Chuck Akre's Firm Boosts KKR, Dollar Tree Positions

- By Tiziano Frateschi

Akre Capital Management, which was founded by legendary investor Chuck Akre (Trades, Portfolio), bought shares of the following stocks in the second quarter.

Warning! GuruFocus has detected 5 Warning Signs with KKR. Click here to check it out.

The intrinsic value of KKR

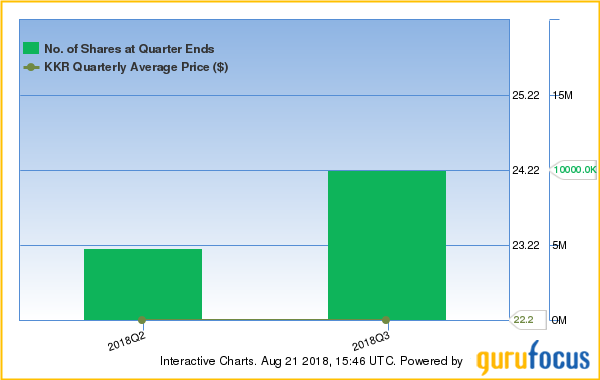

The firm boosted its KKR & Co. Inc. (KKR) stake by 108.33%, impacting the portfolio by 1.63%.

The global investment firm has a market cap of $21.41 billion and an enterprise value of $53.59 billion.

GuruFocus gives the company a profitability and growth rating of 2 out of 10. While the return on equity of 11.64% is outperforming the sector, the return on assets of 1.89% is underperforming 56% of companies in the Global Asset Management industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.16 is below the industry median of 85.28.

The company's largest shareholder among the gurus is Jeff Ubben (Trades, Portfolio)'s ValueAct with 6% of outstanding shares, followed by Akre with 1.21% and John Rogers (Trades, Portfolio) with 0.82%.

The firm added 4.05% to its Dollar Tree Inc. (DLTR) stake. The trade had an impact of 0.21% on the portfolio.

The discount retail store chain has a market cap of $22.62 billion and an enterprise value of $27.18 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 26.06% and return on assets of 10.54% are outperforming 89% of companies in the Global Discount Stores industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.09 is below the industry median of 0.55.

The largest shareholder of the company among the gurus is Steve Mandel (Trades, Portfolio) with 3.04% of outstanding shares, followed by Akre with 2.12% and Lee Ainslie (Trades, Portfolio) with 1.79%.

The Primo Water Corp. (PRMW) position was increased by 48.61%. The trade had an impact of 0.21% on the portfolio.

The company, which provides multi-gallon purified bottled water services, has a market cap of $758.88 million and an enterprise value of $950.93 million.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 11.52% and return on assets of 2.49% are underperforming 86% of companies in the Global Beverages - Soft Drinks industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.03 is below the industry median of 0.73.

Jim Simons (Trades, Portfolio)' Renaissance Technologies is another notable guru shareholder of the company with 1.83% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 1.18% and Caxton Associates (Trades, Portfolio) with 0.05%.

The CarMax Inc. (KMX) holding was increased by 1.79%, expanding the portfolio by 0.09%.

The auto dealership has a market cap of $13.33 billion and an enterprise value of $26.5 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. While the return on equity of 21.13% is outperforming the sector, the return on assets of 4.02% is underperforming 51% of companies in the Global Auto and Truck Dealerships industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.01 is below the industry median of 0.53.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 7.09% of outstanding shares, followed by Ruane Cunniff (Trades, Portfolio) with 6.77% and Lou Simpson (Trades, Portfolio) with 2.8%.

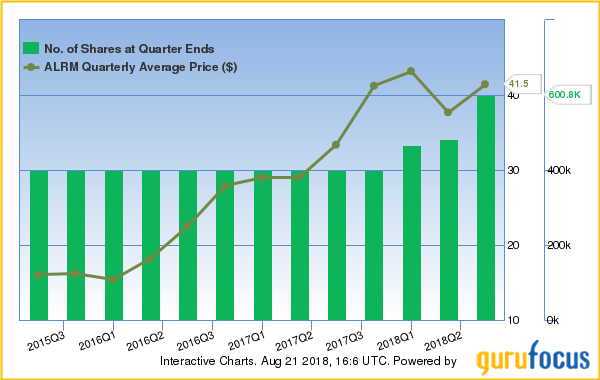

The firm's Alarm.com Holdings Inc. (ALRM) holding was increased 24.26%, impacting the portfolio by 0.06%.

Through its cloud-based services, the company provides home and business security solutions. It has a market cap of $2.68 billion and an enterprise value of $2.65 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 15.40% and return on assets of 9.73% are outperforming 75% of companies in the Global Software - Application industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.54 is below the industry median of 4.27.

With 1.26% of outstanding shares, Akre Capital Management is the company's largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.71% and Columbia Wanger (Trades, Portfolio) with 0.33%.

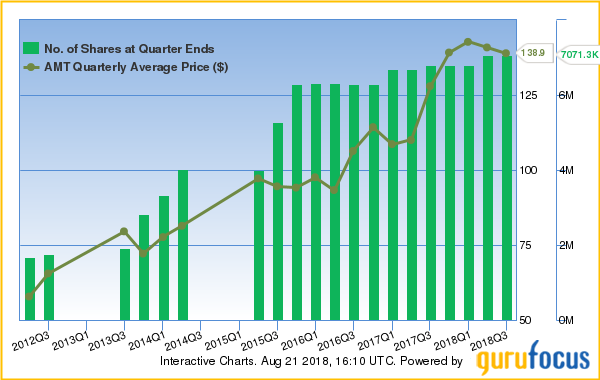

The American Tower Corp. (AMT) holding was expanded 0.21%. The trade had an impact of 0.03%.

The real estate investment trust, which operates communications and broadcast towers, has a market cap of $65.84 billion and an enterprise value of $86.61 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 17.68% and return on assets of 3.47% are outperforming 53% of companies in the Global Telecom Services industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.30.

Another notable guru shareholder of the company is Simons with 1.6% of outstanding shares, followed by David Carlson (Trades, Portfolio) with 0.14% and Pioneer Investments with 0.12%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with KKR. Click here to check it out.

The intrinsic value of KKR