China Deals a Blow to Intel's Turnaround

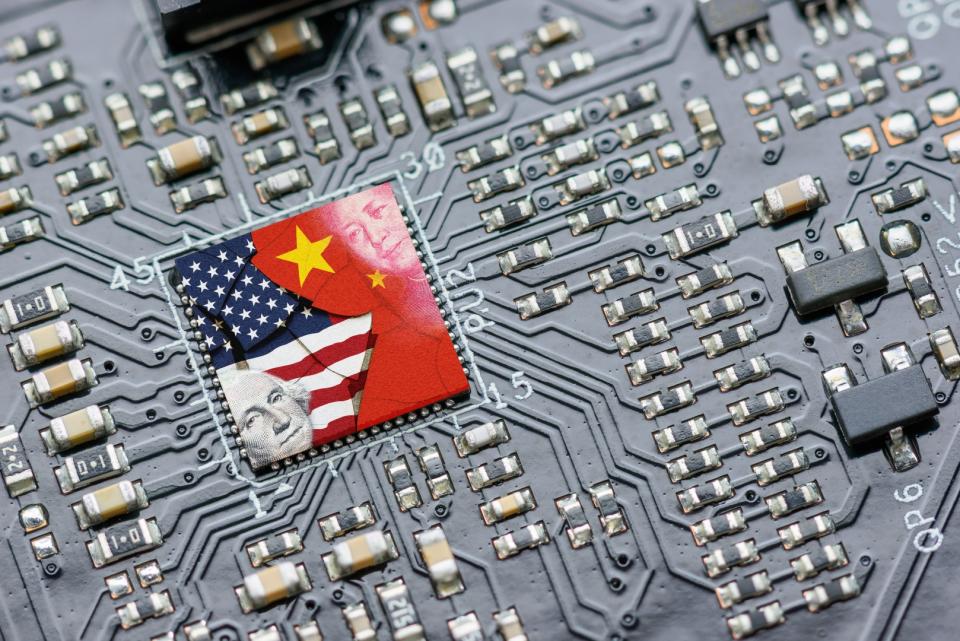

China is making a concerted effort to lower its dependence on foreign technology. Chip giant Intel (NASDAQ: INTC) is the latest U.S. tech company to find itself in the crosshairs.

Financial Times reported over the weekend that China had introduced new guidelines that will result in government PCs and servers powered by Intel or AMD processors being replaced with domestic alternatives. The Chinese government is also looking to cut out Microsoft Windows and foreign database software.

Separately, state-owned Chinese enterprises are also pushing to lower their dependence on foreign hardware and software. State-owned enterprises reportedly have until 2027 to complete the transition away from foreign technology.

A significant hit to Intel's revenue

China is Intel's largest market. The country accounted for nearly 26% of the company's revenue in 2023, edging out the United States by a slim margin. China was an even larger contributor to Intel's revenue in 2021 before PC sales collapsed in a post-pandemic reckoning.

Intel generated $14.9 billion of revenue from China last year. It's important to note that only a portion of this revenue is directly at risk from China's restrictions. Reuters reported that a Bernstein analyst sees a $1.5 billion revenue hit for Intel assuming all Chinese government purchases of Intel chips stop.

However, these restrictions are likely not the end of China's push to boost its domestic tech industry and lower dependence on U.S. and other foreign companies. A larger share of Intel's revenue from China will likely be at risk in the years ahead as domestic alternatives are favored outside of government and state-owned enterprises.

These restrictions come just as Intel is lining up a series of important product launches. Intel rolled out its Meteor Lake laptop chips last December, the first PC chips from the company with a built-in AI accelerator. Arrow Lake will come later this year, built on Intel's upcoming Intel 20A process.

In the server CPU business, Intel plans to launch its powerful Granite Rapids CPUs and its cloud-focused Sierra Forest CPUs. Both are critical products as Intel looks to regain its share in the server CPU market. Notably, Sierra Forest will feature up to 288 CPU cores, positioning it against the coming onslaught of Arm-based server chips.

With China pushing to reduce its reliance on Intel, the company's recovery in both the PC CPU and server CPU markets will get that much harder.

The long-term story hasn't changed

While Intel generates essentially all of its revenue from its own first-party chips today, the company's aggressive push to become one of the world's largest semiconductor foundries will change this situation. Intel's business in China may come under increasing pressure, but the foundry business can more than offset any revenue losses in the long run.

Intel has $15 billion worth of foundry deals on the books, including an agreement with Microsoft to build a custom chip on the upcoming Intel 18A process node. That node will be ready by the start of 2025, and it marks an inflection point for Intel's manufacturing operations. The company expects Intel 18A, decked out with a new type of transistor and backside power delivery, to beat TSMC's top-tier process node in performance.

Intel has set a goal of growing into the second-largest foundry by 2030. With current No. 2 Samsung having a mid-teens share of a market that's now worth over $100 billion and expected to exceed $230 billion by 2032, Intel's foundry could be generating $20 billion of revenue annually by the end of the decade.

Intel's results may come under some pressure as China pulls back on purchases, but this development is unlikely to matter much in the long run. Whether Intel stock delivers for investors will ultimately depend on the success of the company's foundry business.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Timothy Green has positions in Intel. The Motley Fool has positions in and recommends Advanced Micro Devices and Microsoft. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

China Deals a Blow to Intel's Turnaround was originally published by The Motley Fool