Chuck Royce Acquires New Stake in Major Drilling Group International Inc

Introduction to the Transaction

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a significant buy transaction in Major Drilling Group International Inc (MJDLF), acquiring 5,914,947 shares. This new holding, purchased at a price of $7 per share, represents a 0.42% impact on the firm's portfolio, establishing a 7.21% ownership stake in the company.

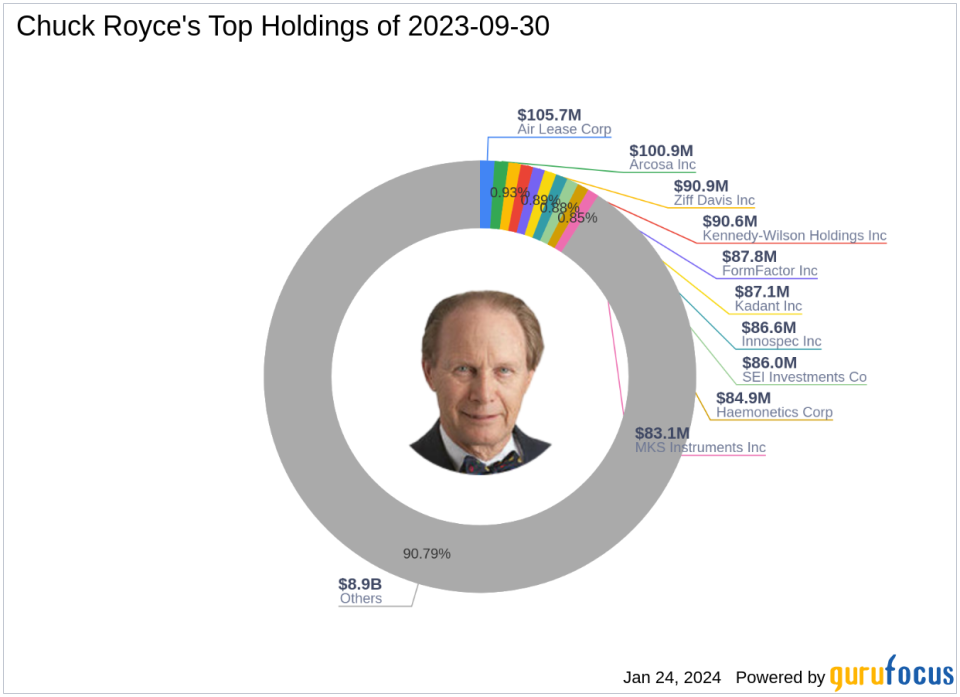

Chuck Royce (Trades, Portfolio)'s Investment Firm Profile

Charles M. Royce, a renowned figure in small-cap investing, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a focus on companies with market capitalizations up to $5 billion, the firm's value investing approach seeks stocks trading below their estimated enterprise value. Royce's investment philosophy emphasizes a strong balance sheet, a successful business track record, and the potential for a profitable future. The firm's equity stands at $9.82 billion, with top holdings in various sectors, including Industrials and Technology.

Overview of Major Drilling Group International Inc

Major Drilling Group International Inc, based in Canada, specializes in contract drilling services for mining and mineral exploration. Since its IPO on October 23, 2001, the company has offered a range of drilling services across multiple geographical segments, with the majority of its revenue stemming from Canada and the United States. With a market capitalization of $547.066 million and a current stock price of $6.67, Major Drilling Group operates within the Metals & Mining industry.

