Choice Hotels International Inc (CHH) Reports Record Revenues for Full-Year 2023

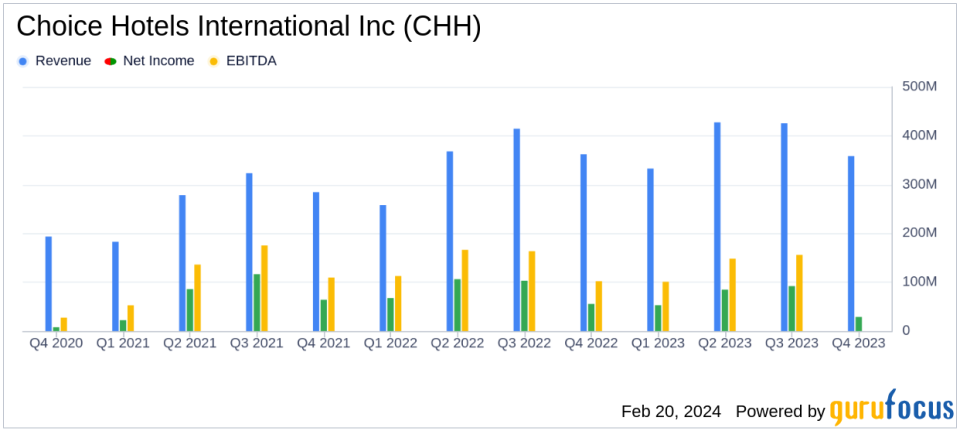

Revenue Growth: Total revenues increased by 10% to $1.5 billion for full-year 2023.

Net Income: Net income reached $258.5 million, with diluted EPS of $5.07.

Adjusted EBITDA: A company record of $540.5 million, up 13% compared to 2022.

Adjusted Diluted EPS: Increased 16% to $6.11, exceeding the top end of the guidance.

Unit Growth: Domestic upscale, extended stay, and midscale brands exceeded unit growth guidance, with a 1.8% increase in hotels and 2.4% in rooms since December 31, 2022.

Global Rooms Pipeline: Increased by 6% to over 105,000 rooms, with conversion rooms up by 16% from September 30, 2023.

2024 Outlook: Full-year net income guidance of $260 million to $274 million, with adjusted EBITDA expected between $580 million to $600 million.

On February 20, 2024, Choice Hotels International Inc (NYSE:CHH) released its 8-K filing, detailing its financial performance for the fourth quarter and full-year 2023. The company, which operates 628,000 rooms across 13 brands, including Comfort Inn, Comfort Suites, Ascend, and Cambria, has achieved record revenues and exceeded its full-year 2023 outlook for unit growth. The company's franchises account for 99% of total revenue, with the United States representing 79% of total rooms in 2022.

Despite facing challenges such as integration costs from the Radisson Hotels Americas acquisition and one-time items, CHH reported a net income of $258.5 million for the full year, a 22% decrease compared to the previous year. However, adjusted EBITDA reached a record $540.5 million, a 13% increase from 2022, highlighting the company's financial resilience and operational efficiency.

Choice Hotels' financial achievements are significant in the Travel & Leisure industry, demonstrating the company's ability to grow and manage its portfolio effectively. The increase in the global rooms pipeline, particularly for conversion hotels, indicates a strong potential for future expansion and revenue growth.

From the income statement, the company's royalty, licensing, and management fees totaled $513.4 million for the full year, a 9% increase from 2022. The balance sheet shows a solid liquidity position, with approximately $650 million in total available liquidity as of December 31, 2023. The cash flow statement indicates that the company generated operating cash flows totaling $297 million for the year.

Key financial metrics such as the domestic effective royalty rate, which increased by 6 basis points to 4.99%, and domestic revenue per available room (RevPAR), which saw a slight increase for the full year, are important indicators of the company's pricing power and operational efficiency.

"Our superior hotel conversion capability increased the velocity of new hotel openings and is a clear advantage in today's hotel development environment," said Patrick Pacious, President and CEO of Choice Hotels. "The positive momentum created by our successful strategy gives us confidence in our 2024 outlook and beyond."

The company's commitment to a combination with Wyndham Hotels & Resorts is also a strategic move aimed at creating value for franchisees and shareholders. The proposed combination is expected to provide cost reductions, improved profitability, and an enhanced rewards program for guests.

In conclusion, Choice Hotels International Inc (NYSE:CHH) has demonstrated a strong financial performance in 2023, with record revenues and a robust pipeline for growth. The company's strategic initiatives and operational efficiencies position it well for continued success in the competitive hospitality industry.

Explore the complete 8-K earnings release (here) from Choice Hotels International Inc for further details.

This article first appeared on GuruFocus.