China Chip Stocks Look Like Long-Term Winners to Wall Street

(Bloomberg) -- While many on Wall Street are going to great lengths to avoid Chinese stocks, some analysts are telling clients to consider local chip companies. The caveat: it might take a while to see the benefits.

Most Read from Bloomberg

Largest Covid Vaccine Study Yet Finds Links to Health Conditions

Capital One to Buy Discover for $35 Billion in Year's Biggest Deal

A $6 Trillion Wall of Cash Is Holding Firm as Fed Delays Cuts

Wall Street’s Moelis Bet Big on the Middle East. Now He’s Cashing In

That’s the view of Wall Street firms including Barclays and Sanford C. Bernstein, with the latter pointing to chip companies such as Naura Technology Group Co. and Hygon Information Technology Co. as names that may one day be as well known as US counterparts like Applied Materials Inc. and Advanced Micro Devices Inc.

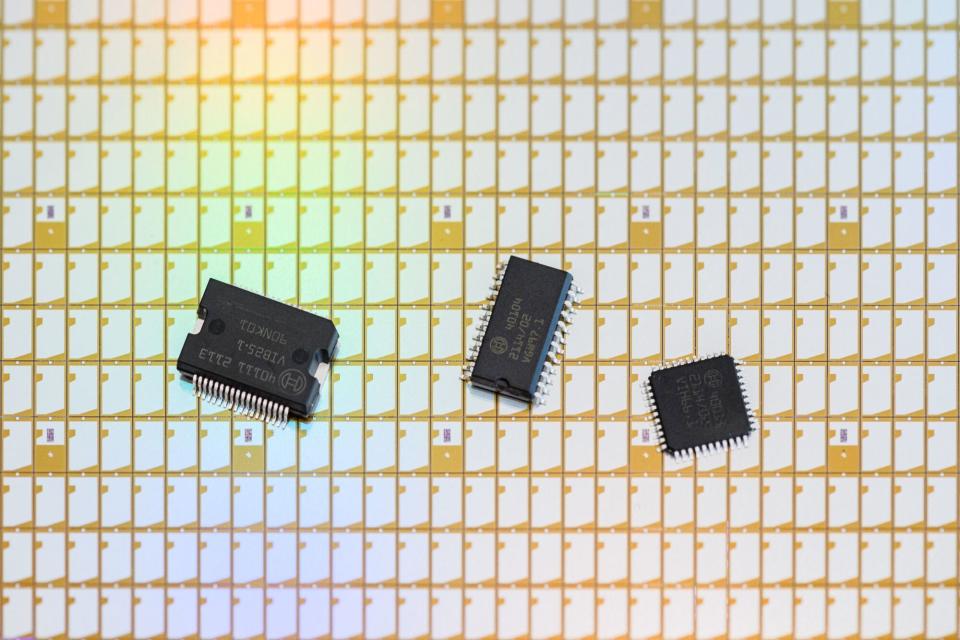

The reasoning is simple: US efforts to curb access to cutting-edge semiconductor tech will supercharge the development of China’s domestic chip industry as a matter of survival and create big opportunities for local companies, whose investments will pay off in years to come.

“This is an industry that’s full of investment opportunities for early investors to identify the ultimate survivors in the market,” said Sun Jianbo, president of China Vision Capital. “As more resources are invested in this industry, some home-grown companies will thrive.”

It may seem like a steep prospect given some $6.5 trillion of market value has been wiped out in Chinese and Hong Kong equity markets since Feb. 2021, as concerns over the feeble economy and rising geopolitical tensions shake confidence in the outlook for Chinese stocks.

Added to the mix are efforts by the US and allies to step up export restrictions on advanced chips like the ones made by Nvidia Corp. used in AI computing. That includes sales to China of equipment used to make them, such as machines made by ASML Holding NV. Various measures have been imposed on firms including Huawei Technologies Co. and Semiconductor Manufacturing International Corp.

China has responded by pouring more than $100 billion into efforts to create domestic suppliers that can fill the void. Among Bernstein’s top picks in China are Naura, a company it says is most comparable to Applied Materials Inc. As the most diversified Chinese maker of equipment needed to manufacture semiconductors, the firm is poised to gain local market share rapidly, according to analysts led by Bernstein’s Qingyuan Lin.

Read More: China Taking On US Fuels $147 Billion Rally in Japan Chip Stocks

“We see the US sanctions as a double-edged sword,” Lin wrote in a recent note initiating coverage on Chinese chipmakers. “While they may slow China’s progress in cutting-edge areas, they also compel China to develop its supply chain, pursue self-sufficiency, and thrive in segments that benefit from increased domestic substitution.”

Another favorite is Hygon. The Beijing-based company had a license to make server chips using AMD technology until the access was cut off by the US government in June 2019. Nonetheless, Hygon has done well at developing its own products and will benefit from a push to convert Chinese data centers to local chips, according to Bernstein.

Naura is projected to see sales rise by about a third in 2024, according to the average of analyst estimates compiled by Bloomberg. That compares with a projected 1% increase in revenue for Applied Materials, which has about 10 times Naura’s annual revenue.

Over the past 12 months, Hygon’s China-listed shares are up 36%, roughly in line with the Nasdaq 100 Index’s 40% gain but underperforming its US counterpart AMD’s 110% jump. Naura is down 2% in that time.

China’s ambitious plan to achieve 70% self-sufficiency in semiconductor consumption by 2025 has been troubled, according to analysts at Barclays. The country’s push toward less reliance on imports is still “at the start of a very long journey,” they wrote. But, with tens of billions of dollars of government money being invested in local production, the role of Chinese producers is going up and output is set to double within five to seven years.

Top Tech News

Oracle Corp. female employees who fought the company in court for almost seven years over gender-pay equity reached a $25 million settlement — a small price for the software giant that amounts to one or two paychecks for most of the women.

Hedge funds bought into some of the biggest technology names in the fourth quarter to chase a scorching rally in the sector fueled by the growth in artificial intelligence, according to the latest quarterly reports investment managers filed with the US Securities and Exchange Commission.

Michael Burry, the money manager made famous in The Big Short, added to wagers on Chinese tech giants Alibaba Group Holding Ltd. and JD.com Inc. in recent months even as a rout in Chinese shares deepened.

Cisco Systems Inc., the largest maker of networking equipment, plans to cut thousands of jobs after a slowdown in corporate tech spending wiped out its sales growth.

Uber Technologies Inc. will buy back as much as $7 billion in shares to return capital to shareholders after reporting its first full year of operating profit and consistent positive free cash flow in 2023.

Taiwan Semiconductor Manufacturing Co. gained about $42 billion of market value after investors bet the chipmaker to Nvidia Corp. and Apple Inc. will become one of the biggest winners of an AI development frenzy

Earnings Due Thursday

Premarket

Epam Systems

Zebra Tech

Postmarket

Applied Materials

Dropbox

Procore Technologies

Globant

--With assistance from Subrat Patnaik and Taryana Odayar.

(Adds first bullet in Top Tech News section.)

Most Read from Bloomberg Businessweek

How Paramount Became a Cautionary Tale of the Streaming Wars

Pursuing ‘American Dynamism,’ Andreessen Horowitz Ups Its Game in DC

Gene Therapy Makers Struggle to Find Patients for Miracle Cures

©2024 Bloomberg L.P.