Chris Davis Adjusts Position in Hollysys Automation Technologies Ltd

Recent Transaction Overview

On December 31, 2023, Davis Advisors, under the leadership of portfolio manager Chris Davis (Trades, Portfolio), made a notable adjustment to its investment in Hollysys Automation Technologies Ltd (NASDAQ:HOLI). The firm reduced its holdings by 119,874 shares, which resulted in a -2.23% change in the trade share. This transaction had a minor impact of -0.02% on the portfolio, with the trade executed at a price of $26.35 per share. Following the trade, Davis Advisors holds a total of 5,248,240 shares in Hollysys, representing an 8.50% ownership stake in the company and accounting for 0.87% of the firm's portfolio.

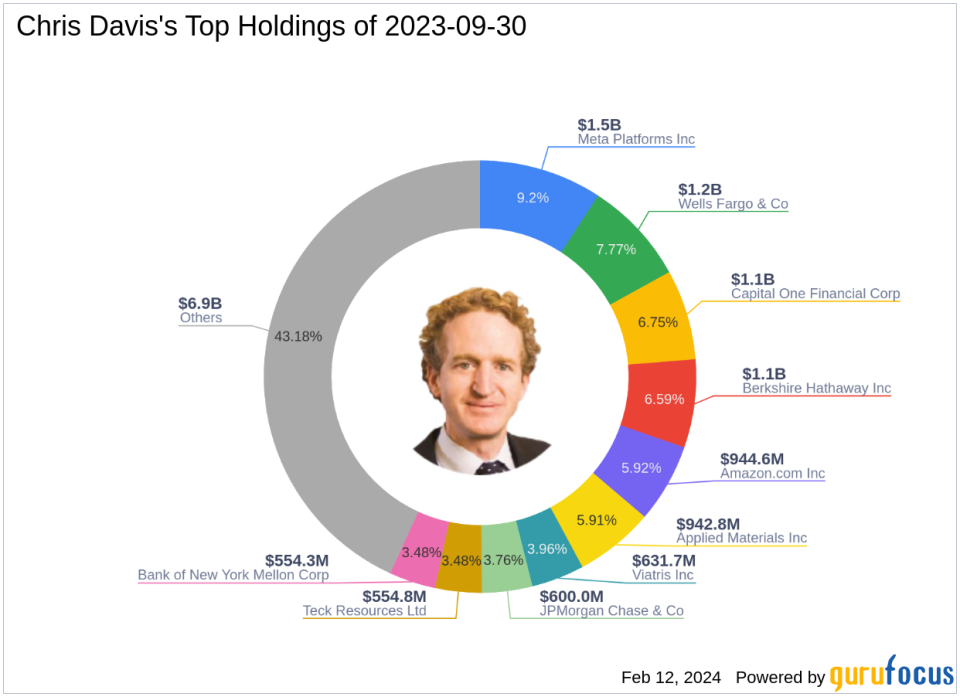

Profile of Chris Davis (Trades, Portfolio) and Davis Advisors

Davis Advisors is a prominent investment management firm overseeing assets worth over $60 billion. Chris Davis (Trades, Portfolio), at the helm of the Davis Financial Fund, is known for a long-term investment approach, favoring durable and well-managed businesses available at value prices. The firm's strategy is particularly focused on financial services companies, with a typical holding period ranging from four to seven years. Among the top holdings are industry giants such as Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and Berkshire Hathaway Inc (NYSE:BRK.A). Davis Advisors has a significant equity portfolio valued at $15.95 billion, with a strong inclination towards the Financial Services and Communication Services sectors.

Hollysys Automation Technologies Ltd at a Glance

Hollysys Automation Technologies Ltd, based in China, specializes in automation and control technologies. The company, which went public on March 10, 2005, operates through segments including Industrial Automation, Mechanical and Electrical Solutions, and Rail Transportation Automation. Hollysys has established a strong presence in the Chinese market, where it generates the majority of its sales. With a market capitalization of $1.6 billion and a current stock price of $25.71, Hollysys is a key player in the industrial products sector.

Impact of the Trade on Davis's Portfolio

The recent transaction by Chris Davis (Trades, Portfolio) has slightly decreased the firm's exposure to Hollysys Automation Technologies Ltd. The trade's impact on the portfolio was minimal, yet it reflects a strategic decision by the firm to adjust its position in the company. With a trade position of 0.87% in the portfolio and a significant 8.50% stake in Hollysys, Davis Advisors remains a major investor in the company.

