Chubb's (CB) Q3 Earnings Coming Up: What's in the Cards?

Chubb Limited CB is slated to report third-quarter 2022 earnings on Oct 25, after market close. The insurer delivered an earnings surprise in each of the last four quarters, the average being 12.12%.

Factors to Consider

Premiums in the third quarter are expected to have benefited from higher new business across a number of retail and wholesale lines, positive rate increases in commercial lines and strong renewal retention. Solid premium retention as well as growth in consumer lines are also likely to have added to the upside. The Zacks Consensus Estimate for net premiums earned is pegged at $11.2 billion. We expect net premiums earned to be $11.1 billion.

The interest rate environment has started to improve. The Fed declared the third consecutive 75-basis point increase in the Federal Funds rate. Currently, the interest rate is in the range of 3%-3.25%. Insurers, being the direct beneficiaries of an improving rate environment, are likely to have gained. Net investment income is likely to have benefited from rising interest rates and widening spreads. Chubb projects adjusted net investment income in the third quarter to be in the range of $980 million to $1 billion. We expect net investment income to be $914.4 million.

The Zacks Consensus Estimate for investment income is pegged at $955 million, indicating a 10.3% increase from the year-ago reported figure.

The top line is likely to have benefited from improved premium revenues as well as higher investment income. The Zacks Consensus Estimate for revenues is pegged at $12.2 billion, indicating an increase of 4.9% from the year-ago reported figure. We expect total revenues to be $12 billion.

Underlying loss ratio improvement, higher favorable prior period development and favorable impact of higher net premiums earned on the expense ratio are likely to have aided the combined ratio. The Zacks Consensus Estimate for combined ratio is pegged at 90, indicating an improvement from the year-ago reported figure of 93.

Expenses are likely to have increased owing to higher loss and loss expenses, policy acquisition costs and administrative expenses as well as higher interest expense.

The continued share buyback is anticipated to have provided an additional boost to the bottom line.

The Zacks Consensus Estimate for third-quarter 2022 earnings of $3.40 per share indicates an increase of 28.8% from the year-ago quarter reported figure. We expect the bottom line to be $5.11 per share for the to-be-reported quarter.

What the Zacks Model Says

Our proven model does not conclusively predict an earnings beat for Chubb this time around. This is because the stock needs to have the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for an earnings beat. This is not the case as you can see below.

Earnings ESP: Chubb has an Earnings ESP of -11.06%. This is because the Most Accurate Estimate of $3.02 is pegged lower than the Zacks Consensus Estimate of $3.40. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

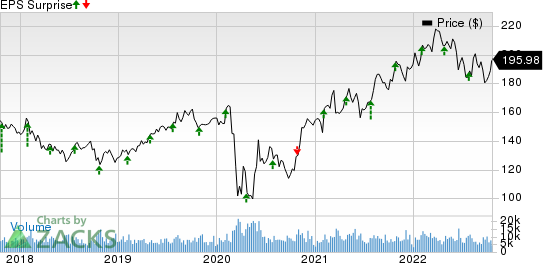

Chubb Limited Price and EPS Surprise

Chubb Limited price-eps-surprise | Chubb Limited Quote

Zacks Rank: Chubb currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Some insurance stocks with the right combination of elements to deliver an earnings beat this time around are:

CNO Financial Group, Inc. CNO has an Earnings ESP of +1.72% and a Zacks Rank of 3. The Zacks Consensus Estimate for third-quarter 2022 earnings is pegged at 49 cents, indicating a decrease of 31.9% from the year-ago reported figure.

CNO Financial beat earnings estimates in three of the last four reported quarters while missing the same in one.

EverQuote, Inc. EVER has an Earnings ESP of +8.21% and a Zacks Rank #2. The Zacks Consensus Estimate for third-quarter 2022 earnings is pegged at a loss of 41 cents, down 127.8% from the figure reported in the year-ago quarter.

EverQuote beat earnings estimates in three of the last four reported quarters while missing the same in one.

Horace Mann Educators Corporation HMN has an Earnings ESP of +28.21% and a Zacks Rank of 2. The Zacks Consensus Estimate for third-quarter 2022 earnings stands at 59 cents, indicating an increase of 18% from the year-ago reported figure.

Horace Mann beat earnings estimates in three of the last four reported quarters while missing the same in one.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

EverQuote, Inc. (EVER) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research