A Chinese Tech Stock Below Book Value

You can buy a big Chinese tech stock on the Nasdaq thats now trading below its book value. Hollysis Automation Technologies Ltd. (NASDAQ:HOLI) is earning money, pays a dividend, has a low price-earnings ratio and very little debt. All of that places it squarely in the value stock category.

Because all stocks in China have sold off severely over the last 12 months or so, it may be possible to identify cheap equities with decent balance sheets and a future. If so, then Hollysis definitely fits as long as investors are willing to accept whatever uncertainty may be involved with Asian markets this year.

The company, founded in 1993, is a leading supplier of automation technology in China, according to its website. Based in Beijing with more than 3,800 employees, Hollysis has research and development and services offices around that country as well as in India, Malaysia and Indonesia.

The stock is selling for just 75% of its book value and the price-earnings ratio right now is a relatively low (for a tech stock) 9.56. Hollysis has a market capitalization of $864.98 million and an enterprise value of $173.88 million. Average daily volume is 476,926 shares on the Nasdaq and it also trades on German and United Kingdom exchanges.

The price-sales ratio is low at 1.52 and the price-to-free cash flow metric comes in at 9.30. There is a tiny amount of long-term debt, which is greatly exceeded by shareholder equity. Not only that, the current ratio is 3.20 with a quick ratio of 3.10.

Investors are paid a dividend of 20 cents per share for an annualized yield of 1.43%.

This years earnings per share are up by 28.80% and the earnings per share growth rate for the past five years is 1.22%. Wall Street earnings expectations for next year are positive and the same goes for the next five years' forecast.

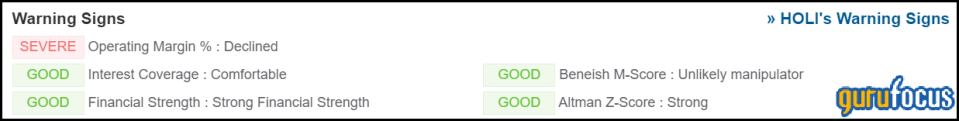

The GuruFocus summary of Hollysis financials shows four good signs and one severe warning sign:

The financial strength indicators look like this:

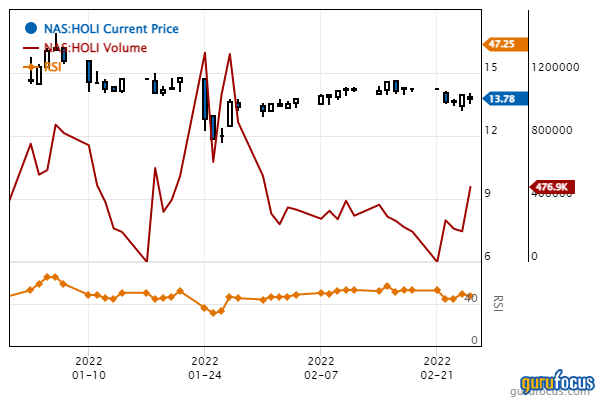

The daily price chart for Hollysis Automation Technologies looks like this:

Whether thats a double bottom chart formation (from late December to late January) remains to be seen.

With its good earnings, its below book value status, its low price-earnings ratio and with a dividend being paid, its highly likely that Hollysis is making appearances on the value screens of large institutional investors worldwide.

This article first appeared on GuruFocus.