Chubb Ltd (CB) Reports Record Earnings, Strong Premium Growth in Q4 and Full-Year 2023

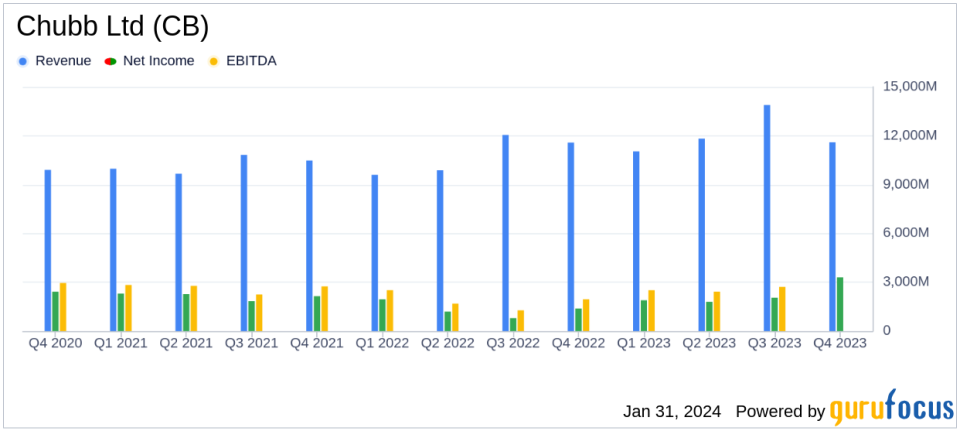

Net Income: Q4 net income soared to $3.30 billion, a 151.7% increase year-over-year, with full-year net income up 72.1% to $9.03 billion.

Core Operating Income: Q4 core operating income rose by 103.6% to $3.41 billion, while full-year core operating income grew 45.2% to $9.34 billion.

Premiums Written: Consolidated net premiums written in Q4 increased by 13.4% to $11.6 billion, with a full-year rise of 13.5% to $47.4 billion.

Combined Ratio: P&C combined ratio for Q4 stood at an impressive 85.5%, contributing to a full-year record combined ratio of 86.5%.

Book Value Growth: Book value per share and tangible book value per share grew significantly by 14.4% and 24.1%, respectively, from the previous quarter.

On January 30, 2024, Chubb Ltd (NYSE:CB) released its 8-K filing, announcing a record-setting performance for both the fourth quarter and the full year of 2023. The company, which is one of the largest domestic property and casualty insurers with a global presence in 54 countries, reported a substantial increase in net income and core operating income, driven by robust premium growth and favorable investment returns.

Financial Performance Highlights

Chubb's fourth-quarter net income reached $3.30 billion, or $8.03 per share, a significant jump from $1.31 billion, or $3.13 per share, in the same period last year. Core operating income followed suit, climbing to $3.41 billion, or $8.30 per share, up from $1.67 billion, or $4.00 per share, in the prior year's quarter. This remarkable growth was attributed to double-digit P&C premium growth globally, record P&C underwriting income, and strong life operating income.

The company's full-year figures were equally impressive, with net income totaling $9.03 billion, or $21.80 per share, and core operating income of $9.34 billion, or $22.54 per share. Chubb's consolidated net premiums written for the year amounted to $47.4 billion, marking a 13.5% increase from the previous year.

Investment Portfolio and Book Value

Chubb's book value was positively impacted by after-tax net realized and unrealized gains of $4.88 billion in the investment portfolio, primarily due to the mark-to-market impact from declining interest rates in the fixed-income portfolio. Book value per share and tangible book value per share now stand at $146.83 and $87.98, respectively.

CEO Commentary

"We had a record fourth quarter which contributed to a blowout year the best in our companys history," said Evan G. Greenberg, Chairman and Chief Executive Officer of Chubb Limited. He highlighted the company's double-digit P&C premium growth, record underwriting income, and exceptional operating earnings. Greenberg also noted the significant impact of a one-time deferred tax benefit related to Bermuda's new income tax law on the results.

Segment Performance and Outlook

Chubb's P&C premiums saw a 12.5% increase in the fourth quarter, with consumer lines up by 20% and commercial P&C by 10%. The company's diversified global operations exhibited strong growth across various regions, with North America up by 9.4%, Asia by 37.2%, and Europe and Latin America each by 15.4%. The company's underwriting actions in its large account primary and excess casualty business are expected to enhance future growth in underwriting income.

Chubb's leadership expressed confidence in the company's momentum and its ability to continue growing operating earnings at a double-digit pace through various revenue streams and underwriting margins.

For a detailed analysis of Chubb Ltd (NYSE:CB)'s financial performance, including segment details and the full-year summary, investors and interested parties are encouraged to review the complete financial supplement available on the company's investor relations website.

Chubb Ltd (NYSE:CB) is poised to maintain its leadership in the insurance industry, backed by its strong financial results, disciplined risk management, and strategic global presence.

Explore the complete 8-K earnings release (here) from Chubb Ltd for further details.

This article first appeared on GuruFocus.