Chuck Royce Adds John B Sanfilippo & Son Inc to Portfolio

Introduction to the Transaction

Chuck Royce (Trades, Portfolio), a notable figure in the investment community, has recently expanded the portfolio with an acquisition of shares in John B Sanfilippo & Son Inc (NASDAQ:JBSS). This move signifies a strategic addition to the firm's diverse investment portfolio, showcasing a continued focus on value investing within the small-cap market space.

Profile of the Guru: Chuck Royce (Trades, Portfolio)

Charles M. Royce, a seasoned investor and a pioneer in small-cap investing, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's firm is known for its keen interest in companies with strong balance sheets, a successful business track record, and promising future profitability. The firm's investment philosophy centers on identifying undervalued stocks that have the potential to offer significant returns.

Details of the Trade

On December 31, 2023, the firm added 5,321 shares of John B Sanfilippo & Son Inc to its portfolio, bringing the total holdings to 386,049 shares. This transaction has a modest impact of 0.01% on the portfolio, with the position in JBSS now representing 0.41% of the firm's holdings and 4.30% of the traded stock's available shares. The shares were acquired at a price of $103.04 each.

Analysis of John B Sanfilippo & Son Inc (NASDAQ:JBSS)

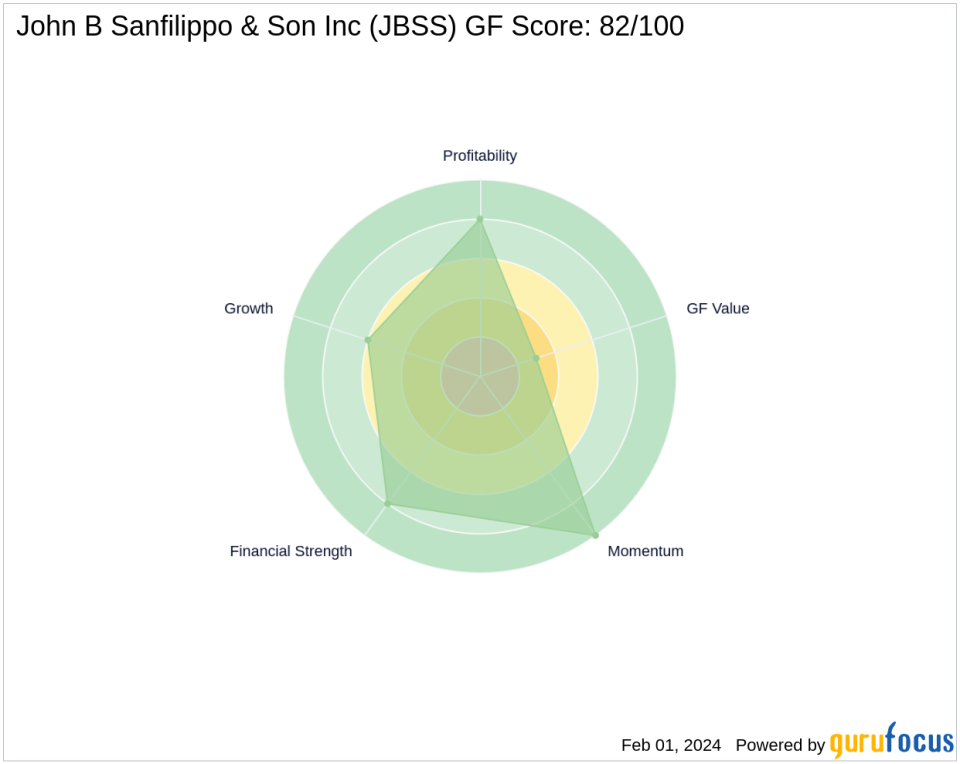

John B Sanfilippo & Son Inc, a leading processor and distributor of nuts and related snack products in the United States, operates under various brand names including Fisher and Orchard Valley Harvest. With a market capitalization of $1.24 billion, the company has a diverse product range that caters to a wide consumer base. JBSS has demonstrated financial resilience with a Financial Strength rank of 8/10 and a Profitability Rank of 8/10, indicating a solid foundation for future growth.

Market Performance and Valuation

Currently, JBSS's stock price stands at $107.255, which is modestly above the trade price of $103.04. The stock is considered "Modestly Overvalued" according to the GF Value, with a GF Value of $94.97 and a price to GF Value ratio of 1.13. Since the transaction, the stock has seen a gain of 4.09%, and year-to-date, it has increased by 1.82%.

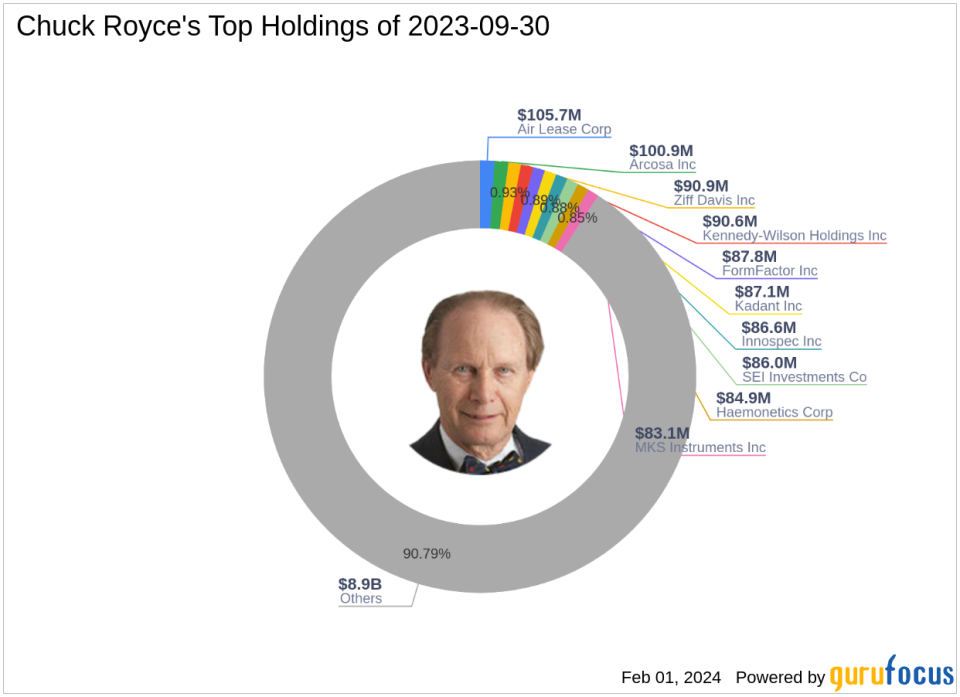

Guru's Portfolio and Top Holdings

Chuck Royce (Trades, Portfolio)'s firm manages an equity portfolio valued at $9.82 billion, with top holdings in sectors such as Industrials and Technology. The firm's top investments include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), Air Lease Corp (NYSE:AL), Kennedy-Wilson Holdings Inc (NYSE:KW), and Arcosa Inc (NYSE:ACA).

Comparative Insight

Other notable investors such as Joel Greenblatt (Trades, Portfolio) also hold positions in JBSS. The largest guru shareholder in John B Sanfilippo & Son Inc is GAMCO Investors, although the specific share percentage is not disclosed.

Conclusion

The recent acquisition by Chuck Royce (Trades, Portfolio)'s firm of additional shares in John B Sanfilippo & Son Inc underscores the firm's commitment to value investing and belief in the company's potential. With a solid financial foundation and a promising market position, JBSS represents a strategic addition to the portfolio. Value investors will be watching closely to see how this investment plays out in the dynamic market landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.