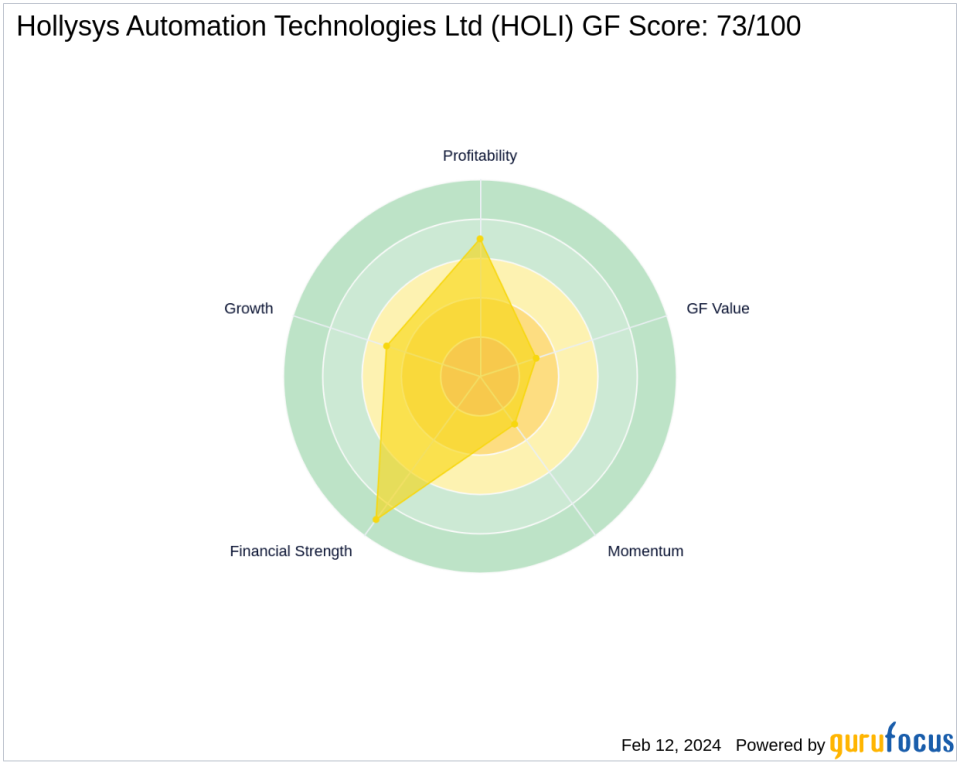

Hollysys' Financial and Market Performance

Hollysys Automation Technologies Ltd is currently deemed Modestly Overvalued with a GF Value of $20.37 and a price to GF Value ratio of 1.26. The stock has experienced a -2.43% price change since the transaction and a -1.72% change year-to-date. Despite these fluctuations, the company has seen a substantial 394.42% price increase since its IPO. Hollysys holds a GF Score of 73/100, indicating a likelihood of average performance in the future.

Comparative Stock Valuation

When comparing the trade price of $26.35 to the current stock price and GF Value, it appears that Davis Advisors capitalized on a higher valuation at the time of the trade. The stock's current status as Modestly Overvalued suggests that the firm's decision to reduce its position was aligned with its value investment philosophy.

Prospects and Performance Metrics

Hollysys Automation Technologies Ltd exhibits a strong Financial Strength with a rank of 9/10 and a Profitability Rank of 7/10. The company's Growth Rank stands at 5/10, while the GF Value Rank and Momentum Rank are both at 3/10. Hollysys' robust interest coverage ratio of 105.35 and an Altman Z score of 3.86 further underscore its financial health.

Industry Context and Largest Guru Stake

In the broader industrial products sector, Hollysys Automation Technologies Ltd maintains a competitive position. Davis Selected Advisers, another investment firm, holds the largest guru stake in Hollysys, although the exact share percentage is not disclosed. This stake by a prominent investment firm underscores the potential that industry experts see in Hollysys within its sector.

Transaction Analysis and Conclusion

The reduction in Hollysys shares by Chris Davis (Trades, Portfolio)'s firm is a strategic move that aligns with the firm's investment philosophy and market valuation assessments. While the transaction had a minor impact on the overall portfolio, it reflects the firm's active management and commitment to value investing. As Hollysys continues to navigate the industrial products market, Davis Advisors' adjusted position will be closely watched by investors seeking insights into the company's future potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.