ChromaDex Corp (CDXC) Reports Encouraging Fiscal Year 2023 Results with Positive Adjusted EBITDA

Net Sales: ChromaDex Corp (NASDAQ:CDXC) reported a 16% year-over-year increase in net sales, reaching $83.6 million.

Gross Margin: Gross margin improved by 140 basis points to 60.8%, reflecting a shift in customer mix and economies of scale.

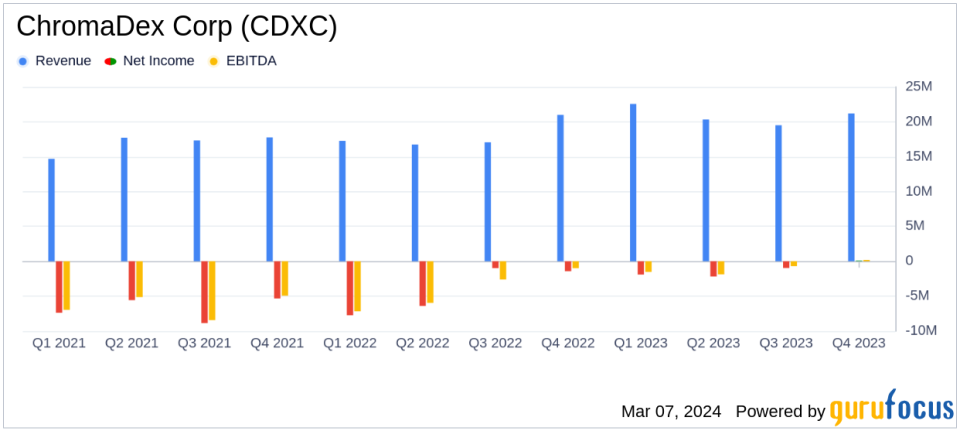

Net Income/Loss: Achieved a net income of $0.1 million in Q4 and reduced the full-year net loss to $4.9 million, a significant improvement from the previous year.

Adjusted EBITDA: Positive Adjusted EBITDA of $1.9 million for the full year, marking an $11.9 million improvement year-over-year.

Operating Cash Flows: Maintained positive operating cash flows for the fourth consecutive quarter, ending the year with $27.3 million in cash and no debt.

Product Expansion: Launched clinical strength Tru Niagen Pro and entered the pet supplement market through a partnership with Zesty Paws.

Research Milestones: Celebrated the 10th anniversary of ChromaDex External Research Program (CERP) with over 275 global research agreements.

On March 6, 2024, ChromaDex Corp (NASDAQ:CDXC) released its 8-K filing, announcing the financial results for the fourth quarter and fiscal year 2023. The bioscience company, known for its research on NAD+ and its flagship ingredient Niagen, reported a year of solid financial performance with significant improvements in net sales, gross margin, and a reduction in net loss.

Financial Performance and Strategic Highlights

ChromaDex's net sales for the fourth quarter were $21.2 million, a slight increase from the previous year, driven by a 9% increase in Tru Niagen sales. The company's gross margin for the quarter was an impressive 61.0%, up from 57.2% in the prior year quarter. This improvement in gross margin reflects a strategic shift in business and customer mix, as well as benefits from economies of scale.

For the full year, ChromaDex exceeded its financial outlook to investors, with total net sales of $83.6 million, marking a 16% increase year-over-year. The company's gross margin saw an improvement of 140 basis points, reaching 60.8%. Selling and marketing expenses, as well as general and administrative expenses, decreased significantly, contributing to a reduced net loss of $4.9 million, or $0.07 loss per share, a notable improvement from the previous year's net loss of $16.5 million, or $0.24 loss per share.

Operational Efficiency and Market Expansion

ChromaDex maintained a strong focus on operational efficiency throughout the year. The company's selling and marketing expenses improved as a percentage of net sales, and general and administrative expenses decreased by $3.3 million year-over-year. These efforts, coupled with a positive Adjusted EBITDA of $1.9 million and positive operating cash flows, underscore the company's financial strength and operational discipline.

The company also made significant strides in expanding its market presence. In 2023, ChromaDex launched Tru Niagen on iHerb, a global destination for supplements, and entered the pet supplement market through a partnership with Zesty Paws. These initiatives, along with the launch of clinical strength Tru Niagen Pro, demonstrate the company's commitment to innovation and growth in new market segments.

Research and Development Achievements

ChromaDex's commitment to scientific research was evident in the celebration of the 10th anniversary of its ChromaDex External Research Program (CERP). The program has signed over 275 global research agreements, exploring the potential health benefits of Niagen. Recent clinical studies have shown promising results in areas such as coordination and eye movement improvements in Ataxia Telangiectasia (AT) patients and mild improvements in Parkinson's Disease.

Rob Fried, ChromaDex Chief Executive Officer, commented on the company's performance, stating,

ChromaDex had its strongest year yet, achieving $83.6 million in revenue, up 16% year-over-year, with positive adjusted EBITDA of $1.9 million, and consistent positive operating cash flows each quarter. Additionally, the fourth quarter marked an important milestone with the company achieving positive net income,"

highlighting the company's financial strength and optimism for accelerated growth in 2024.

Looking Ahead

For the upcoming year, ChromaDex expects to continue its revenue growth trajectory, projecting a higher rate of revenue growth than the previous year's 16%. The company anticipates slight improvements in gross margin driven by supply chain optimization and cost savings. While selling and marketing expenses are expected to increase in absolute dollars, they are projected to remain stable as a percentage of net sales. ChromaDex also plans to increase investments in research and development to drive future innovation.

Investors and stakeholders can look forward to a live webcast to discuss the company's fourth quarter and fiscal year 2023 financial results and provide a general business update.

ChromaDex's solid financial results and strategic initiatives position the company for continued success in the bioscience industry, particularly in the realm of healthy aging and NAD+ research. With a strong financial foundation and a commitment to scientific discovery, ChromaDex is poised for accelerated growth and innovation in the years to come.

Explore the complete 8-K earnings release (here) from ChromaDex Corp for further details.

This article first appeared on GuruFocus.