Chuck Royce Adds Northwest Pipe Co to Portfolio in Recent Trade

Overview of Chuck Royce (Trades, Portfolio)'s Latest Portfolio Addition

The investment firm led by Charles M. Royce has recently expanded its portfolio with the addition of Northwest Pipe Co (NASDAQ:NWPX). On December 31, 2023, the firm acquired 4979 shares of the company, which specializes in water-related infrastructure products. This transaction has increased the firm's total holdings in Northwest Pipe Co to 920,534 shares, representing a 0.28% position in the portfolio and a 9.19% ownership of the traded stock. The shares were purchased at a price of $30.26 each.

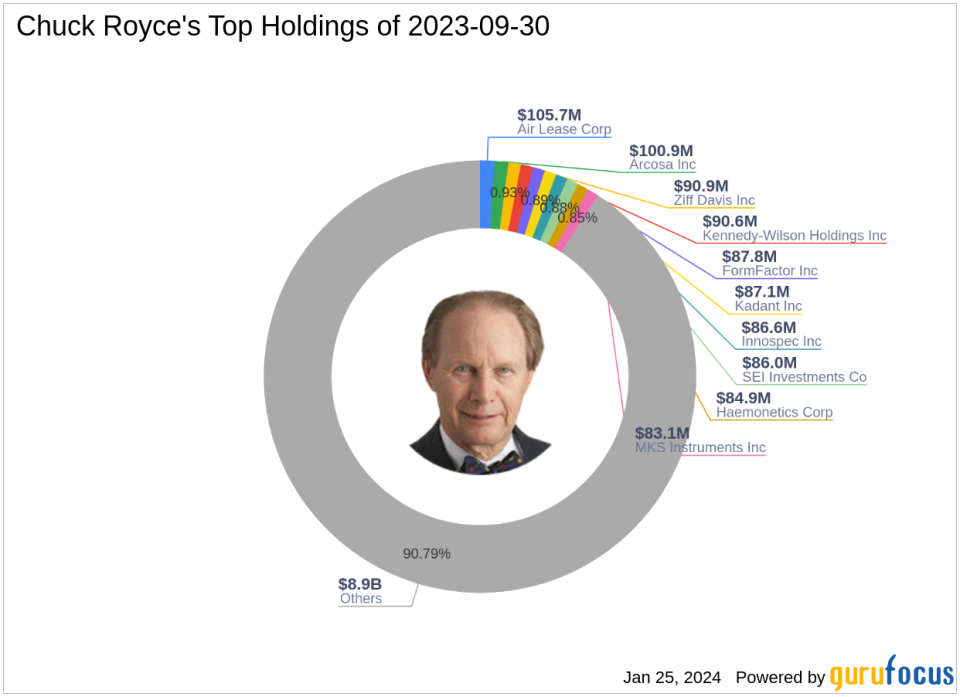

Investor Profile: Charles M. Royce

Charles M. Royce, a renowned figure in small-cap investing, has been managing the Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's investment philosophy centers on identifying undervalued smaller companies with strong balance sheets, a history of success, and promising futures. The firm's approach is to invest in companies with market capitalizations up to $5 billion, and occasionally up to $10 billion, seeking stocks trading below their estimated enterprise value.

Northwest Pipe Co's Business and Financials

Northwest Pipe Co, trading under the symbol NWPX, operates in the Industrial Products sector and has been publicly traded since November 30, 1995. The company is divided into two segments: Engineered Steel Pressure Pipe, which manufactures high-pressure steel pipeline systems, and Precast Infrastructure and Engineered Systems, which offers a variety of precast and reinforced concrete products. With a market capitalization of $296.12 million, Northwest Pipe Co is currently priced at $29.57 per share, holding a PE ratio of 12.64, and is considered modestly undervalued with a GF Value of $36.26.

Impact of the Trade on Chuck Royce (Trades, Portfolio)'s Portfolio

The recent acquisition of Northwest Pipe Co shares has a minimal immediate impact on the firm's portfolio, given the 0% trade impact. However, the strategic addition of NWPX to the portfolio aligns with the firm's investment philosophy, as the stock's GF Value Rank stands at 9/10, indicating a strong potential for value appreciation.

