and 26.5. An average multiple of around 15 times its earnings suggests Chevron could be valued at approximately $212.85 per share. This valuation indicates a potential upside of nearly 42% from its current trading price, showcasing a significant opportunity for growth in its market value.

The bottom line

The decline in Chevron's share price in 2023 presents a strategic investment opportunity. The company's solid business fundamentals, marked by a dominant oil and gas sector position and diversified operations across upstream and downstream segments, highlight its underlying strength. The transformative acquisition of Hess adds significant long-term value, with promising assets expected to boost Chevron's production and cash flow.

Moreover, Chevron's conservative leverage approach, combined with a strong legacy of shareholder returns through dividends and buybacks, underscores its financial resilience. Given its projected earnings and the potential for a 42% upside, the stock appears undervalued at its current price, making it an attractive proposition for investors looking for growth and stability in a volatile market.

This article first appeared on GuruFocus.