Chimera Investment (NYSE:CIM shareholders incur further losses as stock declines 11% this week, taking five-year losses to 44%

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Chimera Investment Corporation (NYSE:CIM), since the last five years saw the share price fall 69%. We also note that the stock has performed poorly over the last year, with the share price down 39%. The last week also saw the share price slip down another 11%. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Chimera Investment

Chimera Investment isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Chimera Investment reduced its trailing twelve month revenue by 21% for each year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 11% (annualized) in the same time period. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

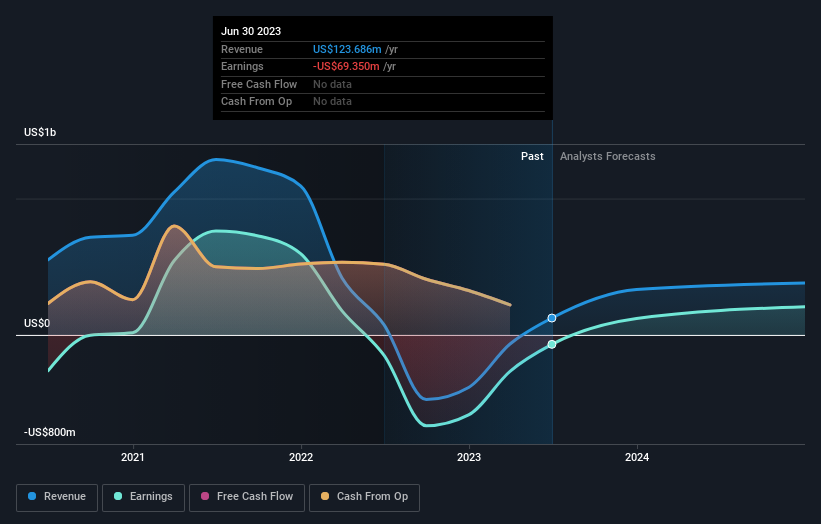

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Chimera Investment stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Chimera Investment the TSR over the last 5 years was -44%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Chimera Investment had a tough year, with a total loss of 29% (including dividends), against a market gain of about 8.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Chimera Investment better, we need to consider many other factors. Take risks, for example - Chimera Investment has 2 warning signs (and 1 which is concerning) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.