Performance and Valuation of Northwest Pipe Co

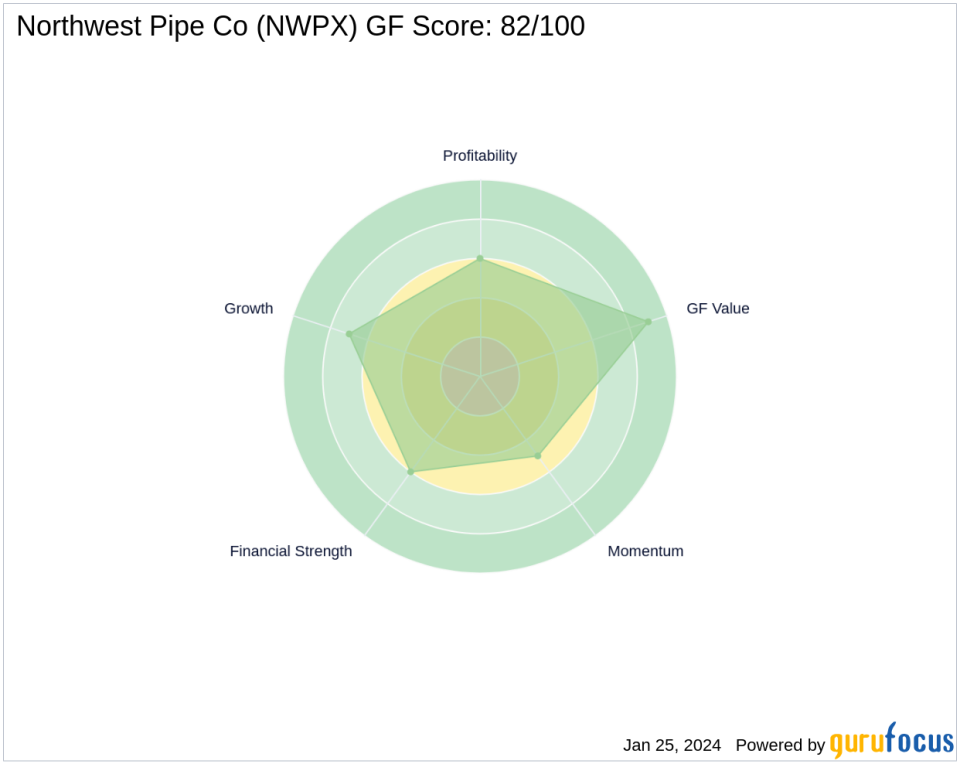

Northwest Pipe Co's current stock price of $29.57 reflects a modest undervaluation, with a Price to GF Value ratio of 0.81. Despite a slight decrease of 2.28% since the trade date, the stock has experienced a significant increase of 195.7% since its IPO. The year-to-date performance shows a minor dip of 1.86%, but the company's GF Score of 82/100 suggests good outperformance potential.

Financial Health and Growth Prospects of Northwest Pipe Co

The company's financial health is solid, with a Financial Strength rank of 6/10 and a Profitability Rank of 6/10. Growth prospects are also promising, as indicated by a Growth Rank of 7/10. Over the past three years, revenue growth has been steady at 17%, with EBITDA growth at 9.8% and earnings growth at 3%. These figures underscore the company's consistent performance and potential for future growth.

Market Reaction and Future Outlook for Northwest Pipe Co

Since the trade, Northwest Pipe Co's stock price has seen a slight decline, but the overall year-to-date performance remains relatively stable. The GF Score indicates that the stock has good potential for outperformance, which may attract investor interest and positively influence future stock performance.

Northwest Pipe Co in the Industrial Products Sector

Within the Industrial Products industry, Northwest Pipe Co stands out with its specialized infrastructure offerings. The company's performance is competitive when compared to industry standards, and its focus on water-related infrastructure positions it well for growth in a sector that is essential for development and sustainability.

Transaction Analysis and Influence

The firm's recent investment in Northwest Pipe Co is a calculated move that aligns with its value investing strategy. The stock's modest undervaluation and strong GF Value Rank suggest that the firm sees potential for value appreciation. As the stock represents a relatively small portion of the portfolio, the immediate impact is limited, but the long-term prospects appear favorable, given the company's solid financial health and growth trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.