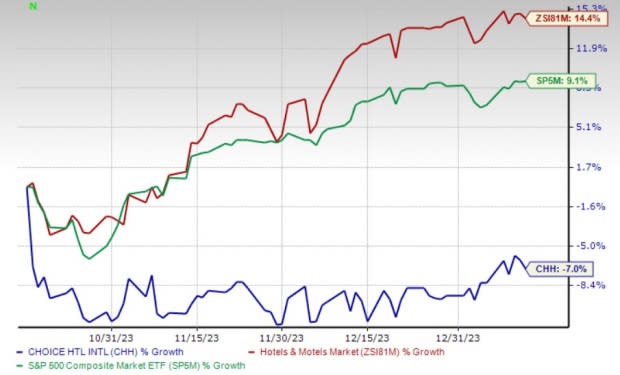

Choice Hotels (CHH) Stock Down 7% in 3 Months: Can It Revive?

Shares of Choice Hotels International, Inc. CHH have declined 7% in the past three months against the industry’s and S&P 500’s growth of 14.4% and 9.1%, respectively. The decline can be primarily attributed to a volatile macroeconomic environment.

The company believes that if inflation rates rise moderately, it will likely lead to comparable or even higher increases in hotel room rates. CHH is monitoring future inflation trends and assessing any potential impacts.

The Zacks Rank #3 (Hold) company’s earnings and revenues in 2024 are likely to witness 12.9% and 2% growth year over year, respectively.

Let’s delve deeper into the factors likely to drive the company’s performance in 2024.

Growth Drivers

The integration of Radisson Hotels Americas has proven advantageous for Choice Hotels, leading to the expansion of their loyalty program, enhanced opportunities for co-brand credit cards and a broader presence in the Americas region.

During the third quarter of 2023, CHH reported $84 million of annual recurring synergies through the integration of Radisson Hotels Americas. It reported improved business performance through the integration of digital channels and rewards program. A rise in traffic and booking conversion rate on the Choice website and mobile apps added to the positives.

Image Source: Zacks Investment Research

The acquisition of Radisson Americas is seen as a strategic move to leverage the company's momentum in the Upscale segment. It is anticipated to accelerate the growth of the Cambria and Ascend brands while expanding the Radisson portfolio. So far, CHH has migrated 75% of Radisson Americas hotels into its property management system. For 2024, management expects adjusted EBITDA from Radisson Hotels Americas to exceed $80 million.

Choice Hotels relies heavily on expansion in both domestic and international markets. Through September 2023, management reported more than four openings per week (on average). It opened 159 domestic hotels, reflecting a rise of 24% year over year.

During the third quarter, the company announced a strategic partnership with a hotel operator in Mexico. The arrangement paves a path for growth in the international portfolio as well as enhancement in Choice Hotels' rewards program.

CHH’s Cambria portfolio has been doing solid business. Cambria significantly outperformed the upscale soft brands (as well as the segment as a whole) in terms of year-over-year RevPAR change. The brand has been well received on account of smart conversion opportunities.

During second-quarter 2023, the Cambria brand achieved 15% year-over-year growth, reaching a total of 69 units. The brand has an additional pipeline of 71 domestic properties. Backed by solid consumer confidence and the attractiveness of Choice Hotels' value proposition, the company anticipates boosting the revenue intensity of its system by adding more properties.

Key Picks

Below, we present some better-ranked stocks from the Zacks Consumer Discretionary sector.

Virco Mfg. Corporation VIRC sports a Zacks Rank #1 (Strong Buy). VIRC has a trailing four-quarter earnings surprise of 188.6% on average. VIRC’s shares have surged 144.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for VIRC’s 2024 sales and earnings per share (EPS) indicates a rise of 15.7% and 32.4%, respectively, from the year-ago levels.

Stride, Inc. LRN flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 44.3% on average. Shares of LRN have increased 77% in the past year.

The Zacks Consensus Estimate for LRN’s 2024 sales and EPS suggests a 9.1% and 34.7% improvement, respectively, from the year-earlier levels.

Skechers U.S.A., Inc. SKX carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 50.3% on average. Shares of SKX have gained 35.7% in the past year.

The Zacks Consensus Estimate for SKX’s 2024 sales and EPS implies 10.2% and 16.3% growth, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Virco Manufacturing Corporation (VIRC) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report