Chief Accounting Officer Kathryn Romano Sells 2,500 Shares of Krystal Biotech Inc

Kathryn Romano, the Chief Accounting Officer of Krystal Biotech Inc, has sold 2,500 shares of the company on January 22, 2024, according to a recent SEC Filing. The transaction was executed at a price of $130 per share, resulting in a total sale amount of $325,000.

Krystal Biotech Inc, listed under the ticker KRYS, is a biopharmaceutical company focused on developing and commercializing gene therapies for patients suffering from rare diseases. The company's proprietary gene therapy platform seeks to treat diseases at the genetic level by delivering therapeutic genes to affected cells.

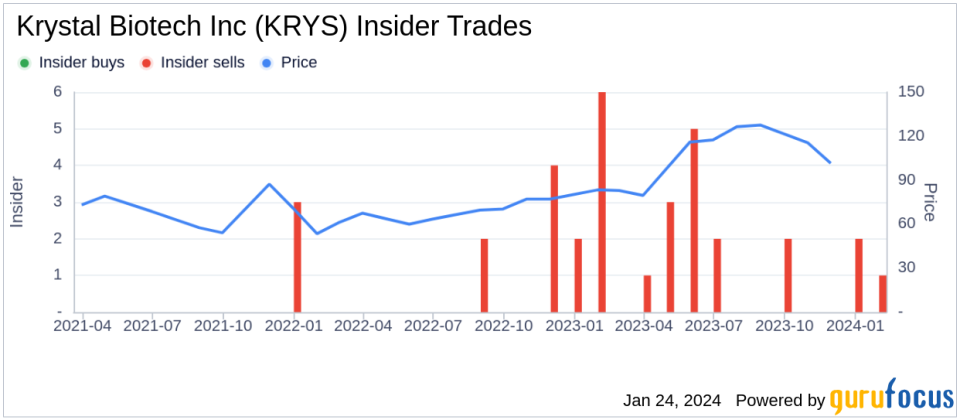

Over the past year, the insider has sold a total of 55,928 shares of Krystal Biotech Inc and has not made any share purchases. This latest transaction continues a pattern of insider sales for the company, with a total of 16 insider sells and no insider buys occurring over the past year.

The stock market valuation of Krystal Biotech Inc stands at $3.616 billion, with the share price at $130 on the day of the insider's recent sale.

The insider transaction history suggests a trend of insider sales for Krystal Biotech Inc, which may be of interest to investors and analysts monitoring insider behaviors as an indicator of company performance and sentiment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.