Chubb (CB) Q3 Earnings Surpass Estimates on Higher Premium

Chubb Limited CB reported third-quarter 2023 core operating income of $4.95 per share, which outpaced the Zacks Consensus Estimate by 17.6%. This outperformance was driven by higher premium revenues and improved net investment income. The bottom line improved 58.1% from the year-ago quarter.

Chubb's results reflected higher premium revenue growth across most of the segments, improved underwriting income and lower catastrophe loss.

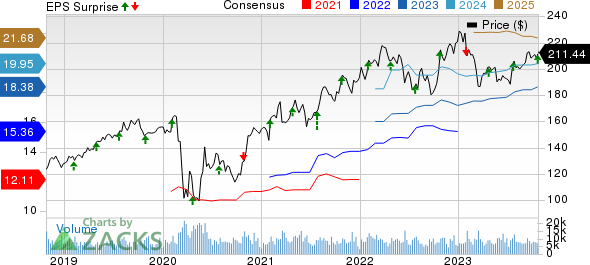

Chubb Limited Price, Consensus and EPS Surprise

Chubb Limited price-consensus-eps-surprise-chart | Chubb Limited Quote

Quarter in Detail

Net premiums written improved 9.1% year over year to $13.1 billion in the quarter, which matched the Zacks Consensus Estimate, while our estimate was $13.5 billion.

Net premiums earned rose 9.9% to $12.7 billion. Our estimate was $11.2 billion.

Net investment income was $1.3 billion, up 34.2%. The Zacks Consensus estimate was pegged at $1.2 billion, while our estimate was pinned at $1 billion.

Property and casualty (P&C) underwriting income was $1.31 billion, which increased 83.8% from the year-ago quarter. Global P&C underwriting income, excluding Agriculture, was $1.2 billion, up 117.2%.

Chubb incurred a pre-tax P&C catastrophe loss of $0.6 billion, narrower than the year-ago catastrophe loss of $1.16 billion. The P&C combined ratio improved 470 basis points (bps) on a year-over-year basis to 88.4% in the quarter under review. The Zacks Consensus Estimate for the combined ratio was pegged at 90, while our estimate was 84.9.

Segmental Update

North America Commercial P&C Insurance: Net premiums written increased 8.7% year over year to $5.1 billion, which was in line with both the Zacks Consensus Estimate and our estimate. The combined ratio improved 670 bps to 84.2%. The Zacks Consensus Estimate was pegged at 88.

North America Personal P&C Insurance: Net premiums written climbed 9.6% year over year to $1.5 billion. Our estimate was $1.4 billion. The combined ratio deteriorated 20 bps to 90.3%. The Zacks Consensus Estimate was pegged at 94.

North America Agricultural Insurance: Net premiums written decreased 11.7% from the year-ago quarter to $1.5 billion. Our estimate was $2 billion, while the Zacks Consensus Estimate was pegged at $1.8 billion. The combined ratio deteriorated 260 bps to 93.2%. The Zacks Consensus Estimate was pegged at 87.

Overseas General Insurance: Net premiums written rose 21.4% year over year to $3.2 billion. Our estimate was $2.8 billion. The combined ratio improved 150 bps to 87%.

Life Insurance: Net premiums written increased 14.9% year over year to $1.4 billion. Our estimate was $1.7 billion. The Life Insurance segment income was $288 million, up 14.8%. It includes earnings from Huatai and higher net investment income.

Financial Update

The cash balance of $2.6 billion, as of Sep 30, 2023, increased 28.5% from the 2022-end level. Total shareholders’ equity increased 13.8% from the level at 2022 end to $57.5 billion as of Sep 30, 2023.

Book value per share, as of Sep 30, 2023, was $128.37, up 5.3% from the figure as of Dec 31, 2022.

Core operating return on tangible equity expanded 710 bps year over year to 21.2%.

Operating cash flow was $4.68 billion in the quarter under consideration.

Capital Deployment

In the quarter, Chubb bought back shares worth $606 million and paid $352 million in dividends.

Zacks Rank

Chubb currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other P&C Insurers

The Travelers Companies, Inc. TRV reported its third-quarter 2023 core income of $1.95 per share, which missed the Zacks Consensus Estimate by 33.4%. The bottom line decreased 11.4% year over year, primarily attributable to higher catastrophe losses and net unfavorable prior-year reserve development. TRV’s total revenues increased 14% from the year-ago quarter to $10.6 billion, primarily driven by higher premiums. The top-line figure beat the Zacks Consensus Estimate by 1.3%.

Net written premiums increased 14% year over year to a record $10.4 billion, driven by strong growth across all three segments. The figure was higher than our estimate of $9.4 billion. TRV witnessed an underwriting gain of $868 million, up 43% year over year, driven by record net earned premiums of $9.7 billion and a consolidated underlying combined ratio, which improved by 90.6%.

The Progressive Corporation’s PGR third-quarter 2023 earnings per share of $2.09 beat the Zacks Consensus Estimate of $1.71. The bottom line improved more than fourfold year over year. Net premiums written were $15.6 billion in the quarter, which grew 20% from $13 billion a year ago and beat our estimate of $14.2 billion.

Net premiums earned grew 20% to $14.9 billion, beating our estimate of $13.6 billion and the Zacks Consensus Estimate of $14.8 billion. Net realized losses on securities were $149 million, narrower than a loss of $216.4 million in the year-ago quarter. The combined ratio — the percentage of premiums paid out as claims and expenses — improved 680 bps from the prior-year quarter’s level to 92.4.

RLI Corp. RLI reported third-quarter 2023 operating earnings of 61 cents per share, beating the Zacks Consensus Estimate by 510%. The bottom line improved 22% from the prior-year quarter. Operating revenues for the reported quarter were $350.4 million, up 12.1% year over year, driven by 9.2% higher net premiums earned and 50.3% higher net investment income. The top line, however, missed the Zacks Consensus Estimate by 7.2%.

Gross premiums written increased 11.3% year over year to $449.3 million. Underwriting income of $4.2 million decreased by 52.3%, primarily due to Hawaiian wildfire losses. The combined ratio deteriorated 170 bps year over year to 98.7. Our estimate was 90.8.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report