Financial Snapshot of Major Drilling Group International Inc

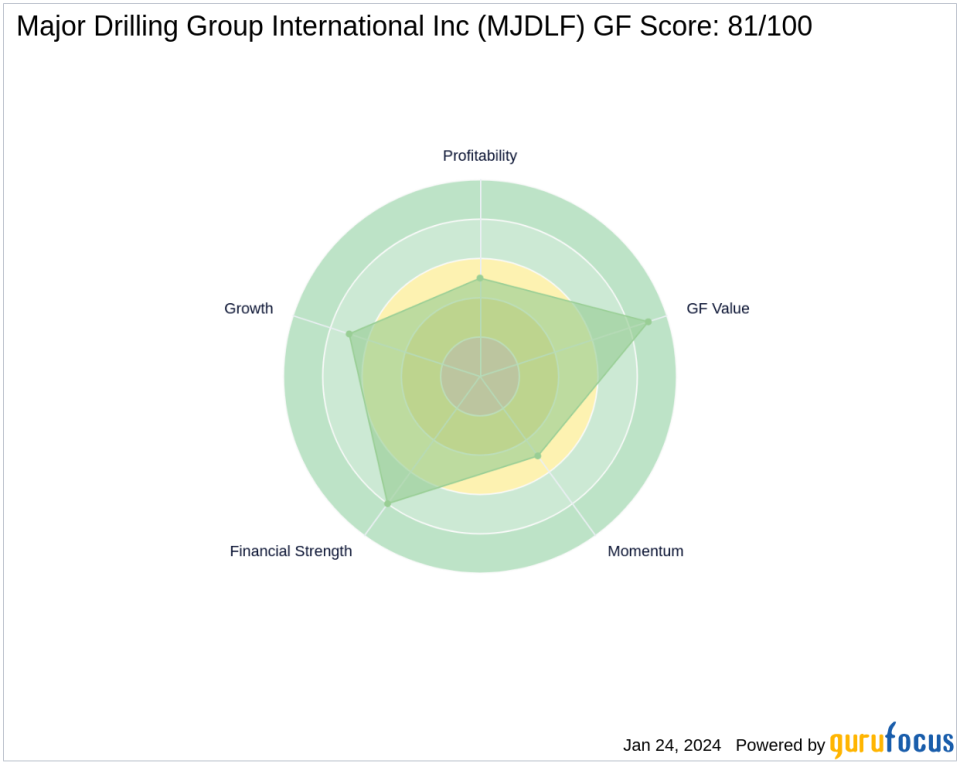

The company's stock is currently deemed modestly undervalued with a GF Value of $8.15 and a price to GF Value ratio of 0.82. The PE Ratio stands at 10.21, indicating profitability despite a recent 4.71% decline in stock price since the trade date. The GF Score of 81/100 suggests good outperformance potential for the stock.

Analysis of the Trade's Impact

The acquisition by Chuck Royce (Trades, Portfolio)'s firm has introduced a significant new position in Major Drilling Group International Inc, accounting for 0.42% of the portfolio. This move aligns with the firm's strategy of investing in undervalued companies with solid financials and growth prospects.

Major Drilling Group's Stock Performance and Metrics

Since its IPO, Major Drilling Group's stock has seen an impressive increase of 4,664.29%. However, the year-to-date price change reflects a decrease of 4.71%. The company's financial strength, profitability, and growth ranks are 8/10, 5/10, and 7/10, respectively, with a GF Value Rank of 9/10. These metrics, along with a Piotroski F-Score of 6 and an Altman Z-Score of 5.88, indicate a stable financial position.

Comparative Analysis of the Sector and Industry

In the Metals & Mining industry, Major Drilling Group stands out with a return on equity (ROE) of 16.05% and a return on assets (ROA) of 12.10%. These figures surpass many of its industry peers, further supported by a gross margin growth of 5.80% and a three-year revenue growth rate of 20.20%.

Conclusion

The recent acquisition by Chuck Royce (Trades, Portfolio)'s firm reflects a strategic investment in Major Drilling Group International Inc, which aligns with the firm's value investing philosophy. The company's solid financial metrics and modest undervaluation suggest potential for future growth, making it a noteworthy addition to the firm's diverse portfolio. Value investors may find this trade indicative of the stock's promising outlook and consider it a potential opportunity in line with Royce's successful investment approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.