China Liberal Education Holdings Ltd's Potential Underperformance: A Deep Dive into the GF Score

Long-established in the Education industry, China Liberal Education Holdings Ltd (NASDAQ:CLEU) has enjoyed a stellar reputation. It has recently witnessed a surge of 2.22%, juxtaposed with a three-month change of -57.38%. However, fresh insights from the GuruFocus Score Rating hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of China Liberal Education Holdings Ltd.

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

1. Financial strength rank: 8/10

2. Profitability rank: 6/10

3. Growth rank: 1/10

4. GF Value rank: 2/10

5. Momentum rank: 3/10

Based on the above method, GuruFocus assigned China Liberal Education Holdings Ltd the GF Score of 60 out of 100, which signals poor future outperformance potential.

China Liberal Education Holdings Ltd: A Snapshot

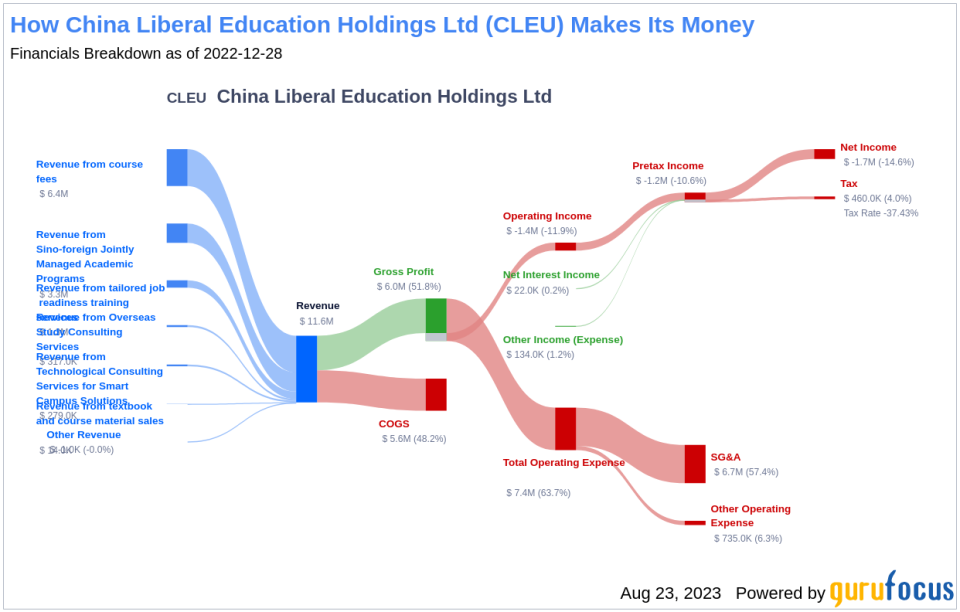

China Liberal Education Holdings Ltd is an educational service provider operating in China. The company's operating segment includes Sino-foreign Jointly Managed Academic Programs, textbooks and course material sales, Overseas Study Consulting Services, Technological Consulting Services for Smart Campus Solutions and Tailored Job Readiness Training Services. Geographically, it derives revenue from China. The company has a market cap of $8.72 million and sales of $11.6 million, but an operating margin of -11.94% raises concerns.

Growth Prospects

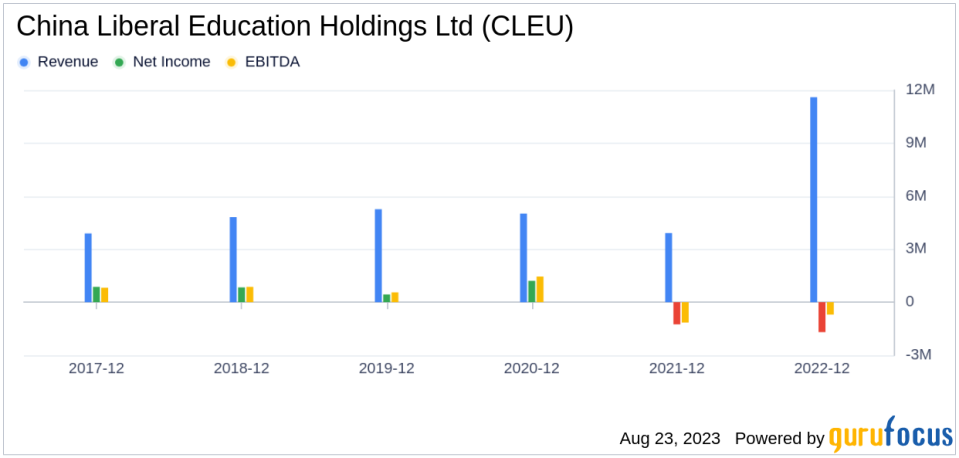

A lack of significant growth is another area where China Liberal Education Holdings Ltd seems to falter, as evidenced by the company's low Growth rank. The company's revenue has declined by -16.1 per year over the past three years, which underperforms worse than 82.61% of 230 companies in the Education industry. Stagnating revenues may pose concerns in a fast-evolving market.

Conclusion

Considering the company's financial strength, profitability, and growth metrics, the GuruFocus Score Rating highlights the firm's unparalleled position for potential underperformance. While China Liberal Education Holdings Ltd has a strong reputation in the education industry, its current financial and growth indicators suggest that it may struggle to maintain its historical performance. Investors should consider these factors when making investment decisions.

GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.