China Mengniu Dairy And Other Top Growth Stocks

Individual investors like stocks with a high growth potential. These companies have a strong outlook that can bring a significant upside to your portfolio, regardless of market cyclicality. Investment in growth companies can benefit your current holdings, whether it be in established tech giants or undiscovered micro-caps. Here, I’ve put together a few companies the market is particularly optimistic towards.

China Mengniu Dairy Company Limited (SEHK:2319)

China Mengniu Dairy Company Limited, an investment holding company, manufactures and distributes dairy products in the People’s Republic of China. Established in 1999, and currently lead by Minfang Lu, the company size now stands at 41,141 people and with the stock’s market cap sitting at HKD HK$102.31B, it comes under the large-cap stocks category.

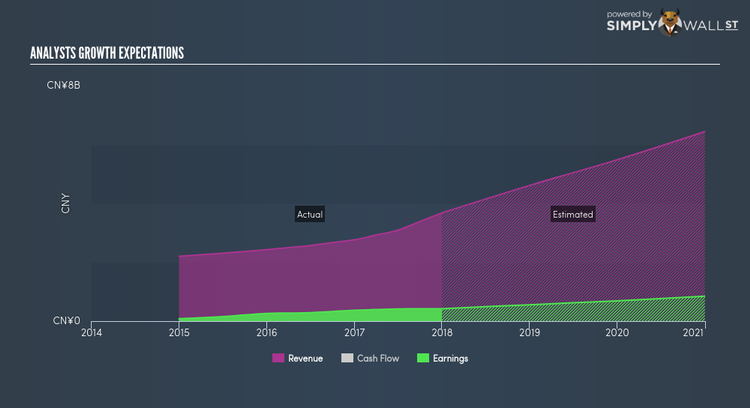

2319 is expected to deliver a buoyant earnings growth over the next couple of years of 27.01%, driven by a positive double-digit revenue growth of 23.78% and cost-cutting initiatives. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 16.27%. 2319 ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Interested to learn more about 2319? I recommend researching its fundamentals here.

Shun Tak Holdings Limited (SEHK:242)

Shun Tak Holdings Limited, an investment holding company, engages in property, transportation, hospitality, and investment businesses in Hong Kong, Macau, and internationally. Established in 1961, and currently headed by CEO Pansy Ho Chiu King, the company provides employment to 3,390 people and with the company’s market cap sitting at HKD HK$10.00B, it falls under the large-cap category.

242 is expected to deliver an extremely high earnings growth over the next couple of years of 50.03%, bolstered by a significant revenue which is expected to more than double. It appears that 242’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 13.55%. 242’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Thinking of investing in 242? Check out its fundamental factors here.

Xiabuxiabu Catering Management (China) Holdings Co., Ltd. (SEHK:520)

Xiabuxiabu Catering Management (China) Holdings Co., Ltd., an investment holding company, operates Chinese hotpot restaurants primarily under the Xiabuxiabu brand name in China. Started in 1998, and now run by Shuling Yang, the company now has 21,200 employees and with the company’s market capitalisation at HKD HK$14.70B, we can put it in the large-cap category.

Extreme optimism for 520, as market analysts projected an outstanding earnings growth rate of 22.36% for the stock, supported by a double-digit sales growth of 48.98%. It appears that 520’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 26.72%. 520 ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Want to know more about 520? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.