Chimerix Inc Reports Fourth Quarter and Full-Year 2023 Financial Results

Net Loss: Chimerix Inc (NASDAQ:CMRX) reported a Q4 net loss of $18.2 million, a decrease from Q4 2022's net loss of $21.0 million.

Research and Development: R&D expenses decreased to $15.6 million in Q4 2023 from $19.3 million in Q4 2022.

General and Administrative Expenses: G&A expenses slightly decreased to $5.2 million in Q4 2023 from $5.3 million in Q4 2022.

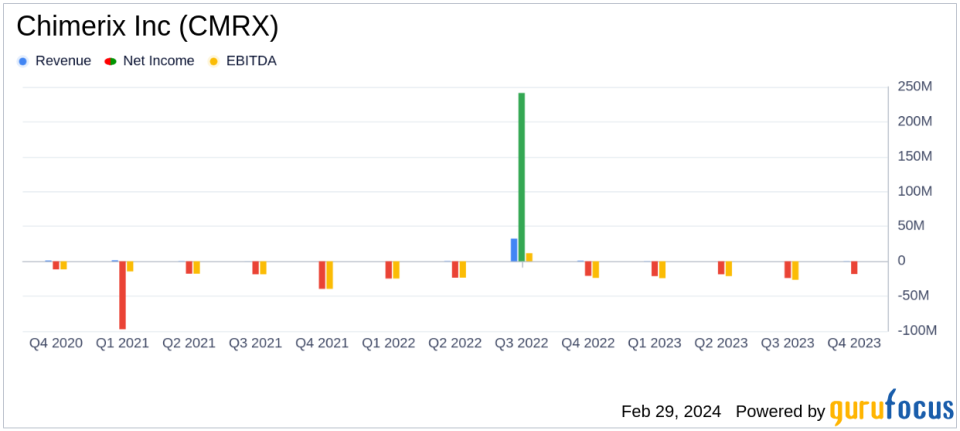

Full-Year Net Loss: For the full year, net loss stood at $82.1 million compared to net income of $172.2 million in 2022, primarily due to the gain on sale of TEMBEXA.

Revenue: Annual revenues decreased to $0.3 million in 2023 from $33.8 million in 2022, following the TEMBEXA divestiture.

Cash Position: Cash and equivalents totaled $204.5 million as of December 31, 2023.

On February 29, 2024, Chimerix Inc (NASDAQ:CMRX) released its 8-K filing, detailing the financial results for the fourth quarter and the full year ended December 31, 2023, along with providing an operational update. The company, a biopharmaceutical entity engaged in the development of medications for cancer and viral infections, has reported a decrease in net loss for the fourth quarter compared to the previous year and a significant full-year net loss due to the sale of TEMBEXA.

Company Overview

Chimerix Inc is a U.S.-based biopharmaceutical company focused on the research, development, and commercialization of novel medications. The company's portfolio includes treatments for acute myeloid leukemia (AML) and antiviral treatments for smallpox. Revenue streams are primarily derived from license agreements and a federal contract with BARDA for drug development. Chimerix operates in the pharmaceuticals business segment.

Financial Performance and Challenges

The company's financial performance in the fourth quarter showed a reduction in net loss, which is a positive sign. However, the full-year results reflect a significant net loss, primarily due to the absence of the one-time gain from the sale of TEMBEXA that boosted the previous year's income. The substantial decrease in annual revenue following the divestiture of TEMBEXA poses a challenge, as the company must now rely on the success of its clinical trials and potential commercialization of its drug candidates to generate future revenues.

Operational Updates and Clinical Development

Chimerix's CEO, Mike Andriole, emphasized the company's commitment to advancing the ONC201 ACTION study and completing ONC206 dose escalation. The company is progressing with its global Phase 3 ACTION study and anticipates interim overall survival data in 2025. The recent publication of Phase 2 ONC201 data in the Journal of Clinical Oncology is a testament to the potential of the company's drug candidates.

"Following strong clinical development in 2023, we remain very focused on advancing the ONC201 ACTION study, completing ONC206 dose escalation this year and strengthening our executive team as we prepare for potential commercialization of ONC201," said Mike Andriole, CEO of Chimerix.

The company's financial achievements, including a strong cash position of $204.5 million, are crucial for sustaining operations and funding ongoing clinical trials. The management of operating expenses, despite the challenges faced, demonstrates Chimerix's commitment to efficiently utilizing its resources.

Financial Statements Summary

Key details from the financial statements include:

The net loss for Q4 2023 was $18.2 million, or $0.20 per share, compared to a net loss of $21.0 million, or $0.24 per share, in Q4 2022.

Research and development expenses for Q4 2023 were $15.6 million, a decrease from $19.3 million in the same period of the previous year.

General and administrative expenses for Q4 2023 were $5.2 million, slightly down from $5.3 million in Q4 2022.

For the full year 2023, the net loss was $82.1 million, or $0.93 per share, compared to a net income of $172.2 million, or $1.97 per basic share and $1.94 per diluted share in 2022.

Revenue for the full year 2023 was $0.3 million, a significant decrease from $33.8 million in 2022.

These metrics are important as they reflect the company's ability to manage expenses and its cash burn rate, which are critical for investors to assess Chimerix's financial health and long-term viability.

Analysis of Company's Performance

Chimerix's performance in 2023 indicates a company in transition, with a focus on clinical development and potential future commercialization of its drug candidates. The reduction in net loss for the fourth quarter is a positive development, but the full-year results highlight the impact of the TEMBEXA divestiture on the company's revenue stream. The strong cash position provides a buffer for the company to continue its research and development activities, which are essential for future growth.

For further details and to listen to the conference call, investors and interested parties can access the webcast on Chimerix's website.

For more in-depth analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Chimerix Inc for further details.

This article first appeared on GuruFocus.