Chief Business Officer Corrine Savill Sells 40,000 Shares of Cullinan Oncology Inc

Corrine Savill, Chief Business Officer of Cullinan Oncology Inc (NASDAQ:CGEM), executed a sale of 40,000 shares in the company on January 29, 2024, according to a recent SEC filing. The transaction was carried out at an average price of $14.09 per share, resulting in a total value of $564,000.

Cullinan Oncology Inc is a biopharmaceutical company focused on developing a diversified pipeline of targeted oncology and immuno-oncology therapies. The company aims to address the unmet medical needs of cancer patients by applying a broad array of cancer therapies such as small molecules, biologics, and nucleic acid-based treatments.

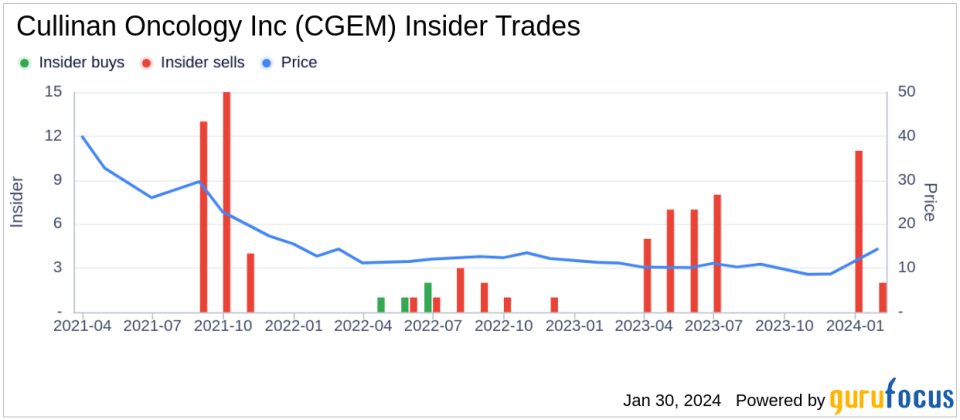

Over the past year, the insider has sold a total of 80,000 shares of Cullinan Oncology Inc and has not made any purchases of the stock. The recent sale represents half of the insider's transactions over the last twelve months.

The insider transaction history at Cullinan Oncology Inc indicates a trend of more insider selling than buying over the past year. There have been no insider buys recorded, while insider sells have totaled 40 transactions.

On the date of the insider's most recent transaction, shares of Cullinan Oncology Inc were trading at $14.09, giving the company a market capitalization of $618.18 million.

Investors and analysts often monitor insider buying and selling trends as an indicator of corporate confidence. While insider selling does not always suggest a lack of confidence in the company, a high volume of selling by insiders may prompt further investigation by shareholders and potential investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.