Chinese car makers are becoming shipping companies

Is BYD, the Chinese electric vehicle giant, turning into a shipping company?

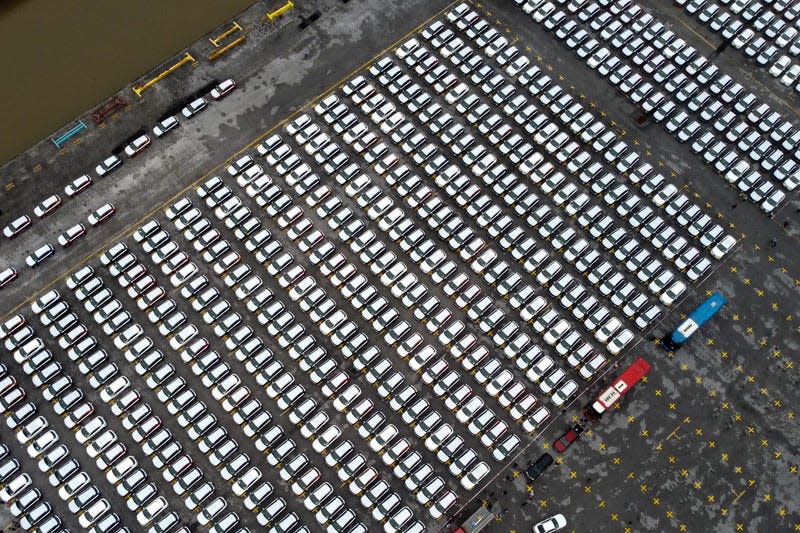

As it aggressively pushes into markets overseas, BYD has ordered at least six massive car carriers, ships that can transport thousands of cars at a time. In part, BYD’s move reflects a keen frustration of the Chinese auto industry. Over the past two years, just as China’s vehicle exports boomed, pandemic-related supply chain snarls led to acute shortages of space on cargo ships.

Read more

Now, BYD appears to be maneuvering not only to ship its own products but also to offer global shipping services to other car manufacturers. Think car company meets ship owner meets shipping logistics provider, all rolled into one.

BYD has made no public statements about its foray into shipping. But a recent update to information about the company on Tianyancha, China’s database of companies, offers some clues.

According to a time-stamped update (link in Chinese) last month, BYD Auto Industry, a subsidiary of the broader BYD group, expanded a paragraph on the scope of its commercial activities. The section now lists activities not usually associated with a car manufacturer: ocean carrier operations, freight forwarding, international shipping agency services, and port cargo handling. (BYD did not respond to a request for comment from Quartz.)

The Tianyancha update suggests that BYD is looking to establish a foothold in global shipping. And it represents yet another push by the company to establish its dominance up and down the automotive supply chain.

“The most vertically integrated company”

BYD has honed its vertical integration strategy for years, having started out as a mobile phone battery maker before manufacturing other electronics, auto components, and finally electric vehicles. That playbook has served it well in the competitive EV field.

“[BYD] has mastered the core technologies of the whole industrial chain of new energy vehicles, such as batteries, motors and electronic controls,” Wang Chuanfu, BYD’s chairman, once told Forbes.

Already, BYD is looking to buy lithium mines in Africa and has secured a contract for lithium extraction in Chile, since lithium is integral to EV batteries. BYD has become a leading producer of EV batteries, even supplying competitors like Tesla and Toyota, and is expanding its battery production capacity from about 285 Gigawatt hours (GWh) in 2022 to an estimated 445 GWh by the end of this year.

“BYD is probably the most vertically integrated [car] company,” said Lei Xing, a US-based auto analyst and co-host of the podcast China EVs and More. “There’s nowhere else to turn to vertically integrate more than to [buy] your own ships... And it’s not out of the question that BYD becomes a provider that they can ship for other people, competitors.”

Not enough ships for China’s car exports

BYD isn’t the only Chinese car maker that’s getting into the shipping business.

Last July, SAIC Motor, the state-owned automaker, partnered with the Chinese shipping giant COSCO and the port operator Shanghai International Port Group to set up Guangzhou Yuanhai Car Carrier Transportation, described as a “vehicle supply chain” company (link in Chinese).

For China, expanding its homegrown vehicle shipping capacity is seen as critical to growing the global footprint of its automotive industry.

“International [marine] transportation is facing the urgent situation of insufficient capacity, unstable capacity, and poorly connected logistics information, becoming a stumbling block for the globalization” of Chinese car makers, noted China Automotive News in a November article (link in Chinese).

The urgency of reliable shipping has become particularly acute as Chinese car exports have skyrocketed over the past two years. According to Chinese customs statistics, the value of vehicle exports in the third quarter of 2022 was $12.7 billion, more than five times higher than the same period in 2020.

Yet over the same period, growth in the global capacity of car carrier vessels lagged far behind, according to data from shipping services provider Clarksons, as cited by Bloomberg.

Of the roughly 750 car carriers in operation worldwide, China currently only operates a fleet of 10 such ships capable of long-haul maritime journeys, according to the automotive logistics firm Changjiu Logistics (link in Chinese, pdf).

As a result, Chinese carmakers struggled to find space on vessels to send their vehicles to overseas markets. As an article last month by the state news agency Xinhua put it (link in Chinese): “As auto exports soar, even a single shipping space on car carriers is hard to find.” Companies that did snag such spots on ships reported paying vastly inflated prices (link in Chinese). BYD’s ambition to own and run ships is a bid to better control the vagaries of the supply chain.

More from Quartz

Sign up for Quartz's Newsletter. For the latest news, Facebook, Twitter and Instagram.